-

×

Clayton Makepeace – The Makepeace Method for Writing Million Dollar Sales

$16.00

Clayton Makepeace – The Makepeace Method for Writing Million Dollar Sales

$16.00 -

×

Pollinate Trading – Systems Building With AI

$34.00

Pollinate Trading – Systems Building With AI

$34.00 -

×

Athlean – X – Max Shred

$12.00

Athlean – X – Max Shred

$12.00 -

×

Robby Blanchard – TikTok Hero

$24.00

Robby Blanchard – TikTok Hero

$24.00 -

×

Glen Allsopp – SEO Blueprint 3

$26.00

Glen Allsopp – SEO Blueprint 3

$26.00 -

×

Jeff Cooper- 7 Setups that Consistently Make Money

$20.00

Jeff Cooper- 7 Setups that Consistently Make Money

$20.00 -

×

Jonathan Montoya – Freedom Accelerator

$14.00

Jonathan Montoya – Freedom Accelerator

$14.00 -

×

Kathrin Zenkina – The Manifestation Babe Academy

$23.00

Kathrin Zenkina – The Manifestation Babe Academy

$23.00 -

×

Sarah Staar – Affiliate Profit Code

$29.00

Sarah Staar – Affiliate Profit Code

$29.00 -

×

Adam Enfroy – AI Income Blueprint Complete Course

$24.00

Adam Enfroy – AI Income Blueprint Complete Course

$24.00 -

×

Chase Reiner – AI Profits

$29.00

Chase Reiner – AI Profits

$29.00 -

×

Vasco Monteiro – Rank sites and Make Money with SEO (Everything I know)

$26.00

Vasco Monteiro – Rank sites and Make Money with SEO (Everything I know)

$26.00 -

×

Gabe Ansel - Locked in Lead

$47.00

Gabe Ansel - Locked in Lead

$47.00 -

×

Jaelin White – Business Builder Mastery

$25.00

Jaelin White – Business Builder Mastery

$25.00 -

×

Retail Capital – My Trading Framework

$20.00

Retail Capital – My Trading Framework

$20.00 -

×

Anton Kreil – 5 in 1 Bundles (FULL COURSE + VIDEO)

$38.00

Anton Kreil – 5 in 1 Bundles (FULL COURSE + VIDEO)

