Michael S. Jenkins – Day Trading For 50 Years

Original price was: $525.00.$7.00Current price is: $7.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Michael S. Jenkins – Day Trading For 50 Years

Day Trading For 50 Years Course: Master the Market with Michael S. Jenkins

Embark on a journey through the dynamic world of day trading with Michael S. Jenkins – Day Trading For 50 Years, a comprehensive guide encapsulating Jenkins’ extensive experience and trading philosophy. Based on his eBook, this course offers invaluable insights for novice and experienced traders. Spanning 23 chapters, the Day Trading For 50 Years course delves into various aspects of day trading, providing a rich tapestry of strategies and concepts accumulated over decades.

Why Should You Enroll in the Day Trading For 50 Years Course?

The Day Trading For 50 Years course is meticulously crafted to offer deep insights into the world of day trading. Michael S. Jenkins shares his 50 years of trading experience, presenting a blend of foundational principles, advanced techniques, and practical strategies. Whether you’re just starting or looking to refine your skills, this course provides the knowledge and tools you need to navigate the complexities of the trading world.

What is Michael S. Jenkins’ Philosophy of Trading?

How Does Jenkins’ Mindset Set the Tone for the Course?

The opening chapter, My Philosophy of Trading, sets the tone for the entire Day Trading For 50 Years course. Jenkins shares his mindset and approach towards day trading, laying a foundational understanding that resonates throughout the subsequent chapters. This initial section is crucial for readers to grasp Jenkins’ perspective and methodology, setting them up for a detailed exploration. His philosophy emphasizes discipline, patience, and understanding market psychology.

Why is Understanding Jenkins’ Philosophy Important?

Understanding Jenkins’ philosophy is essential because it provides a framework for approaching the market. His insights into market behaviour, risk management, and strategic thinking are invaluable for traders at any level. By aligning your mindset with Jenkins’ principles, you can develop a more disciplined and practical trading approach, leading to better decision-making and improved trading outcomes.

What are the Basic Starting Principles of Day Trading?

What Core Concepts are Introduced in the Second Chapter?

In the second chapter, Basic Starting Principles, Jenkins introduces fundamental concepts essential to day trading. This chapter serves as the bedrock for understanding the intricacies of the trading world, offering core principles that are pivotal for building advanced strategies later in the course. Topics such as market structure, trading psychology, and fundamental technical analysis are covered, providing a solid foundation for more complex issues.

How Do These Principles Build a Strong Foundation?

These basic principles build a strong foundation by equipping traders with the essential knowledge needed to navigate the markets. Understanding these core concepts is crucial for developing a robust trading strategy. Jenkins emphasizes the importance of mastering the basics before moving on to more advanced techniques, ensuring that traders are well-prepared for the challenges of day trading.

How Can Measure Move Vectors Enhance Your Trading?

What is the 360 Degree Measured Move Vector?

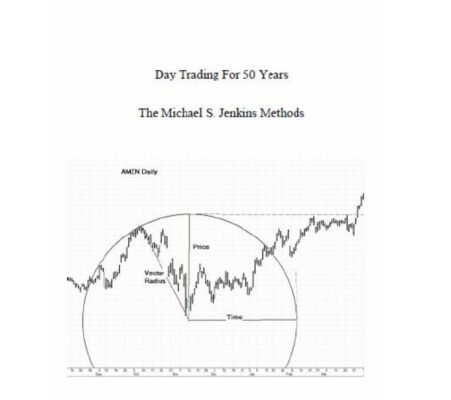

Chapter 3, titled 360 Degree Measured Move Vectors, delves into a specific technical analysis tool. Jenkins explains how traders can use measured move vectors to comprehensively gauge potential market movements, offering a blend of theory and practical application. This technique involves understanding price movements in a circular context, providing a unique perspective on market trends and reversals.

Why are Measured Move Vectors Important?

Measured move vectors are essential because they help traders identify potential price targets and key support and resistance levels. By understanding these vectors, traders can make more informed decisions about entry and exit points. Jenkins’ detailed explanation of this tool provides traders with a valuable addition to their technical analysis toolkit.

What is the Significance of Square the Circle in Trading?

How Does Jenkins Apply Geometric Concepts to Market Analysis?

In the fourth chapter, Square the Circle, Jenkins explores geometric concepts in trading. This unique perspective on market analysis provides traders with innovative ways to understand and predict price action. Jenkins applies geometric principles to chart patterns and price movements, offering a fresh approach to technical analysis.

How Can Geometric Analysis Improve Trading Accuracy?

Geometric analysis can improve trading accuracy by providing clear, visually-driven insights into market behavior. By understanding geometric patterns, traders can more precisely identify potential market turning points and trends. Jenkins’ expertise in this area offers traders a valuable edge in their analytical approach.

How Can Retracements Help Identify Strategic Entry and Exit Points?

What Role Do Market Pullbacks Play in Day Trading?

The fifth chapter, Retracements, focuses on market pullbacks and their significance in day trading. Jenkins’ insights into how retracements can be used to identify strategic entry and exit points enrich the reader’s understanding of market dynamics. Retracements are temporary reversals in a stock’s price direction, providing opportunities for traders to enter or exit positions at favourable prices.

