Fielding Financial – How to Purchase a Buy-to-Let Online Course

$197.00 Original price was: $197.00.$19.00Current price is: $19.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

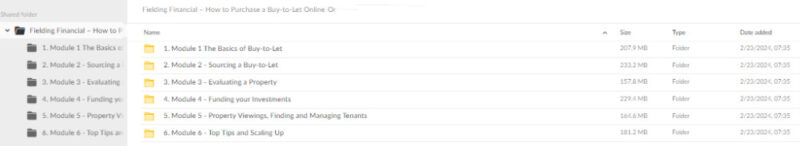

Fielding Financial – How to Purchase a Buy-to-Let Online Course

Unlocking Real Estate Investment Potential: Why This Course Is Essential

Investing in real estate, especially in buy-to-let properties, can be one of the most reliable ways to build wealth and create passive income streams. However, without the proper knowledge, it can also be a complex and risky endeavour. For individuals who want to take their first steps into the world of property investment or even for seasoned investors looking to refine their strategies, Fielding Financial – How to Purchase a Buy-to-Let Online Course is designed to provide you with the insights and practical tools you need to succeed.

Real estate investment offers significant long-term returns but also involves navigating a range of financial, legal, and market dynamics. This comprehensive online course, created by Fielding Financial, equips you with the knowledge to make well-informed decisions, avoid common pitfalls, and maximize your return on investment (ROI). With easy-to-follow modules covering everything from location selection to understanding legal obligations, this course is your guide to becoming a successful property investor.

What Will You Learn in the How to Purchase a Buy-to-Let Online Course?

Why Is Location the Most Critical Factor in Real Estate Investment?

One of the foundational lessons in real estate investing is understanding that location plays a vital role in the success of your buy-to-let property. In the Fielding Financial – How to Purchase a Buy-to-Let Online Course, you’ll learn how to analyze and select the best locations for your investment. This course walks you through several factors that can influence the profitability of a property, such as:

- Rental Demand: Areas with high rental demand tend to be close to essential amenities, including schools, shops, and transport links. You’ll learn how to assess the demand in different areas to ensure that your property is continuously occupied and generating rental income.

- Potential for Capital Growth: Over time, property values in certain areas increase more than in others. The course helps you identify regions with strong growth potential, allowing you to benefit not only from rental income but also from property value appreciation over time.

- Local Real Estate Market Trends: The course covers how to research local real estate market trends, enabling you to forecast price movements and make smart investment decisions.

By the end of this section, you will be able to confidently choose locations that maximize your chances of success and ensure that your property remains attractive to tenants.

How Can You Avoid Common Pitfalls in Property Investment?

Navigating the world of real estate investment without proper guidance can lead to costly mistakes, especially for beginners. Fortunately, Fielding Financial’s course helps you avoid these errors by teaching you to recognize common pitfalls and how to avoid them.

- Overpaying for a Property: One of the most common mistakes new investors make is overpaying for a property. The course teaches you how to conduct thorough market research, compare property values, and negotiate effectively with real estate agents to secure the best price.

- Misunderstanding the Legal Requirements: Real estate investments come with a range of legal obligations, especially if you plan on renting out your property. From landlord regulations to tenant rights and property safety standards, the course ensures that you understand all your legal obligations so that you can avoid costly legal issues in the future.

- Poor Financing Choices: Financing is a key component of any real estate deal, and making the wrong choice can hinder your profitability. The course provides in-depth insights into different financing options, such as buy-to-let mortgages and alternative lending methods. This section helps you find the financing solution that aligns with your investment goals and minimizes your risk.

With this knowledge, you’ll be well-prepared to navigate the real estate market, avoiding the pitfalls that often trip up new investors.

How Do You Identify Profitable Buy-to-Let Properties?

To achieve success in real estate, identifying a property that will generate a good return on investment is essential. In the Fielding Financial – How to Purchase a Buy-to-Let Online Course, you will learn the key metrics that indicate a property’s profitability. This module focuses on two crucial factors:

- Rental Yield: Rental yield is a critical metric for any buy-to-let investor. It refers to the annual rental income as a percentage of the property’s value. The course teaches you how to calculate rental yield and analyze properties to find the ones that offer the highest return.

