Andy Howard – Automatic Payment Pools

Original price was: $997.00.$15.00Current price is: $15.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Andy Howard – Automatic Payment Pools

Andy Howard – Automatic Payment Pools: A Streamlined Approach to Automated Payment Solutions

In today’s fast-paced business world, managing payment processes efficiently is crucial for maintaining steady cash flow and reducing manual effort. Andy Howard’s Automatic Payment Pools course offers a comprehensive solution to automate recurring payments, improve cash flow, and ensure timely collections, all with minimal manual intervention. Designed for individuals and businesses seeking to optimize their payment systems, this course provides practical, actionable insights on setting up and managing an automated payment system tailored to your business needs.

Whether you run a small business, are a freelancer managing client payments, or operate a subscription-based service, the Automatic Payment Pools system can save you time, reduce errors, and enhance the customer experience. The course focuses on making payment management seamless and effortless, allowing you to focus more on growing your business while the system takes care of your financial transactions.

Why Should You Consider the Automatic Payment Pools Course?

In the digital age, managing payments manually can lead to inefficiencies, errors, and cash flow challenges. If you’re an entrepreneur, small business owner, or freelancer, you know how critical it is to have a steady income stream and predictable cash flow. Andy Howard’s Automatic Payment Pools course equips you with the tools and knowledge to automate your payment processes, ensuring consistency and reducing friction in your financial operations.

With clear, step-by-step instructions and the incorporation of cutting-edge technologies like cryptocurrency and blockchain, this course is designed to help you leverage automation to save time, reduce costs, and optimize revenue collection. It is not just about automating payments—it’s about creating a more efficient, scalable, and reliable business model that sets you up for long-term financial success.

What is the Automatic Payment Pools System?

The Automatic Payment Pools system is a revolutionary approach to automating recurring payment systems. In simple terms, it enables businesses to set up payment schedules, automate deductions, and track transactions without needing to manage everything manually. The system integrates with existing payment gateways and provides real-time insights into cash flow and payment statuses.

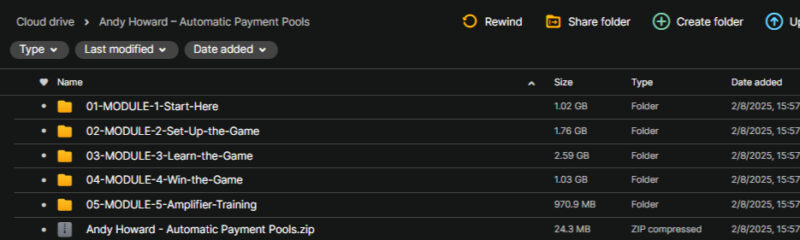

The course covers a three-module framework that guides users through the entire process—from designing payment plans to setting up automated deductions and monitoring payment status. In addition to the core modules, bonus content introduces cryptocurrency and advanced strategies to scale payment processes.

What Are the Key Features of the Automatic Payment Pools Course?

1. Automated Payment Solutions for Business Efficiency

One of the primary features of the Automatic Payment Pools system is its ability to automate recurring payments. This means that payments, such as subscriptions or service fees, can be deducted automatically from customers’ accounts at scheduled intervals without requiring manual intervention. Automation minimises human error and reduces the administrative burden, freeing your time to focus on business growth.

By automating payment systems, businesses can ensure a steady cash flow, making planning for future expenses, investments, and growth easier. The system also provides easy integration with existing payment processors (such as PayPal, Stripe, and others), allowing businesses to get started quickly without major disruptions to their existing financial processes.

2. Flexible Billing Cycles for Predictable Cash Flow

Whether you run a subscription-based business, offer freelance services, or manage a digital product, recurring billing is often essential to maintaining a steady revenue stream. Automatic Payment Pools offers flexible billing cycles, meaning you can choose how often payments are deducted: weekly, monthly, or yearly. This flexibility is ideal for businesses with varying billing needs and service providers needing a reliable and predictable payment schedule.

By setting up automatic deductions based on flexible billing cycles, businesses ensure that customers are billed on time, reducing the risk of payment delinquencies. This recurring model helps ensure your business’s financial health by automating collections and providing a clear and consistent overview of future revenue streams.

3. Real-Time Analytics and Insights for Informed Decisions

A significant advantage of automating your payment systems is the ability to access real-time data and analytics. The Automatic Payment Pools system provides detailed reporting on cash flow, payment statuses, and any potential issues (e.g., declined payments or payment failures). By having access to this data, businesses can make more informed financial decisions, track their performance, and optimize their payment processes to improve overall efficiency.

