Trader Daye Quarterly Theory 2024 (21 Videos)

$150.00 Original price was: $150.00.$18.00Current price is: $18.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Trader Daye Quarterly Theory 2024 (21 Videos)

Trader Daye Quarterly Theory 2024 (21 Videos) Course: Master Long-Term Trading Cycles

If you’re a trader looking to level up your market analysis skills and learn how to make informed, strategic trading decisions, then Trader Daye Quarterly Theory 2024 (21 Videos) course is for you. Developed by seasoned trader Trader Daye, this advanced trading strategy focuses on understanding the power of long-term market trends and aligning your trading strategy with quarterly cycles.

While many traders focus on short-term price fluctuations, Trader Daye Quarterly Theory emphasizes the value of viewing the markets from a broader perspective. By identifying larger trends and utilizing a disciplined, strategic approach, traders can reduce exposure to market noise, make high-probability trades, and improve long-term profitability. This unique trading philosophy, supported by a series of 21 comprehensive videos, offers insights that can transform the way you analyze and execute trades.

In this in-depth product description, we’ll explore what makes the Trader Daye Quarterly Theory 2024 (21 Videos) course a must-have for traders of all experience levels, from novices looking to get started in the markets to experienced traders aiming to fine-tune their strategies.

Why Should You Take the Trader Daye Quarterly Theory 2024 (21 Videos) Course?

The Trader Daye Quarterly Theory 2024 (21 Videos) course is a comprehensive framework that provides traders with a powerful, long-term approach to navigating the financial markets. This course is designed to help you understand and harness the cyclical nature of markets by aligning your trading strategies with quarterly trends.

What Sets the Trader Daye Quarterly Theory Apart?

Unlike traditional trading courses that often emphasize quick profits or focus solely on short-term charts, Trader Daye Quarterly Theory introduces a more methodical approach to trading. The emphasis is on quarterly cycles, which can offer valuable insights into broader market movements, allowing you to make informed, long-term decisions.

The core of this course revolves around fundamental analysis, technical analysis, and market sentiment, and how these components can be combined to understand the broader market landscape. You will learn how to assess economic indicators, analyze corporate earnings reports, and keep an eye on global events that can move markets. Additionally, you’ll learn advanced technical analysis tools like chart patterns, trend lines, and oscillators to help identify high-probability trading opportunities that align with the quarterly cycles.

Perhaps the most distinguishing feature of this course is its patience-first approach to trading. Trader Daye emphasizes discipline and strategy, urging traders to focus on larger trends and longer-term positions rather than chasing every short-term price movement. This approach helps to mitigate the emotional rollercoaster that often comes with day trading and encourages traders to take a more strategic approach to their trades.

What Does the Trader Daye Quarterly Theory 2024 (21 Videos) Course Include?

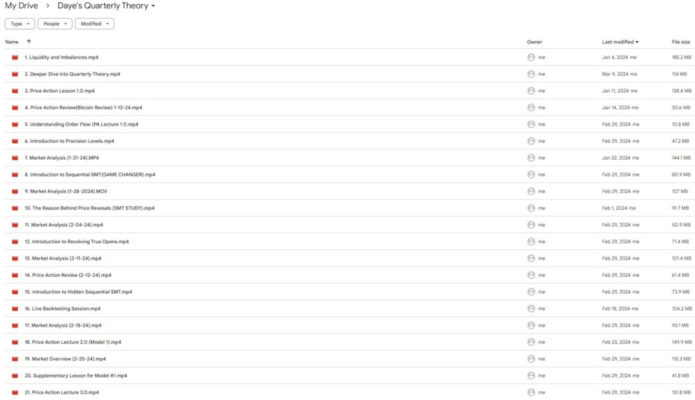

The Trader Daye Quarterly Theory 2024 (21 Videos) course is structured around 21 highly informative videos that break down the key concepts of this unique trading strategy. Here’s a closer look at the course components and what you will learn.

How Does Trader Daye Integrate Fundamental Analysis into Quarterly Trading?

Fundamental analysis plays a crucial role in the Trader Daye Quarterly Theory. Unlike other trading strategies that focus primarily on technical indicators, Trader Daye teaches traders to understand the broader macroeconomic environment and its influence on market trends.

Analyzing Economic Data and Market Fundamentals

One of the first skills you’ll learn in the Trader Daye Quarterly Theory course is how to interpret vital economic indicators and data. These include GDP reports, interest rate changes, unemployment figures, and other relevant data that can provide insights into the long-term direction of the economy. By aligning trading strategies with economic cycles, traders can better predict market moves and position themselves for success.

You’ll also learn how to interpret corporate earnings reports and how major geopolitical events can impact markets. For example, how inflation or a change in government policies could create opportunities for strategic trading. Understanding these fundamental factors allows you to make well-informed trades that align with the larger market cycles.

