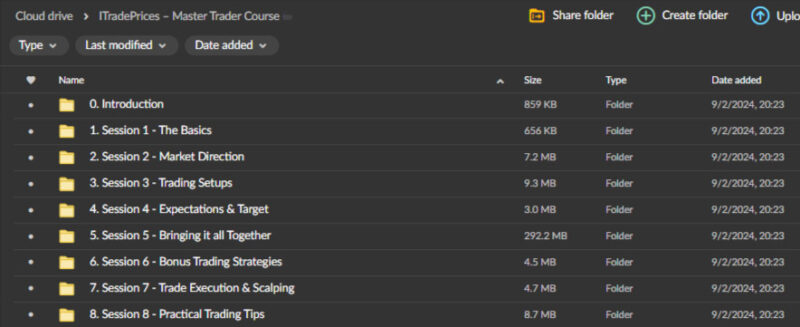

ITradePrices – Master Trader Course

Original price was: $999.00.$24.00Current price is: $24.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

ITradePrices – Master Trader Course

Master Trader Course: Unlock Your Potential with the ITradePrices Master Trader Course

Elevate your trading skills and gain a competitive edge in the financial markets with the ITradePrices – Master Trader Course. This comprehensive program is meticulously designed to empower traders at all levels with the essential knowledge and strategies needed to excel. Whether you’re a novice looking to understand the basics of price action or an experienced trader seeking to refine your market analysis techniques, this course provides the tools and insights to enhance your trading proficiency.

Dive into a world of detailed market analysis, effective trading strategies, and practical applications to achieve your trading goals.

What is the ITradePrices Master Trader Course?

The ITradePrices – Master Trader Course is an extensive educational program focused on price action and market analysis. It offers a deep dive into essential trading concepts, equipping you with the skills to navigate and succeed in various financial markets, including stocks, forex, and cryptocurrencies. This course is designed for traders who are serious about mastering the art of trading and achieving consistent results. With a blend of theoretical knowledge and practical strategies, the course ensures that you gain a robust understanding of market behavior and trading techniques.

How Will You Benefit from Mastering Price Action?

Introduction to Price Action

What is Price Action and Why is It Crucial?

Price action is a fundamental concept in trading that involves analyzing price movement over time. It reflects market psychology and provides insights into how market participants react to various events. Understanding price action allows traders to make informed decisions based on the current state of the market rather than relying on lagging indicators.

How Price Action Reflects Market Psychology

Price movement is a direct result of collective market behavior. By studying price action, traders can interpret market sentiment and predict potential future movements. This insight is invaluable for making strategic trading decisions and identifying profitable opportunities.

Mastering Market Direction

How to Identify and Define Market Direction

Defining market direction is crucial for developing a successful trading strategy. This course section teaches you how to recognize whether the market is trending or consolidating. Mastering these techniques helps make informed decisions about when to enter or exit trades.

Distinguishing Between Trending and Consolidating Markets

Understanding the difference between trending and consolidating markets is key to applying the right trading strategies. Trending markets offer opportunities for capturing larger price movements, while consolidating markets require different approaches to identify potential breakout points.

Understanding Swing Pivots

What are Swing Pivots and Their Significance?

Swing pivots are critical points on a price chart that indicate potential reversals or continuation of trends. This part of the course explains how to identify these pivots and their importance in developing a trading strategy.

Examples of Swing Pivots in Various Market Conditions

By exploring different market conditions, you will learn how swing pivots behave in trending and consolidating markets. This knowledge helps in refining your trading strategy and improving your ability to make profitable trades.

Mastering Trend Lines

What Are Trend Lines and Their Role in Market Analysis?

Trend lines are essential tools for analyzing market trends. They help traders visually identify the direction and strength of a trend. This section covers the basics of drawing and interpreting trend lines to enhance your market analysis skills.

How to Draw and Adjust Trend Lines

Accurate trend lines are vital for effective market analysis. You will learn techniques for drawing precise trend lines and adjusting them as market conditions change, ensuring that your analysis remains relevant and useful.