$38.00 -

×

Sander Stage – The SMMA Academy Plus 2024 + IGPA Course

$24.00

Sander Stage – The SMMA Academy Plus 2024 + IGPA Course

$24.00 -

×

Josh Coffy – Foolproof Facebook Ads

$22.00

Josh Coffy – Foolproof Facebook Ads

$22.00 -

×

Facebook Social Marketing Profit System – Brian Carter

$18.00

Facebook Social Marketing Profit System – Brian Carter

$18.00 -

×

Backtest Wizard – Flagship Trading Course

$15.00

Backtest Wizard – Flagship Trading Course

$15.00 -

×

Adam Waheed – Creator Circle

$15.00

Adam Waheed – Creator Circle

$15.00 -

×

Webinar Conversion Academy – Jon Penberthy

$25.00

Webinar Conversion Academy – Jon Penberthy

$25.00 -

×

Barry Georgiou – 90-Day Profitable Publisher

$13.00

Barry Georgiou – 90-Day Profitable Publisher

$13.00 -

×

The Learn AI skills today – Start learning how to build and work with AI today

$15.00

The Learn AI skills today – Start learning how to build and work with AI today

$15.00 -

×

Jeff Cooper& David Reif – Unlocking the Profits of the New Swing Chart Method

$20.00

Jeff Cooper& David Reif – Unlocking the Profits of the New Swing Chart Method

$20.00 -

×

Steve Mellor – Automated Creator 2.0 Bundle

$27.00

Steve Mellor – Automated Creator 2.0 Bundle

$27.00 -

×

Markuss Hussle – Oura Consulting 2.0

$60.00

Markuss Hussle – Oura Consulting 2.0

$60.00 -

×

Eric Beer – Lead Gen Arbitrage Millionaire Training

$14.00

Eric Beer – Lead Gen Arbitrage Millionaire Training

$14.00 -

×

Drell Jones – IG Hustlers

$22.00

Drell Jones – IG Hustlers

$22.00 -

×

Olga Zarr – SEO Audit Mastery

$26.00

Olga Zarr – SEO Audit Mastery

$26.00 -

×

John D Saunders – Web Design Studio Accelerator

$26.00

John D Saunders – Web Design Studio Accelerator

$26.00 -

×

Natasha Takahashi – The 5-Day Build Your First Instagram DM Funnel Challenge

$15.00

Natasha Takahashi – The 5-Day Build Your First Instagram DM Funnel Challenge

$15.00 -

×

John Assaraf – Winning The Game of Money

$25.00

John Assaraf – Winning The Game of Money

$25.00 -

×

Copyhackers – Certified SaaS Copywriter Bundle

$25.00

Copyhackers – Certified SaaS Copywriter Bundle

$25.00 -

×

Kristina Azarenko – Get SEO Implemented

$16.00

Kristina Azarenko – Get SEO Implemented

$16.00 -

×

Dion Coopwood – DTD Credit Mentorship E-Course

$22.00

Dion Coopwood – DTD Credit Mentorship E-Course

$22.00 -

×

Bernd Skorupinski – Hybrid AI Trading System

$21.00

Bernd Skorupinski – Hybrid AI Trading System

$21.00 -

×

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00

Athlean AX 1 – TRAIN LIKE AN ATHLETE

$14.00 -

×

Jordan O’Connor – Rank To Sell

$15.00

Jordan O’Connor – Rank To Sell

$15.00 -

×

Laura Palladino - Smart Social

$23.00

Laura Palladino - Smart Social

$23.00 -

×

Fractal Flow – Volatility Trading

$18.00

Fractal Flow – Volatility Trading

$18.00 -

×

Bulk Publishing Framework + AI-Integrated Google Sheet

$12.00

Bulk Publishing Framework + AI-Integrated Google Sheet

$12.00 -

×

Smart Money Trader – The Banks Code

$22.00

Smart Money Trader – The Banks Code

$22.00 -

×

Alan Weiss – Alans Super Language Practicum

$17.00

Alan Weiss – Alans Super Language Practicum

$17.00 -

×

Jack Hopkins – 10K Accelerator Program

$22.00

Jack Hopkins – 10K Accelerator Program

$22.00 -

×

Joe McCall – Simple Land Flips Program

$24.00

Joe McCall – Simple Land Flips Program

$24.00 -

×

No-Code Architects

$19.00

No-Code Architects

$19.00 -

×

The AI Kidpreneurs – The Most Powerful AI & Entrepreneur Education System for Future-Ready Children

$14.00

The AI Kidpreneurs – The Most Powerful AI & Entrepreneur Education System for Future-Ready Children

