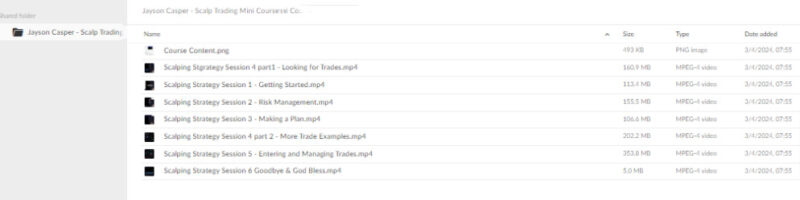

Jayson Casper – Scalp Trading Mini Course

$100.00 Original price was: $100.00.$19.00Current price is: $19.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Jayson Casper – Scalp Trading Mini Course

Scalp Trading Mini Course: Master the Art of Fast-Paced Trading with Jayson Casper

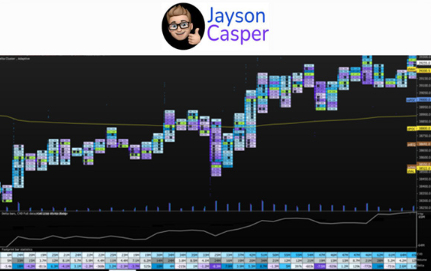

The Scalp Trading Mini Course by Jayson Casper is designed to equip traders with the precise skills and techniques needed to excel in the high-stakes world of scalp trading. With its focus on rapid decision-making and quick execution, scalp trading requires a deep understanding of market movements, technical analysis, and mental discipline. This course provides traders with a detailed roadmap to master these skills, making it an ideal resource for anyone looking to tap into the potential of short-term trading.

Jayson Casper, a seasoned trader known for his technical analysis and high-frequency trading expertise, created this mini-course to provide a streamlined yet comprehensive approach to scalp trading. The Scalp Trading Mini Course focuses on building a strong foundation, covering essential concepts such as market trends, chart patterns, risk management, and psychological resilience. Whether you are a beginner looking to enter the world of scalp trading or an experienced trader aiming to refine your techniques, this course offers valuable insights and practical strategies to achieve trading success.

Why Choose the Scalp Trading Mini Course?

The Scalp Trading Mini Course provides a step-by-step framework that simplifies complex trading concepts. Scalping is a strategy that thrives on precision and timing, and Jayson Casper breaks down these elements into digestible lessons that are easy to apply in real-world trading scenarios. With a focus on execution speed, risk management, and the mental fortitude needed to navigate fast-paced markets, this course offers a unique opportunity to develop a profitable trading edge.

Through interactive content, real-life case studies, and practical simulations, participants gain the confidence to execute trades with accuracy and agility. The Scalp Trading Mini Course isn’t just about theory; it’s about putting knowledge into action and building the skills to succeed in a challenging trading environment.

What Makes Jayson Casper’s Approach to Scalp Trading Unique?

What Key Concepts Are Covered in the Scalp Trading Mini Course?

Jayson Casper’s Scalp Trading Mini Course covers various fundamental and advanced topics that form the backbone of successful scalp trading. The course starts by introducing traders to the foundational principles of scalp trading, including:

- Market Trends and Price Action: Participants learn to identify short-term trends and use price action analysis to anticipate market movements.

- Support and Resistance Levels: Understanding how to identify and utilize key support and resistance levels is crucial for executing high-probability trades.

- Timing and Precision: Timing is everything in scalp trading. Jayson explains how to recognize the ideal moments to enter and exit trades, minimizing risk while maximizing profit potential.

The course takes a step-by-step approach, ensuring that participants thoroughly understand each concept before moving on to more advanced strategies. By the end of the course, traders will be able to read the markets confidently, identify profitable opportunities, and execute trades with precision.

How Does the Course Address Risk Management?

Why Is Risk Management Crucial for Scalp Trading?

Risk management is critical to any successful trading strategy, but it’s especially important for scalp traders operating in volatile, fast-moving markets. Jayson Casper’s Scalp Trading Mini Course provides traders with a robust risk management framework focusing on capital preservation and controlled risk exposure.

What Risk Management Strategies Are Taught?

The course covers key risk management strategies, including:

- Position Sizing: Learn how to calculate the ideal position size for each trade based on your account size and risk tolerance.

- Stop-Loss Placement: Discover how to set effective stop-loss orders that protect capital without being overly restrictive.

- Risk-Reward Ratios: Understand how to evaluate trades based on potential profit versus risk, ensuring that each trade has a positive expectancy.

By mastering these strategies, traders can limit their downside risk while maintaining the potential for consistent profits. Jayson emphasizes the importance of discipline and patience, two qualities that are essential for long-term success in scalp trading.

