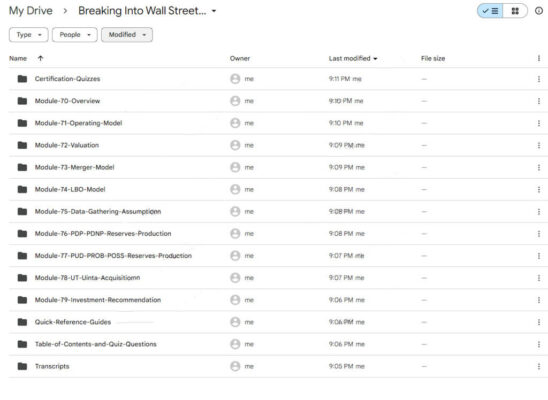

Breaking Into Wall Street – Oil and Gas Modeling

Original price was: $497.00.$28.00Current price is: $28.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Breaking Into Wall Street – Oil and Gas Modeling

Oil and Gas Modeling Course: Master Financial Analysis in the Energy Sector with Breaking Into Wall Street

Gain a competitive edge in the dynamic world of finance with the Oil and Gas Modeling course by Breaking Into Wall Street (BIWS). Designed for aspiring financial analysts, investment bankers, private equity professionals, and students, this specialized program provides in-depth training in financial modelling specifically for the oil and gas sector. The Oil and Gas Modeling course equips participants with the skills and knowledge necessary to build comprehensive financial models from scratch, understand unique industry metrics, and assess the investment potential of oil and gas companies. With real-world case studies, hands-on Excel-based learning, and industry-specific content, this course offers everything you need to excel in the competitive energy finance.

What Makes the Breaking Into Wall Street – Oil and Gas Modeling Course Unique?

The Breaking Into Wall Street—Oil and Gas Modeling course stands out for its exclusive focus on the energy sector. Unlike generic financial modeling courses, this program dives deep into the complexities of oil and gas, covering key topics such as reserves, production forecasts, pricing models, and valuation techniques unique to this industry. Participants will thoroughly understand the value chain from exploration to production and learn how to model the financial health of oil and gas companies using Excel.

What truly sets this course apart is its emphasis on practical application. Through real-life case studies based on actual companies and transactions, participants can apply what they learn in real-world scenarios. This hands-on approach ensures that you not only grasp the theoretical aspects of financial modeling but also gain the practical skills required to analyze, value, and make investment decisions in the oil and gas sector.

Moreover, the Oil and Gas Modeling course is entirely self-paced and online, allowing you to learn at your own speed. This makes it suitable for both full-time professionals and students. Whether you are looking to break into investment banking, private equity, or corporate finance or aiming to specialize in energy finance, this course provides the tools and expertise to help you succeed.

How Does the Oil and Gas Modeling Course Build a Strong Foundation in the Energy Sector?

The Oil and Gas Modeling course begins with a comprehensive introduction to the oil and gas industry, laying the groundwork for understanding its unique financial dynamics. This module provides an overview of the sector, explaining the value chain from exploration to production and breaking down key industry terms and metrics.

Participants will learn about the different stages of the oil and gas lifecycle, from upstream activities such as exploration and drilling to downstream processes like refining and distribution. The course covers the critical components that drive value in the energy sector, including reserves, production levels, and commodity pricing. By understanding these fundamentals, you can assess the performance and growth potential of oil and gas companies more accurately.

Additionally, this module introduces essential financial metrics unique to the oil and gas industry, such as finding and development (F&D) costs, production costs, and reserve replacement ratios. These metrics are crucial for evaluating a company’s operational efficiency and profitability, providing a solid foundation for more advanced financial modelling later.

What Will You Learn About Revenue and Expense Modeling?

One of the core components of the Oil and Gas Modeling course is revenue and expense modelling, which teaches participants how to accurately forecast production, revenues, and costs. This module provides a step-by-step guide to modelling production forecasts, estimating revenue streams, and calculating operating expenses.

You’ll learn how to model different types of revenue, such as sales from oil, natural gas, and other petroleum products, and how to factor in variables like commodity prices, production volumes, and market demand. The course also covers calculating capital expenditures (CapEx), operating expenses (OpEx), and other costs that impact an oil and gas company’s bottom line.

By mastering these techniques, you’ll be able to build robust financial models that reflect the realities of the oil and gas market. These skills are essential for assessing a company’s financial health, forecasting future performance, and making informed investment decisions.

How Does the Oil and Gas Modeling Course Teach Valuation Techniques?

Valuation is a critical aspect of financial modeling, and the Oil and Gas Modeling course provides in-depth training in the valuation methods specific to the energy sector. This module covers several valuation techniques, including Discounted Cash Flow (DCF) analysis, Net Asset Value (NAV) modelling, comparable company analysis (CCA), and precedent transactions.

