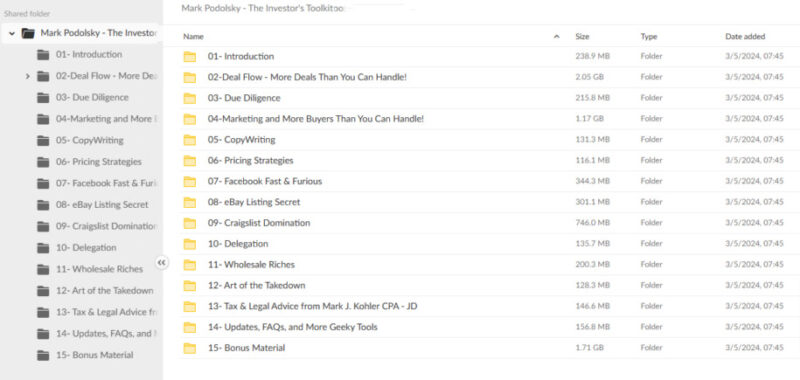

Mark Podolsky – The Investor’s Toolkit

$798.00 Original price was: $798.00.$22.00Current price is: $22.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Mark Podolsky – The Investor’s Toolkit

Transform Your Real Estate Success with Mark Podolsky – The Investor’s Toolkit Course

Unlock the potential of real estate investing with the The Investor’s Toolkit course, a comprehensive program designed by seasoned real estate expert Mark Podolsky. This course is meticulously crafted to provide you with the essential tools, strategies, and techniques needed to thrive in the world of real estate. Whether you are a beginner looking to make your first investment or an experienced investor seeking to expand your portfolio, this toolkit offers a wealth of knowledge and actionable insights to guide you toward financial freedom and success.

Why Choose the Investor’s Toolkit Course?

The The Investor’s Toolkit course is more than just a set of resources; it’s a complete framework that empowers you to build wealth through smart real estate investments. Led by Mark Podolsky, a renowned expert in the field, the course combines practical advice with proven methods to help you navigate the complexities of the real estate market confidently. With a focus on building passive income streams and achieving sustainable growth, this course provides the guidance you need to make informed decisions, negotiate profitable deals, and manage risks effectively.

What Are the Fundamentals of Real Estate Investing?

How Does Understanding Real Estate Investing Fundamentals Benefit You?

Central to the The Investor’s Toolkit course is a deep dive into the fundamentals of real estate investing. This foundational knowledge is crucial for anyone looking to enter or advance in the real estate market. Participants learn about various types of investment properties, including residential, commercial, and land, and explore diverse investment strategies such as wholesaling, flipping, and buy-and-hold approaches.

Understanding these fundamentals equips you with the skills to analyze cash flow, evaluate appreciation potential, and leverage opportunities effectively. By mastering these core principles, you can identify investment opportunities that align with your financial goals and risk tolerance, setting the stage for successful and sustainable investments.

Why Are Investment Strategies Important?

Real estate investing offers numerous paths to success, each with its unique set of challenges and opportunities. The course helps you understand which strategy best suits your goals, whether it’s generating quick profits through flipping properties or building long-term wealth with a buy-and-hold approach. By examining the pros and cons of each method, you can choose the strategy that aligns with your objectives, enabling you to maximize your returns and achieve your financial aspirations.

How Do You Identify Lucrative Investment Opportunities?

What Are the Key Elements in Identifying Profitable Deals?

One of the most critical skills for a real estate investor is the ability to spot lucrative investment opportunities in a competitive market. The The Investor’s Toolkit course teaches you how to conduct thorough market research, analyze investment properties, and identify potential deals that offer the best returns.

You will learn how to assess factors such as location, market trends, and property condition to evaluate the viability of an investment. Armed with these insights, you can make informed decisions that minimize risk and maximize profitability. This knowledge allows you to focus on high-potential properties, ensuring that your investments align with your long-term financial goals.

Why Is Market Research Vital?

Market research is the foundation of any successful real estate investment. By understanding local market conditions, you can determine which areas are likely to experience growth, where demand is highest, and which properties offer the greatest potential for appreciation. The course guides you in conducting effective market analysis, helping you uncover hidden gems that others may overlook and giving you a competitive edge in the marketplace.

What Are the Secrets to Successful Negotiation and Deal Structuring?

How Can You Master the Art of Negotiation?

Negotiation is a critical component of any real estate transaction, and the The Investor’s Toolkit course provides you with the techniques needed to secure the best possible terms. You will learn how to negotiate purchase prices, financing terms, and contract clauses to ensure that every deal aligns with your investment objectives.