Why are Retracements Crucial for Successful Trading?

Retracements are crucial for successful trading because they offer opportunities to enter trades at lower risk levels. By identifying retracement levels, traders can make more strategic decisions about where to place buy and sell orders. Jenkins’ guidance helps traders develop a keen eye for spotting these opportunities.

How to Effectively Analyze Trends in Day Trading?

What Techniques Does Jenkins Recommend for Trend Analysis?

In “Trend,” the sixth chapter, Jenkins dissects the critical aspect of trend analysis. Different types of trends, their identification, and strategies to effectively capitalize on these movements are explored. Jenkins explains how to recognize uptrends, downtrends, and sideways markets, and provides strategies for trading in each type of market condition.

How Can Understanding Trends Improve Trading Performance?

Understanding trends can improve trading performance by enabling traders to align their strategies with the prevailing market direction. By trading in the direction of the trend, traders can increase their chances of success. Jenkins’ techniques for trend analysis offer practical guidance for identifying and capitalizing on market trends.

What is the Secret to the Impulse Bar?

How Does Jenkins Identify and Interpret Impulse Bars?

Chapter 7, Secret to the Impulse Bar, reveals Jenkins’ expertise in identifying and interpreting impulse bars. Understanding these sudden market movements is key to making informed trading decisions. Impulse bars represent strong price movements that can indicate the beginning of a new trend or the continuation of an existing one.

Why are Impulse Bars Important for Day Traders?

Impulse bars are important for day traders because they provide clear signals of market strength and direction. By recognizing these bars, traders can make timely decisions to enter or exit trades. Jenkins’ insights into impulse bars help traders develop a more nuanced understanding of market momentum.

How Do Momentum & Angles Affect Trading Decisions?

What is the Relationship Between Momentum and Price Angles?

The eighth chapter, Momentum & Angles, discusses the relationship between momentum and price angles. This section provides traders with essential tools to gauge the strength and direction of market trends. Understanding momentum helps traders identify when a trend is likely to continue or reverse.

How Can Momentum Analysis Improve Trading Accuracy?

Momentum analysis can improve trading accuracy by providing insights into the speed and strength of price movements. By analyzing momentum, traders can better predict future price action. Jenkins’ explanation of momentum and angles offers practical techniques for incorporating this analysis into trading strategies.

How to Integrate Trading Strategies in Practice?

What Practical Frameworks Does Jenkins Provide?

Chapter 9, “Trading Strategy in Practice,” integrates the concepts from previous chapters into a cohesive, practical framework. This chapter is where theory meets practice, as readers learn to implement strategies in real-world trading scenarios. Jenkins provides step-by-step guidance on developing and executing trading plans.

Why is Practical Application Important?

Practical application is important because it allows traders to test and refine their strategies in real market conditions. By applying theoretical knowledge to practice, traders can gain valuable experience and improve their decision-making skills. Jenkins’ practical frameworks help traders bridge the gap between learning and doing.

How Can Time & Price Squared Enhance Trading Predictions?

What is the Concept of Aligning Time and Price Factors?

Chapter 10, Time & Price Squared, introduces the concept of aligning time and price factors. This advanced technique enhances the accuracy of trading predictions by considering both temporal and price elements. Jenkins explains how to use this method to identify optimal trading opportunities.

How Can This Technique Optimize Trading Decisions?

This technique can optimize trading decisions by providing a more comprehensive view of market conditions. By aligning time and price, traders can identify key moments when the market is likely to make significant moves. Jenkins’ insights into time and price squared offer a powerful tool for improving trading accuracy.

What Advanced Concepts are Explored in the Latter Chapters?

What Topics are Covered in the Advanced Sections?

In the latter part of the eBook, Jenkins explores advanced concepts such as seasonal time cycles, market-generated cycles, and options trading. These chapters offer deeper insights and more sophisticated strategies, catering to traders looking to elevate their trading skills. Jenkins provides detailed explanations and practical applications of these advanced topics.

How Can Advanced Strategies Elevate Trading Skills?

Advanced strategies can elevate trading skills by providing traders with more refined techniques for analyzing and trading the market. By mastering these advanced concepts, traders can develop a more comprehensive understanding of market behavior and improve their trading performance. Jenkins’ expertise in these areas offers valuable guidance for experienced traders.

Conclusion: Why Michael S. Jenkins – Day Trading For 50 Years is Essential for Traders

Michael S. Jenkins – Day Trading For 50 Years is not just a guide but a mentorship journey with a seasoned trading expert. This course provides a rare glimpse into the mind of Michael S. Jenkins, guiding traders through the complexities of the stock market with the wisdom of his 50-year trading career. Whether you’re new to trading or looking to refine your strategies, this course offers invaluable insights into trading based on decades of experience.

Enroll in the Day Trading For 50 Years course today and take the first step towards mastering the art and science of day trading. With Jenkins’ comprehensive guidance, you’ll gain the skills and knowledge necessary to navigate the dynamic world of day trading and achieve long-term success.