Jack Gleason – Startup Trading Masterclass

$1,999.00 Original price was: $1,999.00.$26.00Current price is: $26.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Jack Gleason – Startup Trading Masterclass

Elevate Your Trading Skills with The Jack Gleason – Startup Trading Masterclass

Discover the path to professional futures trading with the Startup Trading Masterclass course by Jack Gleason. Designed for aspiring traders from beginner to intermediate levels, this comprehensive course provides a complete roadmap to mastering the art of trading futures. Covering everything from the foundational basics to advanced strategies and techniques, it places a strong emphasis on mindset and emotional intelligence—key components to achieving consistent success in the markets. Whether you’re a novice eager to break into trading or an experienced trader looking to refine your approach, this masterclass offers all the tools you need to succeed.

Why Choose The Jack Gleason – Startup Trading Masterclass?

What Makes This Course Unique for Aspiring Traders?

The Jack Gleason – Startup Trading Masterclass is a one-of-a-kind program that combines a comprehensive understanding of futures trading with a deep focus on the psychological and strategic aspects of trading. Unlike many other trading courses, this masterclass goes beyond mere technical analysis and trading tactics. It incorporates lessons on how to develop a resilient trading mindset, manage emotions, and maintain discipline—skills that are essential for long-term success in the fast-paced world of futures trading.

Jack Gleason, a seasoned futures trader with a proven track record, brings his extensive experience to this course. His hands-on approach and practical insights are invaluable for anyone looking to navigate the complex landscape of futures trading. With self-paced modules, you can learn at your own speed, building a solid foundation and advancing to more complex strategies and techniques.

What Will You Learn in the Startup Trading Masterclass Course?

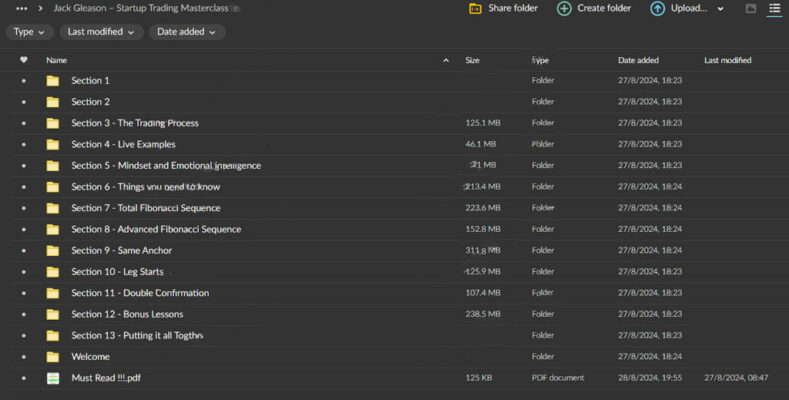

This Startup Trading Masterclass course is divided into multiple sections, each focusing on a crucial aspect of futures trading. You will start by understanding the basics, including key concepts, market participants, and the evolution of futures contracts. From there, you will move on to more advanced topics, such as mastering trading strategies, understanding the role of mindset and emotional intelligence, and applying Fibonacci techniques. By the end of the course, you will be equipped with a full spectrum of trading knowledge, from foundational principles to advanced strategies, allowing you to trade futures like a professional.

What Are the Basics of Futures Trading Covered in This Course?

Why Do We Use Futures to Trade?

The first section of the Startup Trading Masterclass focuses on the fundamentals of futures trading. You will learn why futures contracts are a preferred trading instrument for many professionals. Unlike other financial instruments, futures offer several advantages, such as lower transaction costs, greater leverage, and the ability to trade a wide range of assets, including commodities, currencies, and indices.

Jack Gleason explains how these benefits can be leveraged to enhance your trading strategy, providing a solid foundation for your trading career. By understanding the unique characteristics of futures, you can make informed decisions about when and how to enter the market, maximizing your potential for profit.

What Are the Basics of Trading Futures?

Before diving into advanced techniques, it’s crucial to understand the basics of trading futures. This section covers key concepts and terminology, such as types of orders (market, limit, and stop orders), margin requirements, and the roles of various market participants. You will also explore the historical significance and development of futures contracts, gaining insight into how these instruments have evolved over time.

By grasping these foundational concepts, you’ll be better equipped to navigate the complexities of the futures markets. The course ensures that you have a thorough understanding of the core principles, setting the stage for more advanced learning in later sections.

How Does the Trading Process Work in Real Life?

What Is the Step-by-Step Guide to Executing Trades?

Executing trades effectively is a critical skill for any trader. In the third and fourth sections of the Startup Trading Masterclass, Jack Gleason provides a detailed, step-by-step guide to executing trades in the futures market. You will learn how to use different types of orders, such as market orders, limit orders, and stop orders, to manage your positions and protect your capital.

The course covers the entire trading process, from placing a trade to managing open positions and closing them out profitably. This practical approach helps bridge the gap between theory and practice, giving you the confidence to execute trades with precision and accuracy.

How Can Real-Life Trade Scenarios Enhance Your Learning?

Understanding theoretical concepts is important, but applying them in real-life situations is crucial for developing true trading expertise. The Startup Trading Masterclass includes an analysis of real trade scenarios, providing you with practical insights into how experienced traders make decisions in the market.