By understanding how to position yourself as a confident and informed negotiator, you can build trust with sellers and buyers alike, creating win-win situations that benefit all parties involved. This skill set not only helps you close more deals but also maximizes your returns by reducing costs and mitigating risks.

What Are the Best Practices for Structuring Deals?

Deal structuring involves much more than just agreeing on a price. The course teaches you how to use creative financing options, such as seller financing or lease options, to craft deals that meet your specific needs. By understanding the nuances of different deal structures, you can tailor each transaction to optimize profitability, reduce exposure, and achieve your investment goals.

How Can You Secure Financing and Funding for Your Investments?

What Financing Options Are Available?

Financing is a key element in real estate investing, and the The Investor’s Toolkit course explores a variety of financing strategies to help you fund your investments. Participants learn about traditional options, such as bank loans and mortgages, as well as alternative methods like private lenders, seller financing, and creative funding options like joint ventures and crowdfunding.

By understanding the pros and cons of each financing option, you can choose the strategy that best fits your financial situation and investment objectives. This knowledge enables you to secure the necessary capital to grow your portfolio, whether you’re looking to purchase your first property or expand into new markets.

How Do You Choose the Right Financing Strategy?

Selecting the right financing strategy is crucial to the success of any real estate investment. The course provides you with the tools to evaluate different options based on factors such as interest rates, loan terms, and repayment schedules. You will learn how to assess your risk tolerance and financial goals to determine the most suitable financing method, ensuring that your investments remain profitable and sustainable over the long term.

What Role Does Risk Management and Due Diligence Play?

Why Is Risk Management Essential?

Every investment carries some degree of risk, but effective risk management can help mitigate these risks and protect your capital. The The Investor’s Toolkit course emphasizes the importance of conducting thorough due diligence to identify potential pitfalls before committing to a deal. You will learn how to conduct property inspections, assess market risks, and perform financial analysis to evaluate the potential rewards and risks of each opportunity.

By understanding how to manage risks effectively, you can make more informed investment decisions and safeguard your assets against unforeseen events. This approach ensures that you can capitalize on opportunities while minimizing exposure to potential losses.

How Can You Conduct Effective Due Diligence?

Due diligence is a critical step in the investment process, and the course teaches you how to approach it systematically. From analyzing market conditions and property values to reviewing legal documents and financial statements, you will learn how to gather and interpret the data needed to make sound investment decisions. This comprehensive approach to due diligence helps you avoid costly mistakes and ensures that each investment aligns with your long-term goals.

Why Learn from Mark Podolsky?

Who Is Mark Podolsky?

Mark Podolsky, also known as “The Land Geek,” is a seasoned real estate investor with over two decades of experience in the industry. He is known for his innovative approach to land investing and his ability to turn complex real estate transactions into straightforward, profitable ventures. With a proven track record of success, Mark has helped countless investors achieve financial freedom through real estate.

Why Trust His Expertise?

Mark Podolsky’s The Investor’s Toolkit course is built on years of experience, tested strategies, and real-world examples. His hands-on approach and practical advice have made him a trusted authority in the real estate community. By learning from Mark, you gain access to the insights and strategies that have helped him and many others achieve remarkable success in the real estate market.

Conclusion: Your Pathway to Real Estate Success

The Mark Podolsky – The Investor’s Toolkit course is more than just an educational program; it’s a comprehensive roadmap to achieving financial success through strategic real estate investments. Whether you’re looking to make your first investment or expand an existing portfolio, this course provides the tools, techniques, and guidance needed to navigate the complexities of the market with confidence.

With its focus on understanding real estate fundamentals, identifying lucrative opportunities, mastering negotiation and deal structuring, exploring financing options, and implementing effective risk management practices, the The Investor’s Toolkit course empowers you to take control of your financial future. Don’t miss the chance to transform your investment strategy and build lasting wealth through real estate. Enroll today and start your journey toward financial independence with Mark Podolsky’s expert guidance.

Product For Sale Fielding Financial – How to Purchase a Buy-to-Let Online Course

Product For Sale Related Products

$197.00 Original price was: $197.00.$19.00Current price is: $19.00.

$890.00 Original price was: $890.00.$15.00Current price is: $15.00.

$2,497.00 Original price was: $2,497.00.$25.00Current price is: $25.00.

$987.00 Original price was: $987.00.$20.00Current price is: $20.00.