-

×

Ryan Waczek – The Fan Attraction Formula

$22.00

Ryan Waczek – The Fan Attraction Formula

$22.00 -

×

Trading Tuitions – Hedge Fund Trading Systems

$12.00

Trading Tuitions – Hedge Fund Trading Systems

$12.00 -

×

Portal Jumps by Cat Howell

$24.00

Portal Jumps by Cat Howell

$24.00 -

×

Kim Krompass – Price Action Traders Institute (PATI)

$30.00

Kim Krompass – Price Action Traders Institute (PATI)

$30.00 -

×

John Bejakovic – Most Valuable Email

$23.00

John Bejakovic – Most Valuable Email

$23.00 -

×

Blessed Trader 2024

$10.00

Blessed Trader 2024

$10.00 -

×

Digital Income Project – Instagram Blueprint

$15.00

Digital Income Project – Instagram Blueprint

$15.00 -

×

Quantum Healing With The Energy Codes – Dr. Sue Morter

$24.00

Quantum Healing With The Energy Codes – Dr. Sue Morter

$24.00 -

×

MindValley – Vivid Vision

$14.00

MindValley – Vivid Vision

$14.00 -

×

Carlos Corona Jr – Credit Repair Lead Generation Masterclass

$22.00

Carlos Corona Jr – Credit Repair Lead Generation Masterclass

$22.00 -

×

KojoForex Goat Strategy

$24.00

KojoForex Goat Strategy

$24.00 -

×

Casey Zander – Masculinity Blueprint ACCELERATOR 2.0

$19.00

Casey Zander – Masculinity Blueprint ACCELERATOR 2.0

$19.00 -

×

Matt Diamante – Course Bundle

$13.00

Matt Diamante – Course Bundle

$13.00 -

×

QuickTradeProfit – Profitable Binary Options

$13.00

QuickTradeProfit – Profitable Binary Options

$13.00 -

×

Matt Clark – The Omnichannel Machine

$24.00

Matt Clark – The Omnichannel Machine

$24.00 -

×

Andrew Lock & Chris Farrell – The Crypto Course

$15.00

Andrew Lock & Chris Farrell – The Crypto Course

$15.00 -

×

Krista Kathleen – Born To Coach Training Academy

$24.00

Krista Kathleen – Born To Coach Training Academy

$24.00 -

×

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00 -

×

Mark Podolsky – The Investor’s Toolkit

$22.00

Mark Podolsky – The Investor’s Toolkit

$22.00 -

×

Becca Luna – Design Your Day Rate

$35.00

Becca Luna – Design Your Day Rate

$35.00 -

×

The Secret Trench Reports – Top 50 Most Lucrative Niches

$26.00

The Secret Trench Reports – Top 50 Most Lucrative Niches

$26.00 -

×

Boyuan Zhao – E-commerce Email Masters 2.0

$29.00

Boyuan Zhao – E-commerce Email Masters 2.0

$29.00 -

×

Yasin Mammeri – Viral Video Course

$11.00

Yasin Mammeri – Viral Video Course

$11.00 -

×

Anastasia Blogger – Pinterest SEO Traffic Secrets Course

$14.00

Anastasia Blogger – Pinterest SEO Traffic Secrets Course

$14.00 -

×

Michael Oliver – How to Sell The Way People Buy!

$25.00

Michael Oliver – How to Sell The Way People Buy!

$25.00 -

×

Donald Spann – Call Center Cash

$22.00

Donald Spann – Call Center Cash

$22.00 -

×

RJ Nestor – Your Road to Roam

$24.00

RJ Nestor – Your Road to Roam

$24.00 -

×

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II & Gann Astro Vol III

$17.00

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II & Gann Astro Vol III

$17.00 -

×

Agency Mavericks The Growth Plan Method

$21.00

Agency Mavericks The Growth Plan Method

$21.00

Sale!

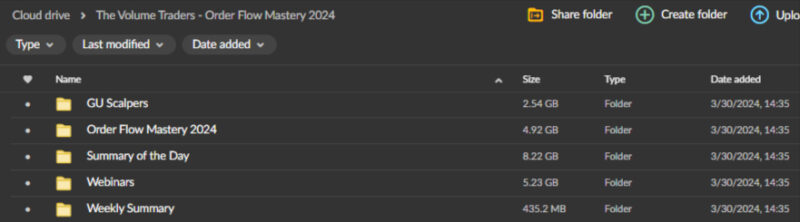

The Volume Traders – OrderFlow Mastry Course 2024

Original price was: $987.00.$24.00Current price is: $24.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

The Volume Traders – OrderFlow Mastry Course 2024

Master the Art of Volume Trading with The Volume Traders – OrderFlow Mastery Course 2024

In the ever-evolving world of financial markets, the ability to analyze and act on trading volume data is a critical differentiator between success and failure. The Volume Traders – OrderFlow Mastery Course 2024 is designed to provide traders with the knowledge and tools necessary to navigate the complexities of volume trading effectively.