By examining these real-world examples, you will learn how to analyze market conditions, identify profitable opportunities, and apply the strategies taught in the course. This hands-on experience helps reinforce the concepts covered in the lessons, ensuring that you have a well-rounded understanding of futures trading.

Why Is Mindset Important in Trading?

How Does Emotional Intelligence Affect Trading Success?

A significant portion of the Startup Trading Masterclass is dedicated to understanding the psychological aspects of trading. Jack Gleason emphasizes the importance of mindset and emotional intelligence, recognizing that successful trading is not just about numbers and charts, but also about managing emotions and maintaining focus.

This section will teach you techniques to develop psychological resilience, manage stress, and maintain discipline, even in volatile market conditions. By mastering these skills, you will be better prepared to navigate the ups and downs of the trading world, making decisions based on logic and analysis rather than emotion.

What Is the “All-In, All-Out” Strategy?

The “All-In, All-Out” strategy is a straightforward yet effective approach to trading that can help maximize gains and minimize losses. This strategy involves entering a trade with a full position and exiting completely once a target or stop-loss level is reached. By removing the ambiguity of partial exits or scaling in and out of positions, this strategy helps you maintain clarity and discipline in your trading.

Jack Gleason provides detailed guidance on implementing the “All-In, All-Out” strategy in various market conditions, ensuring you have the tools to make decisive, confident trading decisions. This approach helps you stay focused on your trading plan and avoid the emotional pitfalls that can derail even the most experienced traders.

How Can Fibonacci Techniques Enhance Your Trading?

What Are the Basics of Fibonacci in Trading?

Fibonacci retracement levels are a powerful tool for traders looking to identify potential market support and resistance levels. In sections seven and eight, the Startup Trading Masterclass introduces you to the mathematical foundation of Fibonacci and its practical application in trading. You’ll learn to set up Fibonacci retracement and extension levels to identify potential entry and exit points.

Understanding the basics of Fibonacci can help you anticipate price movements better and improve your overall trading performance. The course provides a comprehensive overview of using Fibonacci techniques, ensuring you understand this essential tool.

How Do Advanced Fibonacci Setups Work?

For more experienced traders, the course delves into advanced Fibonacci setups, showing you how to combine Fibonacci retracement levels with other indicators to create powerful trading strategies. You’ll learn how to identify high-probability trades using Fibonacci in conjunction with trend lines, moving averages, and other technical analysis tools.

By mastering these advanced techniques, you can develop a more refined trading strategy that adapts to different market conditions. The Startup Trading Masterclass provides step-by-step guidance on setting up and executing these advanced strategies, helping you take your trading to the next level.

What Advanced Trading Techniques Are Covered?

How Do You Identify and Follow Trading Trends?

Trend identification is a critical skill for any trader. In sections nine and ten, the Startup Trading Masterclass covers techniques for identifying and following trends in the market. You’ll learn the “Same Anchor New High” method, which helps you spot emerging trends and capitalize on them early.

By understanding how to identify and follow trends, you can align your trades with the prevailing market direction, increasing your chances of success. The course provides practical examples and exercises to help you apply these techniques in real-time, ensuring you have the skills needed to navigate different market conditions.

What Are Leg Starts in Market Movements?

Leg starts are an advanced concept in trend analysis, referring to the initial movements that mark the beginning of a new trend. The course teaches you how to recognize leg starts, understand their significance, and use them to your advantage in your trading strategy. By identifying these key moments in market movements, you can position yourself to enter trades at optimal points, maximizing your potential for profit.

What Bonus Lessons Are Included in This Course?

How Can You Confirm Trade Signals for Higher Accuracy?

The Startup Trading Masterclass includes bonus lessons on advanced trading topics, such as double confirmation strategies. You’ll learn how to use multiple indicators to confirm trade signals, ensuring higher accuracy and confidence in your trading decisions. This approach reduces the risk of false signals and improves your overall trading success rate.

By mastering these confirmation techniques, you can refine your strategy and increase your probability of success. The course provides practical guidance on how to apply these strategies in real-time, helping you build a more reliable trading system.

Why Is Proper Stop Sizing Important for Risk Management?

Effective risk management is crucial for long-term trading success. The course teaches you how to determine optimal stop-loss levels, a key component of any risk management strategy. By understanding how to set appropriate stop sizes based on market volatility and your risk tolerance, you can protect your capital and minimize potential losses.

This comprehensive approach ensures you are fully equipped to start trading professionally, with all the essential tools and platforms at your disposal.

Conclusion: Achieve Trading Mastery with The Jack Gleason – Startup Trading Masterclass

The Jack Gleason – Startup Trading Masterclass is a comprehensive course that provides a deep understanding of futures trading, from the basics to advanced techniques. With a strong emphasis on mindset, emotional intelligence, and strategic planning, this course prepares aspiring traders to navigate the markets like professionals. By following Jack Gleason’s detailed lessons and practical examples, you can develop the skills and confidence needed to trade futures successfully and achieve long-term success in the markets.

Enroll today and take the first step towards mastering the art of futures trading!

Product For Sale

Product For Sale

Product For Sale

Product For Sale Related Products

$299.00 Original price was: $299.00.$20.00Current price is: $20.00.

$997.00 Original price was: $997.00.$20.00Current price is: $20.00.

$1,491.00 Original price was: $1,491.00.$24.00Current price is: $24.00.

$15,000.00 Original price was: $15,000.00.$38.00Current price is: $38.00.