$14.00 -

×

Brandon Young – Masterclass Advanced PPC Optimization

$12.00

Brandon Young – Masterclass Advanced PPC Optimization

$12.00 -

×

James Tripp – Transforming Realities with The Tetralemma

$9.00

James Tripp – Transforming Realities with The Tetralemma

$9.00 -

×

Cold Email Wizard – Client Ascension Download

$15.00

Cold Email Wizard – Client Ascension Download

$15.00 -

×

Alex Mandossian – Productivity Secrets

$14.00

Alex Mandossian – Productivity Secrets

$14.00 -

×

Revolt Ecom – Training Academy

$25.00

Revolt Ecom – Training Academy

$25.00 -

×

Emma Kate – Be The Boss Of WordPress

$19.00

Emma Kate – Be The Boss Of WordPress

$19.00 -

×

Ed Leake – God Tier Ads Framework + Bonuses + Update 1 + Update 2 + Update 3

$17.00

Ed Leake – God Tier Ads Framework + Bonuses + Update 1 + Update 2 + Update 3

$17.00 -

×

Matt Leitz (BotBuilders) – Ultimate A.I. System

$20.00

Matt Leitz (BotBuilders) – Ultimate A.I. System

$20.00 -

×

James Wedmore – Absolute Automation

$55.00

James Wedmore – Absolute Automation

$55.00 -

×

Joshua Mayo – Pro YouTuber

$18.00

Joshua Mayo – Pro YouTuber

$18.00 -

×

Black Rabbit Trader – 4D Bootcamp

$13.00

Black Rabbit Trader – 4D Bootcamp

$13.00 -

×

Maurice Kenny – How to Day Trade Like the Top 10

$29.00

Maurice Kenny – How to Day Trade Like the Top 10

$29.00 -

×

Keiko – The Great Reset Crypto & Equities Trading Course

$22.00

Keiko – The Great Reset Crypto & Equities Trading Course

$22.00 -

×

Cold Email Wizard – Cold Email Mastery 2.0

$30.00

Cold Email Wizard – Cold Email Mastery 2.0

$30.00 -

×

Ed Leake – The Perfect Agency Framework

$24.00

Ed Leake – The Perfect Agency Framework

$24.00 -

×

Simpler Trading – Triple Squeeze Pro (Elite Package) 2024

$33.00

Simpler Trading – Triple Squeeze Pro (Elite Package) 2024

$33.00 -

×

Price Action Volume Trader – Day Trading With Volume Profile and Orderflow

$7.00

Price Action Volume Trader – Day Trading With Volume Profile and Orderflow

$7.00 -

×

Brett Kitchen and Ethan Kap – P2 Virtual Selling Accelerator

$24.00

Brett Kitchen and Ethan Kap – P2 Virtual Selling Accelerator

$24.00 -

×

Damien Wursten – Shipping and Commodity Operation Course

$24.00

Damien Wursten – Shipping and Commodity Operation Course

$24.00 -

×

Trade Confident – TC Top & Bottom Finder

$25.00

Trade Confident – TC Top & Bottom Finder

$25.00 -

×

NetShilds Memecoin Supercycle Method – Make 1 SOL+Day

$24.00

NetShilds Memecoin Supercycle Method – Make 1 SOL+Day

$24.00 -

×

Andrew Aziz – Peak Capital Trading Bootcamp

$15.00

Andrew Aziz – Peak Capital Trading Bootcamp

$15.00 -

×

Nina Clapperton – 6 Months to 50k Sessions Masterclass

$19.00

Nina Clapperton – 6 Months to 50k Sessions Masterclass

$19.00 -

×

Master Hypnotic Storyteller – Igor Ledochowski

$15.00

Master Hypnotic Storyteller – Igor Ledochowski

$15.00 -

×

Brian James Sklenka – BA Lesson (Very Rare Gann Materials)

$32.00

Brian James Sklenka – BA Lesson (Very Rare Gann Materials)

