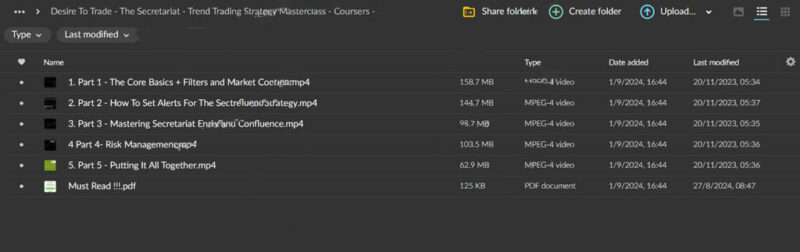

Desire To Trade – The Secretariat – Trend Trading Strategy Masterclass – Course

Original price was: $997.00.$23.00Current price is: $23.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Desire To Trade – The Secretariat – Trend Trading Strategy Masterclass

Master the Art of Trend Trading with The Secretariat – Trend Trading Strategy Masterclass

Unlock the power of trend trading with The Secretariat – Trend Trading Strategy Masterclass by Desire To Trade. Designed for traders of all experience levels, this comprehensive course dives deep into the world of trend trading, equipping you with advanced tools and strategies to capitalize on market trends effectively. Whether you’re new to trading or a seasoned professional, this course delivers a clear, step-by-step framework for identifying, entering, and exiting trades with precision, all while managing risk for long-term success.

Trend trading has long been a preferred strategy among professional traders, as it focuses on capturing market momentum and maximizing profit potential. This course demystifies the complexities of trend trading, guiding you through each aspect with practical examples, technical indicators, and proven methods to ensure you can trade with confidence.

What Will You Learn in The Secretariat – Trend Trading Strategy Masterclass?

Understanding Market Trends

The course begins with a foundational module on market trends. You’ll gain insight into uptrends, downtrends, and sideways trends and understand how each affects trading opportunities. Learning to identify these patterns is essential, as it lays the groundwork for spotting profitable trades and understanding how markets typically behave within each phase.

Why Trend Trading is Effective

The masterclass provides a deep dive into the psychology of market trends and why trading in alignment with them increases your chance of success. You’ll learn how to anticipate market movements and understand the factors driving trends. This perspective allows you to capture extended market moves, providing a consistent edge in your trading approach.

Essential Trading Mindset

A vital component of this course is developing the right trading mindset. Effective trend trading requires patience, discipline, and objectivity. This course includes guidance on cultivating a trader’s mentality so you’re prepared to navigate fluctuations and make decisions grounded in strategy rather than emotion.

How Can You Identify Market Trends Effectively?

Using Technical Indicators for Trend Detection

One of the pillars of trend trading is accurate trend detection. This course introduces critical technical indicators such as moving averages, MACD, and RSI and explains how to apply them to confirm trend direction. You’ll gain hands-on experience using these tools to detect trends and make informed, data-driven trading decisions.

Chart Patterns and Trendlines for Precision

Understanding chart patterns, in addition to technical indicators, is crucial for confirming trends and identifying optimal entry points. The course covers chart patterns like head and shoulders, triangles, and double tops/bottoms, as well as how to draw and interpret trendlines. These skills enable you to pinpoint support and resistance levels, allowing for precise entries and exits.

Recognizing Market Cycles

Understanding market cycles is essential to effectively trend trading. The course takes you through different market phases—accumulation, uptrends, distribution, and downtrends—teaching you how to align your strategy with each stage. You’ll maximize profit potential and reduce exposure to adverse market conditions by timing your trades to fit these cycles.

What Entry and Exit Strategies Are Best for Trend Trading?

Techniques for Confirming Trends

Before entering a trade, verifying the trend’s strength is important. In this masterclass, you’ll learn various trend confirmation techniques, including multi-timeframe analysis. This approach helps you validate trends across different timeframes, improving accuracy and filtering out false signals for more consistent results.

Identifying the Right Entry Points

Successful trend trading relies on accurate entry timing. This course explores strategies for identifying optimal entry points using tools like support and resistance levels, Fibonacci retracements, and key technical indicators. You’ll gain insight into spotting ideal moments to enter a trade, enhancing your profit potential while managing risk.

