-

×

Ryan Waczek – The Fan Attraction Formula

$22.00

Ryan Waczek – The Fan Attraction Formula

$22.00 -

×

Trading Tuitions – Hedge Fund Trading Systems

$12.00

Trading Tuitions – Hedge Fund Trading Systems

$12.00 -

×

Portal Jumps by Cat Howell

$24.00

Portal Jumps by Cat Howell

$24.00 -

×

Kim Krompass – Price Action Traders Institute (PATI)

$30.00

Kim Krompass – Price Action Traders Institute (PATI)

$30.00 -

×

John Bejakovic – Most Valuable Email

$23.00

John Bejakovic – Most Valuable Email

$23.00 -

×

Blessed Trader 2024

$10.00

Blessed Trader 2024

$10.00 -

×

Digital Income Project – Instagram Blueprint

$15.00

Digital Income Project – Instagram Blueprint

$15.00 -

×

Quantum Healing With The Energy Codes – Dr. Sue Morter

$24.00

Quantum Healing With The Energy Codes – Dr. Sue Morter

$24.00 -

×

MindValley – Vivid Vision

$14.00

MindValley – Vivid Vision

$14.00 -

×

Carlos Corona Jr – Credit Repair Lead Generation Masterclass

$22.00

Carlos Corona Jr – Credit Repair Lead Generation Masterclass

$22.00 -

×

KojoForex Goat Strategy

$24.00

KojoForex Goat Strategy

$24.00 -

×

Casey Zander – Masculinity Blueprint ACCELERATOR 2.0

$19.00

Casey Zander – Masculinity Blueprint ACCELERATOR 2.0

$19.00 -

×

Matt Diamante – Course Bundle

$13.00

Matt Diamante – Course Bundle

$13.00 -

×

QuickTradeProfit – Profitable Binary Options

$13.00

QuickTradeProfit – Profitable Binary Options

$13.00 -

×

Matt Clark – The Omnichannel Machine

$24.00

Matt Clark – The Omnichannel Machine

$24.00 -

×

Andrew Lock & Chris Farrell – The Crypto Course

$15.00

Andrew Lock & Chris Farrell – The Crypto Course

$15.00 -

×

Krista Kathleen – Born To Coach Training Academy

$24.00

Krista Kathleen – Born To Coach Training Academy

$24.00 -

×

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00 -

×

Mark Podolsky – The Investor’s Toolkit

$22.00

Mark Podolsky – The Investor’s Toolkit

$22.00 -

×

Becca Luna – Design Your Day Rate

$35.00

Becca Luna – Design Your Day Rate

$35.00 -

×

The Secret Trench Reports – Top 50 Most Lucrative Niches

$26.00

The Secret Trench Reports – Top 50 Most Lucrative Niches

$26.00 -

×

Boyuan Zhao – E-commerce Email Masters 2.0

$29.00

Boyuan Zhao – E-commerce Email Masters 2.0

$29.00 -

×

Yasin Mammeri – Viral Video Course

$11.00

Yasin Mammeri – Viral Video Course

$11.00 -

×

Anastasia Blogger – Pinterest SEO Traffic Secrets Course

$14.00

Anastasia Blogger – Pinterest SEO Traffic Secrets Course

$14.00 -

×

Michael Oliver – How to Sell The Way People Buy!

$25.00

Michael Oliver – How to Sell The Way People Buy!

$25.00 -

×

Donald Spann – Call Center Cash

$22.00

Donald Spann – Call Center Cash

$22.00 -

×

RJ Nestor – Your Road to Roam

$24.00

RJ Nestor – Your Road to Roam

$24.00 -

×

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II & Gann Astro Vol III

$17.00

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II & Gann Astro Vol III

$17.00 -

×

Agency Mavericks The Growth Plan Method

$21.00

Agency Mavericks The Growth Plan Method

$21.00

Sale!

