Neil McCoy-Ward – The ULTIMATE Macro Economics& Stock Market Course

$997.00 Original price was: $997.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

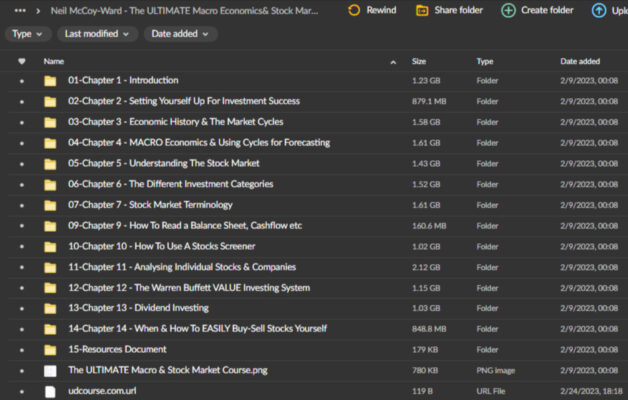

Neil McCoy-Ward – The ULTIMATE Macro Economics& Stock Market Course

Unlock Your Financial Future with Neil McCoy-Ward – The ULTIMATE Macro Economics & Stock Market Course

Are you ready to take control of your financial destiny? Neil McCoy-Ward’s The ULTIMATE Macro Economics & Stock Market Course is your gateway to mastering the intricacies of macroeconomics and stock market analysis. This comprehensive course caters to both beginners and experienced investors, offering a deep dive into macroeconomic principles and their direct impact on market dynamics. By enrolling, you’ll gain the knowledge and tools necessary to confidently navigate the financial landscape, making informed investment decisions that can significantly enhance your wealth.

Why Should You Choose Neil McCoy-Ward’s Course?

What Makes This Course Stand Out?

Neil McCoy-Ward’s course is designed with a well-organized structure that allows participants to build a solid foundation in macroeconomics before diving into the complexities of stock market analysis. The curriculum is carefully crafted to ensure that learners progress seamlessly from basic concepts to more advanced topics, making it accessible for individuals at all levels of expertise. Each section builds on the previous one, creating a cohesive learning experience that is both engaging and informative.

What Will You Gain from the Course?

Participants can expect to emerge from The ULTIMATE Macro Economics & Stock Market Course with a comprehensive understanding of key macroeconomic indicators such as inflation, unemployment, GDP, and fiscal policies. McCoy-Ward employs an engaging teaching style that combines theory with real-world examples, ensuring that you can apply your newfound knowledge in practical scenarios. Whether you aim to enhance your investing skills or simply wish to understand the economic factors influencing your financial decisions, this course equips you with the tools to succeed.

Mastering Macro Economics with Neil McCoy-Ward

How Does Macro Economics Impact Your Financial Decisions?

The first section of the course focuses on mastering macroeconomics, a critical component in understanding the broader economic environment in which stock markets operate. Neil McCoy-Ward skillfully breaks down complex economic theories into digestible modules, ensuring that even those new to the subject can grasp the intricacies of macroeconomic indicators. By comprehensively covering topics such as inflation, GDP, and fiscal policies, participants gain insights into how these factors influence market conditions and investment opportunities.

Understanding macroeconomic principles is essential for any investor. For instance, inflation rates can affect purchasing power and consumer behavior, while GDP growth signals the overall health of an economy. By grasping these concepts, you’ll be better equipped to anticipate market movements and adjust your investment strategies accordingly. Neil’s engaging teaching style, complemented by real-world examples, allows for a deeper understanding of these economic indicators and their implications for investment decisions.

What Are the Key Macroeconomic Indicators You Will Learn?

Throughout this section, you’ll explore crucial macroeconomic indicators that play a significant role in shaping financial markets. Topics covered include:

- Inflation: Understanding how inflation affects purchasing power and investment strategies.

- Unemployment: Analyzing the relationship between unemployment rates and economic growth.

- GDP (Gross Domestic Product): Exploring how GDP influences market sentiment and investment opportunities.

By mastering these indicators, you’ll develop the analytical skills needed to evaluate economic conditions and make informed decisions that align with your investment goals.

Diving into Stock Market Analysis

How Can You Effectively Analyze Stocks?

Following the exploration of macroeconomics, the course transitions into stock market analysis, where Neil McCoy-Ward guides participants through the process of evaluating stocks and identifying potential investment opportunities. His emphasis on both technical and fundamental analysis equips you with a holistic approach to navigating the stock market. You’ll learn how to assess a company’s financial health, evaluate market trends, and make strategic investment choices based on your findings.

The course features practical exercises and case studies that allow participants to apply their knowledge in real-world scenarios. By analyzing historical data, market patterns, and economic events, you’ll develop a keen understanding of how to interpret market signals and make data-driven investment decisions.

What Techniques Will You Learn for Stock Evaluation?