$32.00 -

×

Serge Gatari – The AI System Webby Recording

$19.00

Serge Gatari – The AI System Webby Recording

$19.00 -

×

KJ Rainey Bundle Courses – Copy Elite & Digital Persuasion

$15.00

KJ Rainey Bundle Courses – Copy Elite & Digital Persuasion

$15.00 -

×

Mike Schmidt – ReviewPro Launchpad

$40.00

Mike Schmidt – ReviewPro Launchpad

$40.00 -

×

AAA Quants – Complete Trading Bundle

$24.00

AAA Quants – Complete Trading Bundle

$24.00 -

×

Film Booth – Thumbnail University

$15.00

Film Booth – Thumbnail University

$15.00 -

×

Igor Ledochowski – Practitioner Of Coaching & Practitioner of Life Coaching 2022

$24.00

Igor Ledochowski – Practitioner Of Coaching & Practitioner of Life Coaching 2022

$24.00 -

×

Piranha Profits – The Professional Options Trading Course Options – Ironshell

$14.00

Piranha Profits – The Professional Options Trading Course Options – Ironshell

$14.00 -

×

Justin Goff – List Building Accelerator

$16.00

Justin Goff – List Building Accelerator

$16.00 -

×

Serge Gatari – Natural Born Leaders

$18.00

Serge Gatari – Natural Born Leaders

$18.00 -

×

Ready Set Crypto – Cryptocurrency Security and Wallets Class

$20.00

Ready Set Crypto – Cryptocurrency Security and Wallets Class

$20.00 -

×

Sean D’Souza – Suddenly Talented

$20.00

Sean D’Souza – Suddenly Talented

$20.00 -

×

Travis Sago – Make Em Beg to Buy (Gimme Diamond Level)

$19.00

Travis Sago – Make Em Beg to Buy (Gimme Diamond Level)

$19.00 -

×

Alex Brogan – The Sovereign Creator – Grow a 6-figure audience (without leaving your day job)

$22.00

Alex Brogan – The Sovereign Creator – Grow a 6-figure audience (without leaving your day job)

$22.00 -

×

Bastiaan Slot – Appointment Setter – New Age Setter 2023

$13.00

Bastiaan Slot – Appointment Setter – New Age Setter 2023

$13.00 -

×

John Carlton – Kick Ass Copywriting Secrets

$20.00

John Carlton – Kick Ass Copywriting Secrets

$20.00 -

×

Jesper Hensgens – 90 Days To Online Freedom – $1000/Day With Google Ads Drop Shipping

$37.00

Jesper Hensgens – 90 Days To Online Freedom – $1000/Day With Google Ads Drop Shipping

$37.00 -

×

How To Sell Low Content Paperback Books On Amazon Kdp

$15.00

How To Sell Low Content Paperback Books On Amazon Kdp

$15.00 -

×

Montell Gordon – Agency Transmutation (Week 1 to Week 7)

$35.00

Montell Gordon – Agency Transmutation (Week 1 to Week 7)

$35.00 -

×

JK Molina – Your 3 Big Ideas Workshop

$24.00

JK Molina – Your 3 Big Ideas Workshop

$24.00 -

×

Keaton Walker – Agency Dominance

$20.00

Keaton Walker – Agency Dominance

$20.00 -

×

Ryan Lee – MBX

$19.00

Ryan Lee – MBX

$19.00 -

×

Jeremy Miner – NEPQ Sales Program

$39.00

Jeremy Miner – NEPQ Sales Program

$39.00 -

×

Lattice Hudson – High End Offer Accelerator

$24.00

Lattice Hudson – High End Offer Accelerator

$24.00 -

×

Stefan George – 3 Day “Attention Hacking” VIP Workshop (Updated)

$22.00

Stefan George – 3 Day “Attention Hacking” VIP Workshop (Updated)

