Smart Money Trader – The Banks Code

Original price was: $220.00.$22.00Current price is: $22.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Smart Money Trader – The Banks Code

The Banks Code Course: Unlock the Secrets of Institutional Trading with Smart Money Trader

Do you want to trade like the most prominent players in the financial markets? The Banks Code course from Smart Money Trader is designed to give you an insider’s look into how institutional investors—banks, hedge funds, and other financial giants—dominate the markets. This comprehensive program demystifies the advanced strategies and tactics these large institutions use, helping traders understand and capitalize on market dynamics that often leave retail traders at a disadvantage. This course is a must-have if you’re serious about improving your trading performance and want to learn the “smart money” way.

The Banks Code course offers a step-by-step guide to decoding the behaviour of these market-moving entities, teaching you how to identify and follow institutional order flow, analyze market sentiment, and develop high-probability trading strategies. Created by a team of experienced traders and financial experts, the course blends fundamental market education with cutting-edge trading techniques. You’ll gain the skills to align your trading strategy with institutional movements, giving you an edge over the typical retail trader.

How Does Smart Money Trader Help You Master Institutional Trading?

What makes Smart Money Trader different from other trading education platforms? Smart Money Trader focuses on the behavior of institutional investors, also known as “smart money,” which drives the majority of market liquidity and price action. This course teaches you how to interpret their trades, giving you insight into how these massive players move the markets.

How does The Banks Code help you decode institutional activity? Institutional investors, including banks and hedge funds, employ complex strategies to gain a competitive edge in the financial markets. The The Banks Code course teaches you how to decode these strategies by studying market structure, price action, and supply and demand dynamics. By understanding how smart money operates, you’ll learn to anticipate market movements, improving your ability to enter trades at the right time and increase your profitability.

Why is understanding institutional order flow essential for trading success? Order flow—large institutions’ buying and selling activity—provides vital clues about market sentiment and potential price direction. In The Banks Code, you’ll learn how to analyze order flow data, giving you a deeper understanding of where the big money is moving. By following the footprints of institutional traders, you can make more informed trading decisions and align your strategies with market momentum.

What Can You Expect from The Banks Code Course Structure?

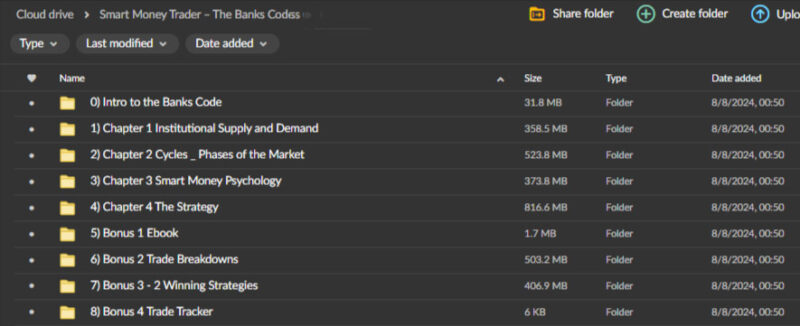

How is the Banks Code course structured to maximize your learning? The course is divided into easy-to-follow modules, each focusing on a different aspect of trading like a professional. It starts with foundational knowledge, ensuring that participants understand key concepts like market structure, supply and demand, and price action. This serves as the foundation upon which more advanced strategies are built.

Module 1: Market Fundamentals

What core principles does the course cover in its foundation module? The Banks Code begins by laying a solid foundation in market fundamentals. You’ll explore critical topics like supply and demand dynamics, price action, and market structure, all essential to understanding how markets behave. These concepts will help you grasp the mechanics behind market movements, giving you the tools you need to make informed trading decisions.

How does this module set the stage for more advanced strategies? Once you understand the basics, you’ll be better equipped to dive into the more advanced tactics covered later in the course. The goal is to ensure that participants have a strong grasp of how markets work before moving on to institutional strategies and order flow analysis.

Module 2: Institutional Order Flow and Market Sentiment

How does The Banks Code teach you to follow institutional money? The second module dives deep into order flow analysis—the study of institutional buying and selling activity. You’ll learn how to “read the tape,” or interpret real-time market data to identify where large financial players are placing their trades. This information is crucial for timing your entries and exits with greater accuracy, helping you make smarter, more strategic moves in the market.