This comprehensive course offers a deep dive into order flow dynamics, volume profiling, and advanced trading strategies, ensuring participants are well-equipped to capitalize on market opportunities.

Why Is Volume Trading Crucial for Success?

Volume trading is a fundamental aspect of market analysis, providing insights into the strength of price movements and the intentions of market participants. By understanding and interpreting volume data, traders can make more informed decisions, reduce risk, and enhance profitability. This course emphasizes the importance of volume analysis in trading and provides participants with the skills to leverage this information for better trading outcomes.

What Are Order Flow Dynamics?

How Does Order Flow Influence Market Movements?

Order flow refers to buying and selling orders in the market, which directly influences price movements. Key factors that affect order flow are large institutional orders, market sentiment, and liquidity levels. In the OrderFlow Mastery Course 2024, participants learn to dissect these elements, gaining insights into how large players move the market and how to position themselves accordingly.

- Institutional Impact: Understand how large orders from institutions can create significant price movements and how to spot these activities in real time.

- Market Sentiment Analysis: Learn to gauge the market’s overall sentiment by analyzing order flow, helping you stay ahead of potential trend changes.

How Can Understanding Liquidity Levels Enhance Trading?

Liquidity is a critical factor in trading, affecting the ease with which positions can be entered or exited. The course teaches participants to identify liquidity pockets and understand how these areas can serve as potential support and resistance zones. By mastering liquidity analysis, traders can better predict price reversals and continuation patterns.

- Liquidity Zones: Identify areas where liquidity is concentrated in the market and use these zones to plan your trades more effectively.

- Risk Management: Learn how to adjust your trading strategy based on the current liquidity environment to minimize slippage and maximize your trading efficiency.

What Is Volume Profiling?

How Does Volume Profiling Aid in Market Analysis?

Volume profiling is a technique that allows traders to analyze the distribution of trading volume at different price levels. This method helps traders identify critical areas of interest, such as support and resistance levels, where significant trading activity has occurred. The OrderFlow Mastery Course 2024 provides in-depth training on how to use volume profiles to enhance trading strategies.

- Support and Resistance: Learn to identify strong support and resistance levels based on historical volume data, improving the accuracy of your trade entries and exits.

- Market Structure Analysis: Gain a deeper understanding of market structure by analyzing how volume is distributed across different price levels, helping you anticipate potential market movements.

How Can Volume Profiles Be Integrated into Trading Strategies?

Integrating volume profiles into your trading strategies can significantly enhance your decision-making process. The course covers practical applications of volume profiling, teaching participants how to use this information in conjunction with other technical analysis tools to create a more comprehensive trading strategy.

- Combining Indicators: Learn how to combine volume profiles with indicators like moving averages, Fibonacci retracements, and trend lines to confirm trade setups.

- Backtesting and Optimization: Understand the importance of backtesting your volume-based strategies and how to optimize them for different market conditions.

What Is Volume Spread Analysis (VSA)?

Why Is Volume Spread Analysis a Powerful Tool?

Volume Spread Analysis (VSA) examines the relationship between price movements, volume, and spread (the difference between the high and low prices during a trading period). VSA provides insights into market strength and potential reversals, making it a powerful tool for traders. The OrderFlow Mastery Course 2024 teaches participants how to recognize VSA patterns and apply them in their trading strategies.

- Identifying Reversals: Learn to spot potential market reversals by analyzing volume and spread patterns, giving you an edge in anticipating market shifts.

- Pattern Recognition: Develop the ability to recognize common VSA patterns, such as stopping volume and no-demand bars, to make more informed trading decisions.

How Can VSA Improve Trading Accuracy?

By understanding the nuances of VSA, traders can improve their accuracy in predicting market movements. The course provides practical examples and exercises to help participants apply VSA techniques in real-time trading scenarios, enhancing their overall trading performance.

- Enhanced Entry and Exit Points: Use VSA to refine your entry and exit points, reducing the risk of false signals and improving your trade success rate.

- Market Timing: Improve your market timing by using VSA to identify when a trend is likely to continue or reverse, allowing you to capitalize on price movements more effectively.