Exploring Chart-Based Trading Setups

What Are Chart-Based Trading Setups?

Chart-based trading setups are strategies that involve analyzing price charts to identify trading opportunities. This course segment delves into various setups and their effectiveness in different market conditions.

Why Are These Setups Effective and How to Use Them?

Understanding the rationale behind chart-based setups allows you to apply them effectively in your trading strategy. This knowledge helps in identifying high-probability trade opportunities and improving your overall trading performance.

Identifying Trade Entry Points

How to Pinpoint Optimal Trade Entry Points

Finding the right entry point is crucial for maximizing profitability. This part of the course teaches techniques for identifying optimal entry points based on price action and market conditions.

What is Positive Expectancy and How to Set Realistic Expectations?

Positive expectancy is a key concept in trading that refers to the likelihood of achieving profitable outcomes. Learning how to set realistic expectations and understand positive expectancy helps maintain a disciplined trading approach and achieve consistent results.

Setting and Achieving Price Targets

Why Are Price Targets Important for Trade Planning?

Setting price targets is essential for planning your trades and managing risk. This section explains why price targets are crucial and how they contribute to effective trade planning.

How to Identify and Set Effective Price Targets

Discover techniques for identifying realistic price targets based on market analysis and historical price behavior. Setting effective price targets helps in managing trades and optimizing profitability.

Utilizing Price Channels

What Are Price Channels and Their Benefits?

Price channels are tools used to identify potential support and resistance levels. This part of the course covers drawing and using price channels to guide trading decisions and improve market analysis.

How to Draw and Use Price Channels in Your Strategy

Learn practical methods for drawing and incorporating price channels into your trading strategy. This knowledge enhances your ability to make informed trading decisions and adapt to changing market conditions.

Developing a Trading Framework and Thought Process

How to Create a Structured Trading Framework

A well-defined trading framework is essential for making consistent and disciplined trading decisions. This section of the course guides you in developing a structured framework that aligns with your trading goals and strategies.

What is the Thought Process Behind Successful Trading Strategies?

Understanding the thought process behind successful trading strategies helps refine your approach and improve decision-making. This knowledge is crucial for adapting to market conditions and achieving long-term success.

Creating and Adjusting Key Price Levels

How to Identify Key Price Levels

Key price levels are significant points on a price chart that influence market behavior. This segment of the course explains how to identify these levels and their impact on your trading decisions.

How to Adjust Price Levels as Market Conditions Change

Master the skill of adjusting key price levels based on evolving market conditions. This ability ensures that your trading strategy remains relevant and effective in dynamic market environments.

Bonus: Specialized Strategies for Crypto-Trading

What Are the Unique Trading Strategies for Cryptocurrency Markets?

Cryptocurrency markets have unique characteristics that require specialized trading strategies. This bonus section provides insights into effective strategies tailored for the volatile and fast-paced world of crypto-trading.

How to Execute Trades and Master Scalping Techniques

Learn the steps for effective trade execution and advanced scalping techniques. These skills are essential for making quick profits in fast-moving markets and managing trades efficiently.

Practical Tips for Small Accounts and Bad Trading Days

Strategies for Trading with Small Accounts

Trading with a small account presents unique challenges. Discover strategies tailored for managing and growing small trading accounts effectively.

How to Handle and Recover from Bad Trading Days

Everyone experiences bad trading days. Learn practical tips for managing losses and recovering from setbacks to maintain a positive trading mindset and achieve long-term success.

Closing Thoughts

The ITradePrices – Master Trader Course offers an in-depth education in trading, focusing on essential concepts like price action, market analysis, and effective trading strategies. With a comprehensive curriculum designed for traders at all levels, this course provides the knowledge and tools needed to excel in various financial markets.

By mastering the skills taught in this course, you will be equipped to navigate the markets confidently, make informed trading decisions, and achieve your financial goals. Whether you are trading stocks, forex, or cryptocurrencies, the ITradePrices – Master Trader Course is your gateway to becoming a proficient and successful trader.