Why is studying market sentiment important for your trading strategy? Market sentiment refers to the overall attitude of investors toward a particular asset or market. Smart Money Trader places a heavy emphasis on understanding how institutional traders view market conditions and how that sentiment influences their trading behavior. By learning to read institutional sentiment, you can better predict price movements and align your trades with the overall direction of the market.

Module 3: Advanced Trading Techniques and Risk Management

What advanced strategies are covered in the final module of The Banks Code? In the final module, the course takes a deep dive into advanced techniques used by institutional traders. This includes strategies for reading price patterns, volume analysis, and identifying high-probability trade setups. You’ll also learn how to use custom indicators and proprietary tools that can give you an edge in fast-moving markets.

Why is risk management such a critical part of trading success? No trading strategy is complete without a solid risk management plan, and The Banks Code doesn’t overlook this crucial element. You’ll learn how to manage your risk effectively, including strategies for position sizing, stop-loss placement, and profit-taking. The course also addresses the psychological aspects of trading, teaching you how to maintain emotional discipline and avoid impulsive decisions that can erode your profits.

How Does Smart Money Trader Address the Psychological Side of Trading?

Why is trading psychology essential for long-term success? Trading is not just about technical analysis and strategy; it’s also about maintaining the right mindset. The Smart Money Trader approach emphasizes the importance of psychological discipline in navigating the ups and downs of the market. The Banks Code covers common psychological pitfalls that traders face, such as fear, greed, and impulsive behavior, and provides strategies for overcoming them.

How does emotional control improve your trading decisions? Successful traders know that emotions can cloud judgment, leading to poor decision-making and unnecessary losses. In The Banks Code course, you’ll learn techniques for controlling emotional impulses and sticking to your strategy, even in volatile markets. This is crucial for maintaining long-term consistency and avoiding the kind of errors that often derail traders.

What role does confidence play in trading success? Confidence comes from knowledge, experience, and emotional control. By understanding how institutional traders operate and learning to manage your own emotions, you’ll gain the confidence to make bold decisions without second-guessing yourself. The Smart Money Trader methodology ensures that you not only develop the technical skills needed for trading but also the psychological resilience required to succeed in the long run.

What Practical Applications Does The Banks Code Offer?

How does The Banks Code ensure hands-on learning? One of the standout features of this course is its focus on practical application. Rather than just teaching theory, the The Banks Code emphasizes hands-on learning through simulated trading exercises and real-world case studies. You’ll get to practice the strategies you learn in a risk-free environment, giving you the confidence to apply them in live markets.

Why is experiential learning important in trading? Experience is often the best teacher, and The Banks Code provides ample opportunities for participants to put their knowledge to the test. Simulated trading exercises allow you to experiment with different strategies, refine your approach, and learn from your mistakes—all without the pressure of risking real money. This approach ensures that by the time you transition to live trading, you’re well-prepared and confident in your abilities.

How do real-world case studies help enhance your learning? Throughout the course, Smart Money Trader integrates real-world examples and case studies to show how institutional strategies play out in different market conditions. These case studies help bridge the gap between theory and practice, giving you a clearer understanding of how to apply the strategies you’ve learned in real-time scenarios.

Why Is Smart Money Trader – The Banks Code a Must-Have Course for Aspiring Traders?

What makes The Banks Code course worth the investment? The Smart Money Trader – The Banks Code offers a rare opportunity to learn the same techniques used by institutional investors, giving retail traders a competitive edge. By mastering order flow analysis, market sentiment, and advanced trading strategies, you’ll be better equipped to navigate the complexities of the financial markets and achieve consistent profitability.

How will this course transform your trading performance? By the end of The Banks Code, participants emerge with a complete understanding of how institutional traders operate and how to align their strategies accordingly. You’ll learn how to spot high-probability trade setups, manage risk effectively, and maintain emotional control—three key components of successful trading.

Conclusion: Why The Banks Code Course is Essential for Every Trader

The Smart Money Trader – The Banks Code is a game-changing course for traders who want to take their skills to the next level. With a focus on understanding institutional behavior, mastering order flow, and applying advanced strategies, this course equips you with everything you need to succeed in the financial markets. Whether you’re new to trading or looking to refine your skills, the The Banks Code course offers the insights, tools, and practical knowledge needed to achieve long-term success.

Don’t miss out on the opportunity to learn from seasoned experts—enroll in The Banks Code course today and start trading like a pro!