How to Implement Volume-Based Indicators?

What Are the Key Volume-Based Indicators?

The course introduces a range of volume-based indicators essential for modern trading. These indicators include Volume Bars, Cumulative Volume Delta, Volume-Weighted Average Price (VWAP), and the Volume Oscillator. Each indicator serves a specific purpose and can be tailored to fit individual trading styles.

- Volume Bars and Cumulative Delta: Learn how to use volume bars and cumulative delta to gauge market sentiment and identify potential breakout or breakdown points.

- VWAP and Volume Oscillator: Understand how to apply VWAP and the Volume Oscillator to track average pricing levels and momentum, providing a clearer picture of market trends.

How to Customize and Optimize Volume-Based Indicators?

Customizing and optimizing volume-based indicators are crucial for aligning them with your trading strategy. The course provides detailed guidance on adjusting these indicators based on market conditions and your personal trading objectives.

- Indicator Customization: Tailor volume-based indicators to suit your trading style, whether you are a day trader, swing trader, or position trader.

- Optimization Techniques: Learn how to backtest and optimize your indicators to ensure they provide the most reliable signals in different market environments.

How to Develop Effective Trading Strategies?

What Are the Best Practices for Integrating Volume Analysis?

The course emphasizes integrating volume analysis with other technical analysis tools to create robust trading strategies. To develop well-rounded trading approaches, participants learn to combine volume insights with candlestick patterns, trend lines, and moving averages.

- Combining Techniques: Discover how to effectively combine volume analysis with other technical indicators to increase the accuracy of your trades.

- Strategy Development: Learn the process of developing, backtesting, and refining trading strategies that incorporate volume data, ensuring they are robust and reliable.

How to Optimize Strategies for Consistent Profitability?

Consistent profitability in trading requires more than just a good strategy; it requires ongoing optimization. The course provides participants with the tools and knowledge needed to continuously refine their approach based on market feedback.

- Backtesting and Analysis: Understand the importance of backtesting your strategies against historical data to identify strengths and weaknesses.

- Ongoing Optimization: Learn how to adjust your strategy in response to changing market conditions to maintain consistent profitability.

Why Are Risk Management and Psychology Important?

How to Manage Risk Effectively in Volume Trading?

Risk management is a critical component of any successful trading strategy. The OrderFlow Mastery Course 2024 emphasizes preserving capital and managing risk through proper position sizing, stop-loss placement, and emotional discipline.

- Capital Preservation: Learn techniques for preserving your capital, including setting appropriate stop-loss levels and avoiding over-leveraging.

- Position Sizing: Understand how to size your positions based on your risk tolerance and the specific conditions of the trade.

How to Maintain Psychological Discipline in Trading?

Psychological discipline is often the deciding factor between success and failure in trading. The course provides strategies for maintaining emotional balance, avoiding impulsive decisions, and staying focused on long-term goals.

- Emotional Control: Develop techniques for controlling emotions such as fear and greed, which can lead to poor decision-making.

- Goal Setting and Discipline: Learn how to set realistic trading goals and maintain the discipline needed to achieve them, even in volatile market conditions.

What Are the Advanced Order Flow Techniques?

How to Use Footprint Charts and DOM Analysis?

Advanced order flow techniques, such as footprint charts and Depth of Market (DOM) analysis, are essential for understanding market microstructure. The course provides detailed instructions on using these tools to gain deeper insights into market activity.

- Footprint Charts: Learn how to read footprint charts to see where trades are being executed in the market, providing you with a clearer view of supply and demand dynamics.

- DOM Analysis: Understand how to use DOM analysis to identify the strength of buy and sell orders at different price levels, helping you to anticipate potential price movements.

How to Navigate Complex Market Environments?

The course equips participants with the knowledge and skills needed to navigate complex market environments. Through live market simulations and case studies, traders learn how to apply advanced order flow techniques in real-time scenarios.

- Market Simulations: Gain hands-on experience through simulated trading environments that mimic actual market conditions.

- Case Studies: Analyze real-world case studies to see how advanced order flow techniques can be applied to achieve successful trading outcomes.

Conclusion: Achieve Mastery in Volume Trading

The Volume Traders – OrderFlow Mastery Course 2024 is your gateway to mastering the intricacies of volume trading. By understanding order flow dynamics, leveraging volume profiles, and implementing advanced trading strategies, participants are well-equipped to excel in today’s dynamic markets.

With a strong focus on risk management and psychological discipline, this course empowers traders to make informed decisions, manage their emotions, and achieve long-term success in their trading careers.