Aeromir – Butterfly and Condor Workshop

Original price was: $799.00.$22.00Current price is: $22.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Aeromir – Butterfly and Condor Workshop

Master the Art of Options Trading with the Butterfly and Condor Workshop by Aeromir

Unlock the potential of advanced options trading strategies with Aeromir’s Butterfly and Condor Workshop. This specialized course is designed for traders eager to elevate their options trading skills by mastering the intricacies of butterfly and condor spreads.

Whether you’re a beginner looking to understand the fundamentals or an experienced trader aiming to refine your strategies, this workshop offers comprehensive insights and hands-on experience to help you achieve your trading goals.

Why Choose the Butterfly and Condor Workshop?

The Butterfly and Condor Workshop is a must-have for anyone serious about options trading. Aeromir, a trusted name in the trading education industry, provides participants with a deep dive into the world of spreads—techniques that can significantly enhance your trading outcomes.

Through this workshop, you’ll learn to capitalize on market movements and volatility, making informed decisions that maximize your profitability while managing risk effectively.

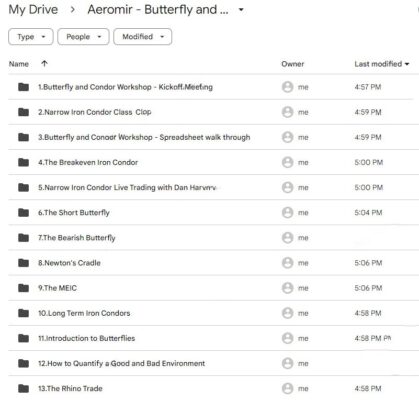

Course Overview

Aeromir’s Butterfly and Condor Workshop is meticulously structured to accommodate novice and seasoned traders. The course covers everything from the basics of options spreads to advanced strategies for managing and adjusting positions.

What Will You Learn?

This workshop is designed to understand butterfly and condor spreads thoroughly. The course content is divided into several key modules, each focusing on different aspects of these trading strategies.

Introduction to Options Spreads

What Are Options Spreads?

Understanding the basics of options trading is crucial for building a solid foundation. In this module, you’ll learn about various types of spreads, their purposes, and how they can be used to manage risk and optimize trading outcomes.

- Basics of Options Trading: A comprehensive primer for those new to the concept, covering the fundamental principles of options trading.

- Understanding Spreads Detailed explanations of different types of options spread, focusing on how they work and why they are used.

Butterfly Spreads

How Can Butterfly Spreads Enhance Your Trading?

Butterfly spreads are a powerful tool in the options trader’s arsenal. This module dives deep into butterfly spread construction, application, and management.

- Definition and Structure: Learn about the different types of butterfly spreads, including long and short butterflies, and how they are structured.

- Risk-Reward Profile: Understand the risk and reward potential of butterfly spreads and how to calculate the expected outcomes of your trades.

- Market Scenarios: Discover the ideal market conditions for deploying butterfly spreads and how to identify these scenarios using market analysis.

Condor Spreads

What Are Condor Spreads, and When Should You Use Them?

Condor spreads, including iron condors, are versatile strategies that can be used in various market conditions. This module provides an in-depth look at how to construct and manage these spreads.

- Definition and Structure: Get to grips with condor spreads’ nuances, including regular and iron condors, and their application in trading.

- Risk-Reward Profile: Analyze condor spreads’ risk and reward dynamics, learning to balance potential profits with the risks involved.

- Market Scenarios: Learn to identify the market conditions most conducive to successful condor spread trading.

Advanced Strategies and Adjustments

How Can You Adjust Your Spreads for Maximum Profit?

Successful trading requires the ability to adapt to changing market conditions. This module covers advanced strategies and adjustments that can help you optimize your spreads.

- Adjusting Positions: Explore techniques for adjusting butterfly and condor spreads in response to market changes, ensuring you remain profitable even in volatile conditions.

- Combination Strategies: Learn how to use butterfly and condor spreads in combination with other trading strategies for enhanced results.

- Managing Risk: Delve into advanced risk management techniques specific to butterfly and condor spreads, ensuring you protect your capital while pursuing profits.

Practical Application

How Do You Apply What You’ve Learned in Real-World Trading?

Theory is essential, but real learning happens in practical application. This module emphasizes hands-on learning through real-world examples and interactive exercises.

- Live Trading Examples: Watch real-time examples and case studies demonstrating the application of butterfly and condor spreads in various market conditions.

- Simulation Exercises: Participate in interactive simulations that allow you to practice constructing and managing spreads without risking natural capital.

- Backtesting: Learn techniques for backtesting butterfly and condor strategies to evaluate their effectiveness over time, ensuring you only deploy strategies with a proven track record.

Psychological Aspects of Trading

What Role Does Psychology Play in Successful Trading?

Trading is as much about mindset as it is about strategy. This module addresses the psychological challenges of options trading and how to overcome them.

- Trader Psychology: Understand the psychological barriers that can impact your trading decisions and learn techniques to maintain discipline and focus.

- Discipline and Patience: Develop the discipline and patience required to successfully trade butterfly and condor spreads, avoiding the pitfalls of emotional trading.

Course Delivery

How Is the Course Delivered?

The Butterfly and Condor Workshop by Aeromir is designed to be accessible and flexible, allowing participants to learn at their own pace.

- Format: The course is delivered through video lectures, detailed notes, and practical exercises.

- Duration: It is self-paced, allowing you to progress through the material at a speed that suits you while having access to the course materials for ongoing reference.

Benefits of the Butterfly and Condor Workshop

Why Should You Enroll in This Course?

The Butterfly and Condor Workshop offers numerous benefits for traders looking to enhance their options trading skills:

- Comprehensive Learning: Gain a deep understanding of butterfly and condor spreads from basic construction to advanced management techniques.

- Hands-On Practice: The course emphasizes practical, hands-on learning with real-world examples and simulations to ensure you can apply your learning.

- Expert Instruction: Benefit from the insights and guidance of experienced options traders and instructors committed to your success.

Success Stories

What Do Past Students Say About the Course?

The Butterfly and Condor Workshop has received positive feedback from students who have successfully applied the strategies learned to enhance their trading performance.

- Student Testimonials: Read testimonials from students who have seen significant improvements in their trading results after completing the workshop.

- Case Studies: Explore detailed case studies that showcase how traders have utilized butterfly and condor spreads to achieve consistent profits.

Conclusion

The Butterfly and Condor Workshop by Aeromir is an essential resource for options traders seeking to deepen their understanding of these advanced trading strategies. By covering everything from basic construction to advanced adjustments and risk management, the course provides a comprehensive toolkit for effectively trading butterfly and condor spreads.

Whether you are a beginner looking to learn the ropes or an experienced trader aiming to refine your strategies, Aeromir’s workshop offers valuable insights and practical skills to help you succeed in the complex world of options trading.

This detailed product description highlights the key features and benefits of the Butterfly and Condor Workshop, making it clear why this course is a valuable investment for anyone serious about options trading.