These real-time insights can also help identify patterns in payment behavior, allowing businesses to adjust pricing models, offer discounts, or incentivize timely payments. Whether you’re a business owner or a freelancer, this feature helps you stay ahead of payment trends and proactively manage cash flow.

How Can You Integrate the Automatic Payment Pools System into Your Business?

The Automatic Payment Pools system is designed to integrate smoothly with existing financial tools and platforms, making it easy to adopt without disrupting your current workflow.

1. Seamless Integration with Payment Gateways

The system integrates with popular payment gateways such as PayPal, Stripe, and others, allowing you to connect your existing payment accounts to the Automatic Payment Pools framework. This integration is simple and does not require major changes to your current payment setup. Once connected, payments can be processed automatically, saving time and ensuring consistency.

Additionally, the integration ensures that you don’t need to invest in new tools or software—Automatic Payment Pools works seamlessly with your existing systems. Whether dealing with credit card payments, bank transfers, or cryptocurrency, the course explains how to integrate and automate each method to enhance payment collection efficiency.

2. Setting Up Payment Plans and Deductions

Once integrated, you can create custom payment plans that suit your business’s unique needs. From determining the frequency of payments to specifying the amounts, you have full control over how payments are structured. For example, you can design plans for subscription services, payment instalments for products or services, or recurring service fees for freelance work.

Automated deductions will occur based on these pre-established plans, minimizing the risk of human error or missed payments. As a result, both you and your clients can rest assured that payments will be processed on time, every time.

3. Monitoring and Managing Payments with Ease

With real-time tracking features, you can easily monitor the status of payments, ensuring they are successfully processed and identifying any issues that need attention. If a payment fails, you will receive a notification and have the option to take corrective action. This proactive approach helps ensure minimal disruptions to your cash flow and allows you to resolve payment issues promptly.

The Automatic Payment Pools system also helps reduce payment delinquencies by sending automated reminders to clients or customers with overdue payments. These reminders can be personalized to encourage timely payments and avoid any negative impact on your financial stability.

Who Will Benefit from the Automatic Payment Pools Course?

The Automatic Payment Pools course is an invaluable resource for individuals and businesses that want to streamline their payment processes and improve their overall financial management.

1. Small and Medium-Sized Businesses

Entrepreneurs and small business owners who struggle with inconsistent cash flow or manual payment processing will find the course particularly beneficial. Automating payments can ensure a steady revenue stream and reduce the administrative burden associated with manual billing.

2. Freelancers and Service Providers

Freelancers and independent professionals often face challenges with timely payments. This course helps freelancers set up a reliable and automated billing system, ensuring clients are billed regularly and on time without requiring constant follow-up.

3. Subscription-Based Businesses

Businesses that rely on subscription models (e.g., SaaS, digital memberships, etc.) will benefit greatly from automating payments. Setting up flexible billing cycles and ensuring continuous payment collection can provide peace of mind and reduce revenue leakage.

4. Organizations Focused on Financial Optimization

Enterprises and larger organizations looking to enhance their financial management systems can utilize the Automatic Payment Pools system to reduce inefficiencies and improve cash flow forecasting.

How Will This Course Improve Your Business?

By completing the Automatic Payment Pools course, you will:

- Automate your payment processing to eliminate manual errors and save time.

- Streamline your cash flow management to predict revenue more accurately.

- Improve customer satisfaction by offering a seamless payment experience.

- Reduce the chances of missed payments or delinquencies through automated reminders and real-time tracking.

This course provides a powerful toolkit to help you build an automated, efficient payment collection system that works for your unique business needs.

Conclusion

Andy Howard’s Automatic Payment Pools is a transformative course for anyone looking to streamline their payment processes and optimize their financial operations. Whether you’re a small business owner, freelancer, or subscription-based service provider, this course provides the knowledge and tools needed to automate payments, improve cash flow, and enhance the customer experience.

With detailed step-by-step guidance, bonus content on cryptocurrency, and powerful strategies for scaling your payment systems, this course offers immense value for businesses of all sizes.

If you’re ready to automate your payment processes and set your business up for long-term success, Automatic Payment Pools is the course you need.

Dan Lok – Ultra High Ticket Closer

Dan Lok – Ultra High Ticket Closer