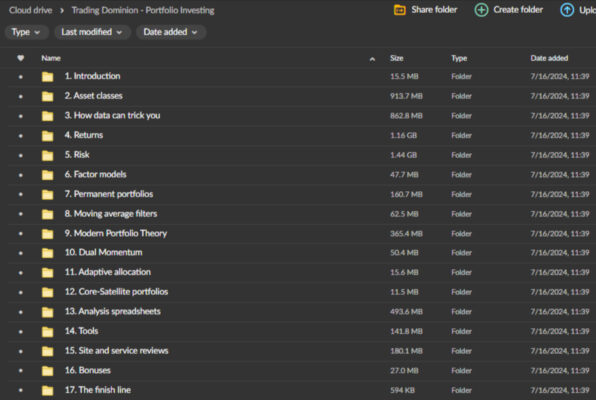

Trading Dominion – Portfolio investing

Original price was: $397.00.$35.00Current price is: $35.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Trading Dominion – Portfolio investing

Master Wealth Management with Trading Dominion – Portfolio Investing Course

Unlock the secrets to long-term wealth accumulation and financial independence with the Trading Dominion – Portfolio Investing course. This comprehensive program is designed to provide you with the tools, strategies, and knowledge necessary to build and manage a diversified investment portfolio that aligns with your financial goals.

Whether you’re a seasoned investor or just starting, this course will equip you with the skills needed to navigate the complexities of the financial markets and achieve sustainable growth.

Why Choose the Trading Dominion – Portfolio Investing Course?

The Trading Dominion: Portfolio Investing course offers a strategic wealth management approach focusing on diversification, risk management, and informed decision-making. Created by experts in the field, this course is tailored to help you optimize your investment returns while minimizing risk, ensuring that your portfolio is resilient and well-positioned for long-term success.

Course Overview

What Can You Expect from the Trading Dominion – Portfolio Investing Course?

The Trading Dominion – Portfolio Investing course is meticulously structured to provide a thorough understanding of portfolio management. It covers every aspect of investing, from asset allocation and risk management to market analysis and portfolio construction, ensuring you gain the confidence and competence to manage your investments effectively.

Course Provider: Trading Dominion is a leader in financial education.

Duration: A multi-week program offering in-depth insights into portfolio management and wealth accumulation strategies.

Format: A mix of video lectures, interactive exercises, and real-world case studies to provide a comprehensive learning experience.

Target Audience: Ideal for investors of all levels, from beginners looking to enter the market to experienced investors seeking to refine their strategies and achieve financial independence.

Key Learning Objectives

The Trading Dominion – Portfolio Investing course is designed with clear, actionable objectives that guide you through the process of building and managing a successful investment portfolio:

- Understanding Portfolio Investing Fundamentals: Learn the essential concepts of portfolio investing, including the importance of diversification and asset allocation principles.

- Mastering Risk Management: Discover strategies to manage investment risks effectively, protect your capital, and ensure long-term profitability.

- Conducting Market Analysis: Gain the skills to analyze financial markets, identify investment opportunities, and make informed decisions based on fundamental and technical analysis.

- Building and Optimizing Portfolios: Develop customized portfolios that align with your risk tolerance and financial goals, and learn how to optimize performance through ongoing management and adjustment.

Module Breakdown

What Will You Learn in Each Module?

The Trading Dominion – Portfolio Investing course is divided into comprehensive modules, each focusing on a critical area of portfolio management. This modular approach ensures that you build your knowledge systematically, deeply understanding each concept before moving on to more advanced topics.

Introduction to Portfolio Investing

- Overview of Portfolio Investing: Start with the basics, learning about the core principles of portfolio investing, including the importance of diversification and long-term asset allocation.

- The Role of Diversification: Understand how diversification can help mitigate risk by spreading investments across different asset classes and sectors, reducing the impact of market volatility on your portfolio.

- Trading Dominion’s Approach: Explore Trading Dominion’s unique approach to portfolio investing, which emphasizes a disciplined, research-driven strategy designed to optimize risk-adjusted returns.

How Does Asset Allocation Drive Portfolio Success?

Asset Allocation Strategies

- Designing Optimal Asset Allocation: Learn how to design an asset allocation strategy that aligns with your risk tolerance, investment objectives, and time horizon. Understand the role of different asset classes, including stocks, bonds, real estate, and alternative investments, in achieving a balanced portfolio.

- Balancing Asset Classes: Discover strategies for balancing asset classes to achieve diversification and minimize portfolio volatility. Learn how to adjust your asset allocation over time to respond to changing market conditions and personal financial goals.