$22.00 -

×

David Liu – YouTube Storytelling Beyond Retention

$20.00

David Liu – YouTube Storytelling Beyond Retention

$20.00 -

×

Charlie Houpert – Charisma University 2023

$12.00

Charlie Houpert – Charisma University 2023

$12.00 -

×

Frank Kern – Rainmaker AI

$23.00

Frank Kern – Rainmaker AI

$23.00 -

×

Brian Mark & Cole DaSilva - Change Lives Academy

$32.00

Brian Mark & Cole DaSilva - Change Lives Academy

$32.00 -

×

Rob Lennon – AI Content Reactor 3.0

$14.00

Rob Lennon – AI Content Reactor 3.0

$14.00 -

×

American Hypnosis Association – Rapid and Instant Inductions

$15.00

American Hypnosis Association – Rapid and Instant Inductions

$15.00 -

×

Apteros Trading – Scalping Course

$50.00

Apteros Trading – Scalping Course

$50.00 -

×

Michael Jenkins Books Bundle

$15.00

Michael Jenkins Books Bundle

$15.00 -

×

Copy Secrets Academy – 30 Days to $9K

$19.00

Copy Secrets Academy – 30 Days to $9K

$19.00 -

×

HigherLevels – SDR Accelerator

$13.00

HigherLevels – SDR Accelerator

$13.00 -

×

Donna Eden – Eden Energy Medicine for Pain

$27.00

Donna Eden – Eden Energy Medicine for Pain

$27.00 -

×

Becca Luna – Design Your Day Rate

$35.00

Becca Luna – Design Your Day Rate

$35.00 -

×

Jasper.ai Course for Bloggers

$19.00

Jasper.ai Course for Bloggers

$19.00 -

×

Travis Sago – Cold Outreach & Prospecting AMA 2022 Offer (Best Value with All Bonuses)

$14.00

Travis Sago – Cold Outreach & Prospecting AMA 2022 Offer (Best Value with All Bonuses)

$14.00 -

×

Rob Lennon – Hooked on Writing Hooks

$13.00

Rob Lennon – Hooked on Writing Hooks

$13.00 -

×

Alexander Trading – Comprehensive Market Profile Seminar

$8.00

Alexander Trading – Comprehensive Market Profile Seminar

$8.00 -

×

Anthony Lee – The Ultimate AI Automation Bundle

$20.00

Anthony Lee – The Ultimate AI Automation Bundle

$20.00 -

×

MasterTrader – Option Strategies Series for Investors and Active Traders

$40.00

MasterTrader – Option Strategies Series for Investors and Active Traders

$40.00 -

×

Nomad Grind – Drop Servicing Funnel Academy

$14.00

Nomad Grind – Drop Servicing Funnel Academy

$14.00 -

×

Dan Koe – The Future Of Work Event (Workshop)

$18.00

Dan Koe – The Future Of Work Event (Workshop)

$18.00 -

×

Scott Pulcini – SI Indicator Course 2023

$20.00

Scott Pulcini – SI Indicator Course 2023

$20.00 -

×

Ganim Corey – Wholesale Challenge Replays

$12.00

Ganim Corey – Wholesale Challenge Replays

$12.00 -

×

LIT Trading – Adventure (Algo Concepts)

$26.00

LIT Trading – Adventure (Algo Concepts)

$26.00 -

×

WHOP – Social Army Academy

$18.00

WHOP – Social Army Academy

$18.00 -

×

The Volume Traders – OrderFlow Mastry Course 2024

$24.00

The Volume Traders – OrderFlow Mastry Course 2024

$24.00 -

×

WWA Trading 2023

$10.00

WWA Trading 2023

$10.00 -

×

INNER CIRCLE MORPHEUS – Time Dilation Theory

$26.00

INNER CIRCLE MORPHEUS – Time Dilation Theory

$26.00 -

×

Larry Williams – Stock Trading and Investing Course

$21.00

Larry Williams – Stock Trading and Investing Course

$21.00 -

×

Pedro Adao – Movement Maker 5-Day Intensive

$17.00

Pedro Adao – Movement Maker 5-Day Intensive

$17.00 -

×

Supliful – Supliful Roadmap

$14.00

Supliful – Supliful Roadmap

$14.00 -

×

Russell Brunson – Course Secrets

$15.00

Russell Brunson – Course Secrets

$15.00 -

×

Glynn Kosky – Passive Income System 2.0

$14.00

Glynn Kosky – Passive Income System 2.0

$14.00 -

×

Axia Futures – Online Career Programme (London)

$20.00

Axia Futures – Online Career Programme (London)

