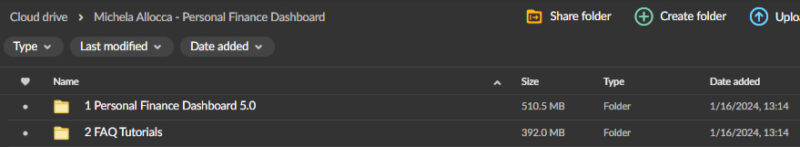

Michela Allocca – Personal Finance Dashboard

Original price was: $675.00.$22.00Current price is: $22.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Michela Allocca – Personal Finance Dashboard

Take Control of Your Finances with Michela Allocca’s Personal Finance Dashboard Course

In an era where financial stability is more important than ever, having the right tools and knowledge to manage your money effectively can make all the difference. The Personal Finance Dashboard course by Michela Allocca is a comprehensive resource designed to empower individuals to take charge of their finances.

Whether you want to get out of debt, save for future goals, or better understand your spending habits, this course provides the insights and tools necessary to achieve financial wellness. With its intuitive interface and robust features, the Personal Finance Dashboard is not just another budgeting tool—it’s a gateway to financial empowerment.

Why Is the Personal Finance Dashboard Course a Game-Changer?

How Does Michela Allocca’s Personal Finance Dashboard Help You Track Expenses Effectively?

Understanding where your money goes is the first step towards financial freedom. Michela Allocca’s Personal Finance Dashboard offers streamlined expense tracking that allows users to monitor their spending in real-time. This course emphasizes the importance of categorizing expenses and setting budget limits to keep your finances in check. By using the dashboard, you can gain valuable insights into your spending patterns and identify areas where you can cut back.

Accurately tracking expenses helps you stay on top of your financial situation, making it easier to avoid unnecessary expenditures and focus on your financial goals.

Expense tracking is more than just listing where your money goes; it’s about understanding your financial habits and making informed decisions based on that understanding.

The Personal Finance Dashboard’s user-friendly design makes it simple to categorize your expenses, whether you’re tracking groceries, utilities, or discretionary spending. This categorization lets you see exactly where your money is going each month, helping you identify trends and make adjustments as needed. Setting budget limits for each category ensures that you’re living within your means and working towards your financial goals.

What Are the Benefits of Setting Financial Goals with the Personal Finance Dashboard?

Setting and achieving financial goals is a key component of financial success. The Personal Finance Dashboard course by Michela Allocca guides users through the process of setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals. Whether you’re saving for a vacation, building an emergency fund, or paying off debt, the dashboard provides the tools to track your progress and stay motivated. With visual progress trackers and reminders, you’ll always know where you stand about your goals, making it easier to stay on track and achieve them.

Financial goals are the roadmap to your financial future, and the Personal Finance Dashboard makes goal setting both easy and effective. By breaking down your financial objectives into manageable steps, this course helps you create a clear plan for achieving them. The dashboard’s visual tools clearly represent your progress, allowing you to see how far you’ve come and what still needs to be done. This visual feedback is crucial for maintaining motivation and staying committed to your financial goals.

How Does Michela Allocca’s Dashboard Offer Financial Insights and Analysis?

You need access to clear and actionable data to make informed financial decisions. Michela Allocca’s Personal Finance Dashboard offers a suite of financial insights and analysis tools that allow users to dive deep into their financial health. The course teaches you how to use these tools to analyze income trends, breakdown expenses, and calculate your net worth. By leveraging data visualization techniques, the dashboard presents this information in a way that’s easy to understand, empowering you to make decisions that will improve your financial situation.

Financial analysis is critical for understanding your overall financial health. The Personal Finance Dashboard provides detailed breakdowns of your income and expenses, allowing you to see exactly where your money is coming from and where it’s going. This information is crucial for identifying areas where you may be overspending or under-saving. By calculating your net worth, the dashboard gives you a clear picture of your financial standing, helping you to set realistic goals and create a plan for improving your financial health over time.

What Makes Budget Optimization a Key Feature of the Personal Finance Dashboard?

Budgeting is the foundation of financial stability, and Michela Allocca’s Personal Finance Dashboard makes the process of budgeting straightforward and effective. This course teaches users how to create and manage personalized budgets that reflect their unique financial circumstances. By allocating funds to different expense categories, tracking spending against budget targets, and adjusting budgets as needed, the dashboard helps ensure that you stay on track towards your financial goals. The flexibility of the budgeting tools allows you to adapt your budget as your financial situation changes, ensuring that you’re always in control of your finances.

A well-optimized budget is essential for financial success, and the Personal Finance Dashboard provides all the tools you need to create one. Setting budget limits for each spending category ensures that your money is being used effectively.