- Capital Growth Potential: While rental income is important, so is the property’s potential for capital growth. The course explains how to evaluate a property’s potential to increase in value over time, ensuring that you not only benefit from monthly rental income but also build long-term wealth through appreciation.

By mastering these techniques, you’ll be able to confidently assess which properties are worth investing in and which ones are not.

How Can You Build Confidence in Negotiating Property Deals?

Negotiation is a crucial skill in real estate investing, whether you’re dealing with real estate agents, sellers, or property management teams. In this course, you’ll receive expert tips and strategies on how to negotiate effectively to secure the best deals.

- Negotiation Tactics: The course covers essential negotiation techniques, helping you build rapport with real estate professionals, understand the seller’s motivations, and make offers that are beneficial to both parties.

- Viewing Properties Like a Pro: By attending property viewings with a critical eye, you can spot potential issues or advantages that others may miss. The course teaches you what to look for during property viewings and how to use that information to your advantage during negotiations.

- Closing the Deal: Once you’ve identified a property that meets your investment criteria, closing the deal is the final step. This course offers insights into closing negotiations, ensuring that you secure the property at the best price possible.

With this newfound confidence and practical skills, you’ll be able to negotiate like a seasoned investor and increase your chances of success.

What Are Your Financing Options for Buy-to-Let Properties?

One of the main challenges for new investors is finding the right financing options. The Fielding Financial – How to Purchase a Buy-to-Let Online Course demystifies the complex world of real estate financing, giving you the tools you need to make informed decisions.

- Buy-to-Let Mortgages: The course explains the ins and outs of buy-to-let mortgages, including how to apply, what lenders look for, and how to compare rates. You’ll learn about mortgage terms, interest rates, and how to secure a deal that maximizes your profitability.

- Alternative Financing Options: In addition to traditional buy-to-let mortgages, the course explores other financing methods such as bridging loans and property crowdfunding. These options are often underutilized by new investors, but they can provide flexible financing solutions for a wide range of investment scenarios.

By understanding the different financing options available to you, you can minimize your initial investment while maximizing your potential returns.

How Can You Ensure Compliance with Legal Obligations as a Landlord?

Real estate investment comes with various legal responsibilities, especially when you’re renting out properties. The Fielding Financial course covers all the legal obligations of a landlord, helping you stay compliant with laws and regulations.

- Landlord Responsibilities: From safety inspections to tenancy agreements, you’ll learn what is required to protect both yourself and your tenants. The course ensures that you understand your obligations and avoid legal pitfalls that could result in fines or tenant disputes.

- Taxation: Tax laws for landlords can be complex. The course provides an overview of the tax implications of owning rental properties, including tax deductions for landlords, capital gains tax, and how to maximize your after-tax profits.

- Lease Agreements: Understanding lease agreements is key to ensuring a smooth relationship with your tenants. The course offers guidance on drafting legally sound lease agreements that protect both you and your tenants.

By mastering these legal aspects, you can ensure that your investment is both profitable and compliant with local laws.

Conclusion: Why Enroll in the Fielding Financial Buy-to-Let Course?

The Fielding Financial – How to Purchase a Buy-to-Let Online Course provides you with everything you need to become a successful real estate investor. Whether you’re just starting out or looking to refine your skills, this course will guide you through every step of the process—from choosing the right property and location to financing your investment and understanding your legal obligations.

By enrolling in this course, you’ll gain the confidence, knowledge, and practical tools to make smart real estate decisions that lead to long-term financial success. Don’t let the complexities of the property market hold you back. Invest in yourself and your future by taking the first step towards building your buy-to-let property empire today.

Product For Sale

Product For Sale Ryan Serhant – Mastering CODO – The Closing & Negotiations CourseRelated Products

$890.00 Original price was: $890.00.$15.00Current price is: $15.00.

$997.00 Original price was: $997.00.$18.00Current price is: $18.00.

$879.00 Original price was: $879.00.$24.00Current price is: $24.00.

$780.00 Original price was: $780.00.$15.00Current price is: $15.00.