$20.00 -

×

Alicia Scott – How To Build A Million Dollar Beauty Brand

$14.00

Alicia Scott – How To Build A Million Dollar Beauty Brand

$14.00 -

×

Micro Content Mastery by The Real Deal Video Strategist Club

$18.00

Micro Content Mastery by The Real Deal Video Strategist Club

$18.00 -

×

Sell While you Sleep – 3 Buyers a day

$25.00

Sell While you Sleep – 3 Buyers a day

$25.00 -

×

Pollinate Trading – Equities Earnings Strategy

$14.00

Pollinate Trading – Equities Earnings Strategy

$14.00 -

×

Jeff J Hunter – AI Persona Method Course

$19.00

Jeff J Hunter – AI Persona Method Course

$19.00 -

×

Robert W. Bly – Bly Copy Training Recordings 2022

$13.00

Robert W. Bly – Bly Copy Training Recordings 2022

$13.00 -

×

Tim Denning – Six-Figure Copywriting for Writers

$27.99

Tim Denning – Six-Figure Copywriting for Writers

$27.99 -

×

Dan Koe – Mental Monetisation

$25.00

Dan Koe – Mental Monetisation

$25.00 -

×

Depesh Mandalia Courses Bundle 2025

$15.00

Depesh Mandalia Courses Bundle 2025

$15.00 -

×

Hubert Senters – Ichimoku 101 Cloud Charting Secrets 2024

$28.00

Hubert Senters – Ichimoku 101 Cloud Charting Secrets 2024

$28.00 -

×

Date IQ 2.0 – Jon Zherka

$24.00

Date IQ 2.0 – Jon Zherka

$24.00 -

×

Shane Parris – Decision By Design

$23.00

Shane Parris – Decision By Design

$23.00 -

×

Hayden Hillier-SmithE – Edit Like an Artist

$20.00

Hayden Hillier-SmithE – Edit Like an Artist

$20.00 -

×

20 Minute Trader – Forex Masterclass

$29.00

20 Minute Trader – Forex Masterclass

$29.00 -

×

Katy Amezcua – The IG Bootcamp

$21.00

Katy Amezcua – The IG Bootcamp

$21.00

Sale!

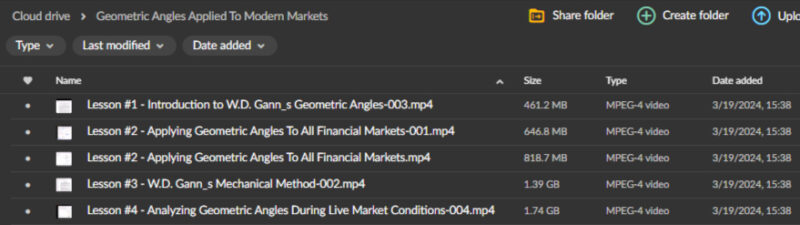

Geometric Angles Applied To Modern Markets

Original price was: $682.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Geometric Angles Applied To Modern Markets

Master Market Trends with the Geometric Angles Applied To Modern Markets Course

In the complex and ever-evolving world of financial markets, traders and investors constantly seek innovative strategies to gain a competitive edge. The Geometric Angles Applied To Modern Markets course offers a groundbreaking approach that merges the timeless principles of geometry with contemporary market analysis techniques.

This course comprehensively explains how geometric angles, such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork, can be applied to analyze market trends and price movements. Whether you are a seasoned trader or just starting out, this course equips you with the knowledge and tools to make more informed trading decisions and enhance your financial strategies.

Why Should You Consider the Geometric Angles Applied To Modern Markets Course?

How Do Geometric Angles Enhance Market Analysis?

The concept of using geometric angles in market analysis is not new, but its application in modern markets offers fresh perspectives and insights. The Geometric Angles Applied To Modern Markets course delves into how these mathematical principles can be used to interpret price trends, identify key support and resistance levels, and predict potential market turning points. By understanding and applying geometric angles, traders can gain a deeper insight into market behavior, allowing them to anticipate price movements with greater accuracy. This course teaches you how to integrate these techniques into your trading strategy, giving you a distinct advantage in navigating today’s dynamic financial markets.