The dashboard’s real-time tracking features allow you to see how much you’ve spent in each category, making it easy to adjust your spending habits as needed. This dynamic approach to budgeting ensures that you’re always in control of your finances and can make informed decisions that support your financial goals.

How Do Customizable Financial Reports Enhance Your Money Management?

Every individual’s financial situation is unique, which is why customizable financial reports are a key feature of Michela Allocca’s Personal Finance Dashboard. This course shows you how to generate income, expenses, savings, investments, and more reports tailored to your specific needs. These reports provide deeper insights into your financial status, allowing you to make informed decisions about your money management strategies. Whether you need a snapshot of your current financial situation or a detailed analysis of your spending habits, the dashboard’s customizable reports give you the information you need to take control of your finances.

Customizable financial reports are invaluable for anyone serious about managing their money. The Personal Finance Dashboard allows you to generate reports tailored to your specific needs, whether tracking your monthly expenses, analyzing your investment portfolio, or reviewing your savings goals. These reports provide a clear and detailed view of your financial situation, making it easier to identify areas where you can improve. With access to this level of detail, you can make informed decisions that will help you achieve your financial goals more efficiently.

How Does Michela Allocca Ensure the Security and Privacy of Your Financial Data?

Security and privacy are paramount when it comes to managing personal finances, and Michela Allocca’s Personal Finance Dashboard takes these concerns seriously. The course covers the robust security measures that have been implemented to protect user data, including encryption protocols, multi-factor authentication, and regular security audits. By ensuring that your financial information is secure, the dashboard gives you the peace of mind to focus on achieving your financial goals without worrying about the safety of your data.

In today’s digital age, protecting your financial information is more important than ever. The Personal Finance Dashboard uses state-of-the-art security measures to ensure that your data is safe from unauthorized access. Encryption protocols protect your information as it’s transmitted over the internet, while multi-factor authentication adds an extra layer of security to your account.

Regular security audits ensure that the system remains secure and up-to-date with the latest security standards. With these protections in place, you can confidently use the dashboard, knowing that your financial data is secure.

Why Choose Michela Allocca’s Personal Finance Dashboard Course?

What Sets the Personal Finance Dashboard Apart from Other Tools?

Countless personal finance tools are available, but Michela Allocca’s Personal Finance Dashboard stands out for its comprehensive features and user-friendly design. This course goes beyond basic budgeting to offer a complete solution for managing your finances. The dashboard provides all the tools you need to achieve financial wellness, from tracking expenses and setting goals to analyzing financial data and optimizing your budget. Its intuitive interface makes it easy for anyone to use, regardless of their level of financial expertise.

The Personal Finance Dashboard isn’t just another budgeting app; it’s a complete financial management tool designed to help you take control of your finances. With its wide range of features and easy-to-use interface, the dashboard makes it simple to track your expenses, set financial goals, and make informed decisions about your money. Whether you’re new to personal finance or a seasoned pro, Michela Allocca’s course provides the knowledge and tools you need to succeed.

How Can the Personal Finance Dashboard Help You Achieve Financial Wellness?

Financial wellness is about more than just having money in the bank; it’s about having the confidence and knowledge to manage your finances effectively. Michela Allocca’s Personal Finance Dashboard is designed to help you achieve this by providing you with the tools and insights you need to take control of your financial future. Using the dashboard to track your expenses, set goals, and analyze your financial data, you can develop a clear plan for achieving your financial objectives and building a secure financial future.

Achieving financial wellness requires more than just a budget; it requires a comprehensive understanding of your financial situation and the ability to make informed decisions about your money. The Personal Finance Dashboard provides all the tools you need to achieve this. By tracking your expenses, setting and monitoring financial goals, and analyzing your financial data, you can develop a clear and actionable plan for achieving your financial objectives. With Michela Allocca’s course, you’ll have the knowledge and confidence you need to take control of your finances and achieve lasting financial wellness.

Conclusion: Empower Your Financial Future with Michela Allocca’s Personal Finance Dashboard

In a world where financial security is more important than ever, having the right tools to manage your money is crucial. Michela Allocca’s Personal Finance Dashboard course offers a comprehensive, easy-to-use solution for anyone looking to take control of their finances.

This course provides everything you need to achieve financial wellness, from expense tracking and goal setting to financial analysis and budget optimization. With its robust features, intuitive interface, and strong security measures, the Personal Finance Dashboard is the ultimate tool for empowering your financial future.

Don’t leave your financial security to chance—enroll in Michela Allocca’s course today and start your journey towards economic stability and success.