How Do You Apply Technical Analysis in the Quarterly Framework?

Technical analysis is another critical component of the Trader Daye Quarterly Theory 2024. The course delves deep into advanced charting techniques, tools, and indicators that help traders identify patterns, trends, and entry/exit points.

Identifying Key Market Patterns and Trends

You will learn to read chart patterns and use trend lines, moving averages, and oscillators to identify entry and exit points. These tools help traders identify longer-term patterns that align with the quarterly cycles. For example, the course may highlight how specific price action patterns appear after a significant economic event, providing traders with a clear roadmap to make informed decisions.

Trader Daye goes beyond simply teaching these tools—he also explains how to integrate them into a quarterly trading framework. You’ll learn how to use technical indicators in conjunction with fundamental data to create a more robust and effective trading strategy. By focusing on more significant trends rather than getting caught up in daily price action, traders are better able to avoid noise and impulsive decisions.

How Does Trader Daye Emphasize Patience and Discipline?

One of the core philosophies of Trader Daye Quarterly Theory is patience. Many traders fall victim to the temptation of short-term gains, but the course teaches a different approach.

Focusing on High-Probability Trades

Trader Daye emphasizes that successful traders focus on high-probability trades that align with quarterly trends. This approach encourages patience, as traders wait for the ideal setups and align their strategies with long-term market cycles rather than attempting to make profits from random price fluctuations.

This disciplined approach can help reduce the emotional highs and lows often associated with trading. By being patient and allowing the market to come to you, traders are less likely to make impulsive decisions based on fear or greed. As a result, they can maintain a more sustainable and profitable trading career over time.

How Does Risk Management Fit Into the Trader Daye Quarterly Theory?

Effective risk management is a cornerstone of Trader Daye Quarterly Theory. Throughout the course, you will learn how to manage risk and preserve capital even in volatile market conditions.

Position Sizing and Stop-Loss Orders

The course covers essential risk management strategies such as position sizing, setting stop-loss orders, and diversifying your portfolio. By carefully managing the amount you risk on each trade and setting clear exit points, you can limit your losses while maximizing your profits.

Trader Daye teaches how to calculate your risk-to-reward ratio, ensuring that each trade you make has a favorable risk profile. Whether you’re trading stocks, commodities, or forex, understanding these principles can prevent large losses and protect your capital over the long run.

Diversification and Portfolio Protection

In addition to risk management at the trade level, the Trader Daye Quarterly Theory course also covers how to diversify your portfolio to reduce exposure to specific market events. This holistic approach helps traders achieve consistent returns while minimizing risk, which is especially important in an unpredictable market.

How Can This Course Help Traders of All Levels?

The Trader Daye Quarterly Theory 2024 (21 Videos) course is suitable for traders of all experience levels, from beginners to seasoned professionals. Whether you’re just starting your trading journey or you’ve been trading for years, this course provides valuable insights that can help refine your approach and improve your performance in the markets.

Ideal for Novice Traders

For novice traders, the Trader Daye Quarterly Theory provides a solid foundation for understanding the broader market landscape. With detailed lessons on fundamental analysis, technical analysis, and risk management, new traders can learn the core principles of successful trading and develop a disciplined approach from the start.

Perfect for Experienced Traders

For experienced traders, this course offers a fresh perspective on trading by focusing on the long-term cycles of the market. Seasoned traders who are looking to refine their strategy and reduce the emotional impact of day trading will benefit from the patience-first approach taught in this course. The quarterly cycle perspective provides a new lens through which to evaluate market conditions and identify profitable opportunities.

Conclusion: Is the Trader Daye Quarterly Theory 2024 (21 Videos) Course Worth It?

In conclusion, the Trader Daye Quarterly Theory 2024 (21 Videos) course is an invaluable resource for any trader who wants to build a strategic, long-term approach to the markets. Whether you’re a beginner looking to build a solid foundation or an experienced trader seeking to refine your skills, this course offers a wealth of knowledge, practical techniques, and real-world examples to help you succeed.

By focusing on quarterly market cycles, risk management, and disciplined trading, Trader Daye Quarterly Theory equips you with the tools and mindset needed to succeed in the financial markets. With its comprehensive approach and emphasis on patience, this course can help you become a more strategic, informed, and confident trader in today’s dynamic market environment.

Product For Sale

Product For Sale

Product For Sale

Product For Sale Related Products

$1,491.00 Original price was: $1,491.00.$24.00Current price is: $24.00.

$299.00 Original price was: $299.00.$20.00Current price is: $20.00.

$15,000.00 Original price was: $15,000.00.$38.00Current price is: $38.00.

$997.00 Original price was: $997.00.$20.00Current price is: $20.00.