What Technical Analysis Tools Are Included in the Course?

How Do Technical Analysis Tools Enhance Scalp Trading?

Technical analysis is at the heart of scalp trading, and Jayson Casper’s Scalp Trading Mini Course equips traders with the tools and techniques needed to make informed decisions quickly. Participants gain a deep understanding of technical indicators and chart patterns, allowing them to spot opportunities in real time.

What Tools and Indicators Are Covered?

The course provides a detailed exploration of the most effective technical analysis tools for scalp trading, including:

- Moving Averages: Use short-term moving averages to identify momentum shifts and trend direction.

- Stochastic Oscillators: Learn how to use stochastic indicators to determine overbought and oversold conditions.

- Fibonacci Retracements: Discover how to apply Fibonacci levels to pinpoint potential reversal zones.

Additionally, Jayson introduces advanced tools like volume analysis and trendlines, helping traders develop a nuanced understanding of price movements. By combining these tools, participants learn to create a comprehensive trading strategy that adapts to various market conditions.

What Role Does Execution Play in Successful Scalp Trading?

How Does the Course Improve Trade Execution Skills?

In scalp trading, even a fraction of a second can make the difference between a winning trade and a losing one. The Scalp Trading Mini Course places a strong emphasis on trade execution, teaching traders how to enter and exit positions quickly and accurately.

What Are the Key Execution Techniques?

Participants learn about different order types and their applications, including:

- Market Orders: For quick entry and exit, ensuring immediate execution at the current market price.

- Limit Orders: To control entry prices and avoid slippage in fast-moving markets.

- Stop Orders: To protect against adverse price movements and lock in profits.

Jayson Casper demonstrates how to use these order types in different scenarios, providing practical tips for enhancing execution efficiency. By mastering these techniques, traders can avoid common pitfalls and capitalize on rapid price movements with confidence.

How Does the Course Address the Psychological Aspects of Scalp Trading?

Why Is Psychological Resilience Important in Scalp Trading?

Scalp trading is not just a test of skill but also of mental fortitude. The fast-paced nature of this strategy can lead to emotional reactions such as fear, greed, or frustration, which can negatively impact trading decisions. The Scalp Trading Mini Course dedicates a significant portion to developing the psychological resilience needed to succeed.

What Psychological Strategies Are Taught?

Jayson Casper shares proven techniques for maintaining focus and composure, including:

- Stress Management: Learn how to stay calm under pressure and avoid impulsive decisions.

- Discipline and Patience: Understand the value of waiting for the right setup and sticking to your trading plan.

- Emotional Control: Develop strategies for managing emotions like fear and greed, ensuring that they do not interfere with your trading strategy.

These psychological skills are essential for maintaining a balanced mindset, enabling traders to execute their strategies without succumbing to emotional biases.

How Does the Course Enhance Practical Learning Through Real-Life Case Studies?

What Role Do Case Studies Play in Learning?

The Scalp Trading Mini Course includes real-life case studies that bridge the gap between theory and practice. By analyzing actual trades and market scenarios, participants can see how the concepts learned are applied in a live trading environment.

How Do Case Studies Improve Understanding?

These case studies offer invaluable insights into:

- Trade Setup and Execution: Understand the thought process behind successful trade setups and how to execute them.

- Post-Trade Analysis: Learn how to review trades objectively, identifying strengths and areas for improvement.

- Adaptation to Market Conditions: See how to adjust strategies in response to changing market dynamics.

Through these case studies, participants gain a practical understanding of scalp trading, reinforcing the lessons learned and building confidence in their trading abilities.

Conclusion: Why the Scalp Trading Mini Course Is a Must-Have for Traders

The Scalp Trading Mini Course by Jayson Casper provides a unique opportunity to master the intricate art of scalp trading. Covering everything from key concepts and risk management to advanced technical analysis tools and psychological resilience, this course offers a holistic approach to intraday trading success. With its emphasis on real-world application and interactive learning, traders gain the skills and confidence needed to navigate the fast-paced world of scalp trading with precision.

For those looking to build a profitable trading strategy and thrive in the highly competitive trading arena, the Scalp Trading Mini Course is an invaluable resource that will set you on the path to success.

Product For Sale

Product For Sale

Product For Sale

Product For Sale Related Products

$689.00 Original price was: $689.00.$15.00Current price is: $15.00.

$989.00 Original price was: $989.00.$17.00Current price is: $17.00.

$247.00 Original price was: $247.00.$14.00Current price is: $14.00.

$499.00 Original price was: $499.00.$14.00Current price is: $14.00.