- Real-World Applications: Apply what you’ve learned by designing and managing your diversified portfolio, using case studies and simulations to practice asset allocation in real-world scenarios.

Why is Risk Management Essential in Portfolio Investing?

Risk Management Techniques

- Mitigating Investment Risks: Explore techniques for assessing and mitigating investment risks, including diversification, asset allocation, and hedging strategies. Learn how to protect your capital by managing downside risks effectively.

- Position Sizing and Stop-Loss Orders: Gain insights into managing portfolio downside risk through position sizing, stop-loss orders, and portfolio rebalancing. Learn how to set and adjust stop-loss orders to limit losses and protect gains during market downturns.

- Portfolio Rebalancing: Understand the importance of regular portfolio rebalancing to maintain your desired asset allocation and risk profile. Learn when and how to rebalance your portfolio to keep it aligned with your financial objectives.

How to Conduct Effective Market Analysis?

Market Analysis and Research

- Fundamental and Technical Analysis: Master the methods for conducting both fundamental and technical analysis to identify investment opportunities and assess market trends. Learn how to analyze financial statements, evaluate valuation metrics, and use technical indicators to make informed investment decisions.

- Research Tools and Resources: Discover the tools and resources available for researching individual securities, analyzing market data, and staying informed about economic developments. Learn how to use these resources to enhance your investment decision-making process.

- Identifying Investment Opportunities: Gain the skills to identify and capitalize on investment opportunities in various market conditions. Learn how to evaluate the potential risks and rewards of different investments and make decisions that align with your portfolio strategy.

How to Construct and Optimize a Winning Portfolio?

Portfolio Construction and Optimization

- Building a Well-Balanced Portfolio: Learn strategies for constructing a well-balanced investment portfolio that is tailored to your specific risk-return profile and financial objectives. Understand the importance of asset allocation, diversification, and strategic investment selection in building a resilient portfolio.

- Optimizing Portfolio Performance: Discover techniques for optimizing portfolio performance through asset allocation adjustments, portfolio rebalancing, and tactical asset allocation based on market conditions. Learn how to adapt your portfolio to changing economic environments and maximize returns.

- Real-Time Portfolio Management: Apply your knowledge by constructing and managing a virtual portfolio in real-time. Use simulations and case studies to practice portfolio management techniques and refine your approach to achieving long-term financial success.

Benefits of the Trading Dominion – Portfolio Investing Course

What Makes This Course the Right Choice for You?

The Trading Dominion – Portfolio Investing course offers a wealth of benefits that make it an essential resource for anyone serious about achieving long-term financial success through disciplined investing:

- Long-Term Wealth Accumulation: The course empowers you to build wealth over the long term by providing a systematic saving and investing framework. Learn how to grow wealth through disciplined portfolio investing strategies aligning with your financial goals.

- Risk Mitigation and Capital Preservation: Gain the tools and techniques needed to mitigate investment risks and preserve capital, ensuring that your portfolio is resilient and able to withstand market downturns. Learn how to minimize portfolio volatility and protect your investments from significant losses.

- Financial Independence and Freedom: Achieve greater financial independence and freedom by taking control of your investment strategy. The course provides the knowledge and skills needed to generate passive income, grow wealth, and create a secure financial foundation for yourself and your family.

- Professional Development and Growth: Enhance your investment knowledge and expertise, opening up opportunities for career advancement in the fields of finance, investment management, and wealth advisory. Gain a deeper understanding of the financial markets and develop the skills needed to make better financial decisions.

Conclusion

Why Should You Invest in the Trading Dominion – Portfolio Investing Course?

The Trading Dominion – Portfolio Investing course is more than just a learning program; it’s a comprehensive guide to building and managing a successful investment portfolio that can provide long-term financial security and independence.

By focusing on critical areas such as asset allocation, risk management, market analysis, and portfolio construction, this course equips you with the knowledge and tools needed to optimize your investment returns, preserve capital, and achieve your financial goals.

Whether you’re just starting your investment journey or looking to refine your existing strategies, this course offers the insights and expertise necessary to navigate the complexities of the financial markets with confidence and success. Enroll today and take the first step toward mastering portfolio investing with Trading Dominion.