What Foundational Knowledge Will You Gain in the Course?

Before diving into advanced applications, the course begins with a thorough exploration of the foundational concepts of geometric angles. You will learn about the origins and principles behind tools like Fibonacci retracements, Gann angles, and Andrews’ pitchfork. These concepts are rooted in geometry and mathematics, providing a solid base for understanding how they can be applied to modern market analysis. By mastering these basics, you will be equipped to use geometric angles to assess market conditions, identify potential entry and exit points, and make more confident trading decisions.

What Role Do Fibonacci Retracements and Extensions Play in Market Analysis?

How Can Fibonacci Retracements Help You Identify Market Reversals?

Fibonacci retracements are one of the most widely used tools in technical analysis, and for a good reason. The Geometric Angles Applied To Modern Markets course covers how these retracement levels, derived from the Fibonacci sequence, can help traders identify potential reversal points in market trends. By applying Fibonacci retracement levels to price charts, you can pinpoint areas where prices are likely to reverse or consolidate. This knowledge is invaluable for setting up strategic entry and exit points and managing risk more effectively.

Fibonacci retracements work by dividing the vertical distance between two significant price points—usually a high and a low—into key percentages: 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels are then used to forecast potential areas of support or resistance. Traders often use these levels to gauge whether a trend is likely to continue or reverse, making them a critical component of any trading strategy. The course provides practical examples and exercises to help you apply these retracements to real-world market scenarios, enhancing your ability to anticipate market movements.

What Are Fibonacci Extensions and How Do They Set Profit Targets?

While Fibonacci retracements are used to identify potential reversal levels, Fibonacci extensions help traders project possible price targets beyond the initial trend. In the Geometric Angles Applied To Modern Markets course, you’ll learn how to use Fibonacci extensions to forecast where the price might head next. This is particularly useful for setting profit targets and managing your trades more precisely.

Fibonacci extensions are calculated by projecting the Fibonacci ratios beyond the current trend, providing potential levels where the price may resist. These levels can be crucial for determining where to take profits or where the market might stall after a significant move. Understanding how to apply Fibonacci extensions allows you to set realistic profit targets and improve your risk management practices, making this technique an indispensable part of your trading toolkit.

How Do Gann Angles and Time Analysis Contribute to Trading Success?

What Are Gann Angles and How Do They Integrate Price and Time?

Gann angles, developed by the legendary trader W.D. Gann, are a unique tool that combines price and time analysis to forecast market trends. The Geometric Angles Applied To Modern Markets course explores how these angles can be used to predict price movements and identify potential trend reversals. Gann angles are based on the idea that price movements occur in predictable geometric patterns over time. By drawing these angles from significant highs and lows on a price chart, traders can gain insights into the timing of market trends and make more informed decisions.

Gann angles are typically plotted at specific angles, such as 45 degrees, to visually represent how price and time interact. These angles can indicate whether a market is in an uptrend, downtrend, or consolidation phase. By understanding how to apply Gann angles, you can better anticipate when a trend might reverse or continue, allowing you to time your trades more effectively. This course provides a detailed breakdown of how to use Gann angles in conjunction with other technical analysis tools to enhance your market forecasts.

How Can Gann Time Analysis Improve Your Trading Strategy?

Time analysis is a crucial component of Gann’s methodology, and the Geometric Angles Applied To Modern Markets course delves into how this concept can be applied to modern trading. By analyzing the timing of market movements, traders can predict when significant price changes are likely to occur. This allows for more strategic entry and exit points, improving the overall effectiveness of your trading strategy.

Gann time analysis involves examining historical price data to identify patterns and cycles that may repeat in the future. By understanding these cycles, you can anticipate when key market turning points might occur, giving you an edge in timing your trades. The course provides practical examples of how to apply Gann time analysis to various markets, helping you develop a more robust trading strategy that incorporates both price and time elements.