- Discounted Cash Flow (DCF) Analysis: The course teaches you how to build a DCF model tailored to the oil and gas industry. You’ll learn how to forecast free cash flows, calculate the weighted average cost of capital (WACC), and discount future cash flows to present value. The DCF model is a fundamental tool for valuing companies based on their projected cash flows, and this course ensures you can apply it effectively in the context of the energy sector.

- Net Asset Value (NAV) Modeling: The NAV model is particularly important for valuing oil and gas companies, as it takes into account the value of the company’s reserves. The course provides a step-by-step guide to constructing a NAV model, teaching you how to estimate the value of proved, probable, and possible reserves, and how to apply appropriate discount rates to account for risk.

- Comparable Company Analysis (CCA) and Precedent Transactions: You’ll also learn how to perform comparable company analysis and analyze precedent transactions to value oil and gas companies relative to their peers. This module covers how to select appropriate comparables, calculate valuation multiples, and interpret the results to make informed investment decisions.

By mastering these valuation techniques, you will be equipped to assess the true value of oil and gas companies, whether for investment, mergers, or acquisitions.

What Skills Will You Gain in M&A Modeling for Oil and Gas Companies?

The Oil and Gas Modeling course provides specialized training in merger and acquisition (M&A) modeling, focusing on the unique considerations of the energy sector. This module teaches you how to build pro forma models for potential acquisitions, assess the impact of mergers and acquisitions on company valuation, and analyze synergies and integration costs.

You’ll learn how to construct pro forma financial statements, including income statements, balance sheets, and cash flow statements, to evaluate the financial implications of a proposed merger or acquisition. The course also covers how to estimate potential synergies, such as cost savings and revenue enhancements, and how to factor in integration costs and other risks associated with M&A transactions.

By developing these skills, you’ll be able to provide valuable insights into the strategic rationale for mergers and acquisitions in the oil and gas sector, helping you stand out in fields like investment banking, private equity, and corporate finance.

How Does the Oil and Gas Modeling Course Prepare You for Risk and Sensitivity Analysis?

Understanding risk is critical in the oil and gas industry, where companies are exposed to numerous uncertainties, including price volatility, geopolitical events, and regulatory changes. The Oil and Gas Modeling course provides comprehensive training in risk and sensitivity analysis, teaching you how to stress-test financial models under different scenarios.

You’ll learn how to create sensitivity tables and charts to analyze the impact of changes in key variables, such as oil prices, production levels, and capital expenditures, on a company’s financial performance and valuation. The course also covers the assessment of geopolitical, regulatory, and market risks, helping you identify and quantify potential threats to an investment’s profitability.

By mastering these techniques, you’ll be able to build more resilient financial models that account for various risk factors, enabling you to make more informed decisions in the volatile world of energy finance.

Why Should You Choose the Breaking Into Wall Street – Oil and Gas Modeling Course?

The Breaking Into Wall Street – Oil and Gas Modeling course is ideal for anyone looking to specialize in the energy sector and gain a competitive edge in the job market. Here are some of the key reasons to enroll in this course:

- Industry-Specific Content: Unlike generic financial modeling courses, this program focuses exclusively on the oil and gas industry, providing the specific skills needed to excel in energy finance.

- Real-Life Case Studies: Gain practical experience by working on real-world case studies and exercises based on actual companies and transactions.

- Excel-Based Learning: All modeling is done in Excel, with step-by-step instructions, ensuring you gain hands-on experience with the tools used by industry professionals.

- Self-Paced Learning: The course is entirely online and self-paced, allowing you to progress at your own speed and fit your learning around your schedule.

Who Should Take the Oil and Gas Modeling Course?

The Oil and Gas Modeling course is ideal for:

- Aspiring Financial Analysts: Those seeking to specialize in the energy sector, particularly oil and gas.

- Investment Bankers: Professionals looking to enhance their industry-specific modeling skills and better understand the dynamics of energy finance.

- Private Equity and Hedge Fund Analysts: Individuals interested in energy sector investments and who need a thorough understanding of oil and gas valuation techniques.

- Corporate Finance Professionals: Finance professionals working in or targeting roles in oil and gas companies who want to build specialized skills.

- Students: University students in finance, economics, or related fields preparing for a career in investment banking or the energy sector.

Conclusion: Advance Your Career with the Breaking Into Wall Street – Oil and Gas Modeling Course

The Breaking Into Wall Street – Oil and Gas Modeling course is a robust and comprehensive program designed to provide participants with the specialized skills needed to excel in financial analysis and valuation within the oil and gas sector. Whether you’re a professional looking to advance your career or a student aiming to enter the industry, this course offers valuable insights and practical experience that can set you apart in the competitive world of finance.

Gain hands-on experience, master industry-specific modeling techniques, and build a strong foundation for a successful career in energy finance—enroll in the Oil and Gas Modeling course today and take the next step toward achieving your professional goals.