Key topics covered in this section include:

- Technical Analysis: Learning how to use charts and indicators to forecast price movements.

- Fundamental Analysis: Understanding financial statements and economic conditions that impact stock prices.

By mastering these techniques, you’ll be well-prepared to identify undervalued stocks, recognize potential growth opportunities, and optimize your investment portfolio.

Effective Risk Management Strategies

Why Is Risk Management Essential for Investors?

A distinguishing feature of Neil McCoy-Ward’s course is its comprehensive coverage of risk management strategies. Recognizing the inherent uncertainties in the stock market, McCoy-Ward devotes significant attention to teaching participants how to mitigate risks effectively. Understanding and managing risk is crucial for any investor, as it helps protect your portfolio and ensures long-term success.

Throughout this section, you’ll explore various risk management techniques, including diversification and the importance of setting stop-loss orders. By learning how to create a balanced investment portfolio and implement risk-reducing strategies, you’ll empower yourself to make informed decisions that align with your financial objectives.

What Risk Management Techniques Will You Master?

Participants will gain insights into:

- Diversification Techniques: Spreading investments across various asset classes to minimize risk.

- Stop-Loss Orders: Setting limits on potential losses to protect capital.

By mastering these techniques, you’ll be equipped to navigate market fluctuations with confidence, safeguarding your investments while maximizing growth potential.

Understanding Market Psychology

How Does Market Psychology Influence Investing?

Understanding market psychology is essential for successful investing, and Neil McCoy-Ward’s course incorporates valuable insights into this aspect. By exploring the emotional and behavioral factors influencing market trends, participants gain a nuanced understanding of investor sentiment. Recognizing how fear, greed, and other psychological factors can impact market movements allows you to make more rational decisions during volatile market conditions.

McCoy-Ward’s lessons on maintaining discipline and managing emotions contribute to a well-rounded education that goes beyond mere technical analysis. You’ll learn to identify common psychological traps and develop strategies to avoid them, ensuring that your investment decisions are based on sound analysis rather than emotional reactions.

What Insights Will You Gain into Market Behavior?

Key concepts covered in this section include:

- Behavioral Finance: Understanding how psychological factors affect investor decisions.

- Investor Sentiment: Analyzing how public perception can drive market trends.

By mastering these insights, you’ll enhance your ability to navigate market dynamics, make informed decisions, and maintain a long-term investment strategy.

Interactive Learning Experience

How Does the Course Facilitate Active Learning?

Neil McCoy-Ward’s course utilizes an interactive learning platform, providing participants with a dynamic and engaging educational experience. This approach encourages active participation and fosters a sense of community among learners. Live Q&A sessions, discussion forums, and interactive quizzes create opportunities for participants to exchange ideas and seek clarification on complex topics.

McCoy-Ward’s accessibility and responsiveness to student queries further enhance the overall learning environment, ensuring that participants receive the support they need to succeed. This interactive format not only makes learning more enjoyable but also reinforces key concepts through collaboration and discussion.

What Resources Are Available to Support Your Learning Journey?

Participants will have access to a range of resources, including:

- Live Q&A Sessions: Engage with McCoy-Ward directly and gain insights on challenging topics.

- Discussion Forums: Collaborate with fellow learners and share experiences.

- Interactive Quizzes: Test your understanding of course material and reinforce learning.

By taking advantage of these resources, you’ll deepen your understanding of macroeconomics and stock market analysis while building connections with a community of like-minded individuals.

Conclusion: Transform Your Investing Journey with Neil McCoy-Ward

Neil McCoy-Ward’s The ULTIMATE Macro Economics & Stock Market Course emerges as a comprehensive and accessible resource for individuals seeking to master the intricacies of macroeconomics and stock market analysis. Through its well-structured modules, emphasis on risk management, insights into market psychology, and interactive learning platform, this course equips participants with the knowledge and skills needed to navigate the dynamic world of finance successfully.

Whether you are a novice investor looking to build a solid foundation or a seasoned professional aiming to refine your strategies, McCoy-Ward’s course offers valuable insights that can significantly enhance your understanding of macroeconomic principles and stock market dynamics. Don’t miss the opportunity to invest in your financial education and unlock your full potential as an investor.

Enroll today in The ULTIMATE Macro Economics & Stock Market Course and take the first step towards achieving your financial goals! With Neil McCoy-Ward as your guide, you’ll gain the confidence and knowledge needed to navigate the complexities of the financial world, making informed decisions that pave the way for a successful investing journey.

Product For Sale

Product For Sale

Product For Sale

Product For Sale Related Products

$1,491.00 Original price was: $1,491.00.$24.00Current price is: $24.00.

$299.00 Original price was: $299.00.$20.00Current price is: $20.00.

$15,000.00 Original price was: $15,000.00.$38.00Current price is: $38.00.

$997.00 Original price was: $997.00.$20.00Current price is: $20.00.