How Can Andrews’ Pitchfork and Trend Channels Guide Your Trades?

What Is Andrews’ Pitchfork and How Does It Identify Trend Channels?

Andrews’ pitchfork is a powerful tool for identifying trend channels and potential reversal points within market trends. The Geometric Angles Applied To Modern Markets course teaches you how to use this tool to analyze price movements and predict future trends. By drawing three parallel lines based on significant price pivots, Andrews’ pitchfork helps you visualize potential support and resistance areas, making it easier to anticipate market direction.

The pitchfork is constructed by selecting three key points on a price chart—usually a high, a low, and a retracement point. These points form the basis for the three parallel lines that define the trend channel. The central line, or median line, acts as a magnet for price movements, while the outer lines serve as boundaries for the trend. Understanding how to use Andrews’ pitchfork allows you to identify the strength and direction of a trend and potential reversal points, enhancing your ability to make strategic trading decisions.

How Can Trend Channels Improve Your Market Forecasting?

Trend channels are an essential aspect of technical analysis, and the Geometric Angles Applied To Modern Markets course provides a deep dive into how they can be used to improve your market forecasting. By identifying trend channels with tools like Andrews’ pitchfork, you can better understand the market’s direction and potential future movements. This knowledge is crucial for setting entry and exit points and managing risk effectively.

Trend channels are formed by drawing parallel lines along the highs and lows of a price trend. These channels can help you determine whether a market is trending upward, downward, or sideways, providing a framework for trading decisions. The course teaches you how to apply trend channels to various markets, from stocks to commodities to cryptocurrencies, giving you a versatile toolset for navigating different market conditions.

How Can Geometric Angles Be Applied to Modern Markets?

Why Are Geometric Angles Relevant in Today’s High-Frequency Trading Environment?

Traditional analysis tools may not always provide the insights needed to stay ahead in today’s fast-paced markets, characterized by high-frequency trading and algorithmic strategies. The Geometric Angles Applied To Modern Markets course demonstrates how geometric angles can be applied to modern markets to gain a competitive edge. By incorporating these principles into your trading strategy, you can better understand market sentiment, identify hidden patterns, and anticipate potential turning points with greater precision.

Geometric angles offer a unique perspective that goes beyond standard technical analysis. In markets driven by complex algorithms and high-speed trading, the ability to recognize geometric patterns and angles can give you an advantage in identifying market trends before they become apparent to others. This course provides practical guidance on how to apply geometric angles to modern trading scenarios, helping you stay ahead of the curve and make more informed trading decisions.

How Do You Integrate Geometric Angles with Risk Management?

While geometric angles provide valuable insights into market dynamics, effective risk management is essential for long-term success. The Geometric Angles Applied To Modern Markets course emphasizes integrating geometric analysis with robust risk management strategies. Combining these tools can protect your capital, preserve profitability, and minimize potential losses.

The course teaches you how to set stop-loss orders, diversify your portfolio, and adhere to disciplined trading plans, all while applying geometric angles to your analysis. This approach ensures that you are making informed decisions based on market trends and managing your risk effectively. By the end of the course, you will have a comprehensive understanding of how to use geometric angles and risk management techniques to confidently navigate the markets.

Conclusion: Elevate Your Trading with the Geometric Angles Applied To Modern Markets Course

The Geometric Angles Applied To Modern Markets course offers a unique fusion of mathematical principles and technical analysis methodologies, providing traders with a powerful toolkit for analyzing market trends and price movements.

You can gain valuable insights into market behaviour and make more informed trading decisions by understanding the foundations of geometric angles and applying tools such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork. This course enhances your market analysis skills and equips you with the risk management strategies needed to succeed in today’s dynamic financial markets.

Whether you’re looking to identify potential reversal points, project price targets, or assess trend strength, the principles taught in this course will empower you to navigate the markets with greater precision and confidence.