Mastering Exit Strategies

Exiting trades effectively is just as crucial as entering them. The course covers multiple exit strategies, including trailing stops, profit targets, and dynamic exit strategies based on market conditions. With these techniques, you’ll learn to lock in profits and limit losses, ensuring a balanced approach to capital preservation and growth.

Why is Risk Management and Position Sizing Essential?

Building a Strong Risk Management Foundation

The Secretariat emphasizes risk management as the backbone of successful trading. This course module covers how to set stop losses, balance risk-reward ratios, and calculate acceptable risk per trade. With these risk management principles, you’ll be better equipped to protect your capital and achieve long-term sustainability in your trading.

Position Sizing Strategies

Position sizing is vital for optimizing returns while managing risk exposure. The course provides practical guidance on calculating position size based on account size, risk tolerance, and market conditions. By mastering position sizing, you’ll be able to maximize profitability while minimizing risk, a fundamental skill for any serious trader.

Adapting to Market Volatility

Financial markets are dynamic, and strategies must adapt to varying levels of volatility. In this module, you’ll learn to adjust your trend trading approach to suit different market conditions, whether calm or volatile. This flexibility enhances your ability to maintain a profitable strategy across market environments.

What Advanced Techniques Will You Master?

Analyzing Multiple Timeframes for Greater Precision

Trading across multiple timeframes can enhance your trend trading accuracy. The course teaches how to analyze and trade using multiple timeframes, giving you a comprehensive view of market trends. This approach enables you to refine entry and exit points and gain a holistic understanding of market direction.

Diversifying Across Asset Classes

The course covers how to apply trend trading across various assets, including stocks, Forex, and commodities. This diversification strategy allows you to reduce risk and capitalize on different market opportunities, expanding your profit potential while reducing exposure to single-market fluctuations.

Introduction to Algorithmic Trend Trading

For traders interested in automation, the course includes an introduction to algorithmic trend trading. You’ll learn how to set up trading algorithms based on trend criteria, helping you execute trades efficiently and reduce human error. Algorithmic trading also allows you to manage multiple trades seamlessly, increasing overall efficiency.

What Makes The Secretariat – Trend Trading Strategy Masterclass Exceptional?

Comprehensive Framework for Trend Trading Success

This masterclass provides a complete, step-by-step guide to mastering trend trading. From foundational concepts to advanced strategies, the course covers every element needed to develop a successful trend trading strategy. You’ll gain a deep understanding of market behavior and build a comprehensive trading framework that is adaptable and sustainable.

Focus on Real-World Application

Theory alone doesn’t drive success in trading, which is why this course emphasizes practical application. With real-world examples, live trading sessions, and hands-on exercises, you’ll apply the strategies directly to actual market scenarios, ensuring you’re well-prepared to execute trades confidently.

Expert-Led Instruction

Led by seasoned traders who have consistently succeeded with trend trading, this course offers expert guidance that can accelerate your learning curve. The instructors provide insights and strategies based on real experience, helping you avoid common pitfalls and optimize your trading approach.

Why Should You Join The Secretariat – Trend Trading Strategy Masterclass?

Refine Your Skills and Boost Profitability

The Secretariat course is designed to elevate your trend trading skills, refine your technical knowledge, and boost profitability. By combining technical analysis with disciplined risk management, you’ll be well-prepared to trade with confidence and improve your overall trading performance.

Become Part of a Supportive Community

When you enroll in The Secretariat – Trend Trading Strategy Masterclass, you’ll join a community of dedicated traders who share your passion for trend trading. This community offers support, networking, and collaboration opportunities, providing ongoing motivation and accountability as you grow in your trading journey.

Conclusion: Transform Your Trading Potential with The Secretariat – Trend Trading Strategy Masterclass

The Desire To Trade – The Secretariat – Trend Trading Strategy Masterclass is essential for any trader aiming to excel in trending markets. With a structured approach, expert guidance, and a focus on practical application, this course equips you to navigate market trends confidently and maximize profit potential.

Ready to elevate your trading skills? Enroll in The Secretariat – Trend Trading Strategy Masterclass today and take the first step toward mastering trend trading!