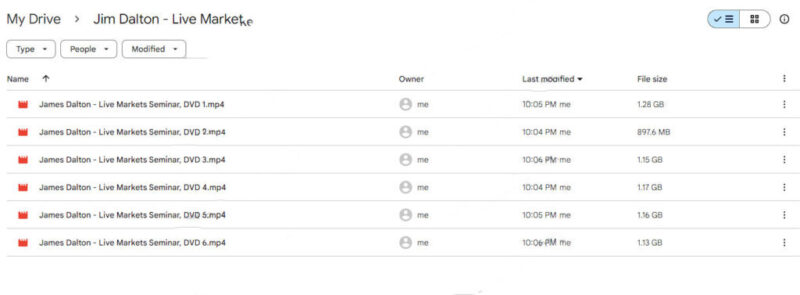

Jim Dalton – Live Markets Seminar

Original price was: $500.00.$24.00Current price is: $24.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Jim Dalton – Live Markets Seminar

Master Market Dynamics with the Jim Dalton – Live Markets Seminar

Understanding the complexities of market behavior requires more than just theory—it demands real-time experience, expert guidance, and a solid strategy. The Live Markets Seminar course by Jim Dalton offers all this and more, making it an invaluable resource for traders seeking to refine their skills using Market Profile analysis. This comprehensive 16-hour seminar, recorded from a sold-out event in Chicago, provides participants with an unparalleled opportunity to delve into the thought process, trading methodology, and market interpretation techniques of Jim Dalton, a renowned authority in Market Profile trading.

Why Is the Live Markets Seminar Course Worth Buying?

The Live Markets Seminar course is designed for traders who want to elevate their understanding of Market Profile and auction theory. It offers a unique combination of theoretical learning and practical application through live market analysis, which is rarely found in other trading courses. Jim Dalton’s seminar goes beyond generic trading concepts, focusing instead on how to read the market’s story as it unfolds in real time. The course breaks down complex market dynamics into actionable insights, equipping traders with a structured approach to interpreting the market and making informed trading decisions. Whether you are a novice trader or a seasoned professional, this course will help you build a robust foundation in Market Profile analysis and refine your trading strategies for greater profitability.

What Makes Jim Dalton’s Market Profile Approach Unique?

How Does Jim Dalton Use Market Profile Analysis?

Jim Dalton’s trading methodology is built around Market Profile analysis, a tool that provides a visual representation of how prices are distributed over time. Unlike traditional charting techniques, Market Profile reveals the auction process that drives market behavior, offering a deeper understanding of price action and volume distribution.

- Analyzing Market Structure: Through Market Profile, traders can identify areas of high and low trading activity, understand market value areas, and pinpoint where the most significant buying and selling occurs. This level of analysis helps traders discern market sentiment and predict potential price movements.

- Auction Theory Concepts: Dalton emphasizes the importance of auction theory, which views market activity as a continuous auction where buyers and sellers seek equilibrium. Understanding this theory allows traders to interpret shifts in market dynamics and adjust their strategies accordingly.

- Reading the Market Narrative: One of the most powerful aspects of Dalton’s approach is his ability to narrate the market’s story. By understanding the underlying forces driving price action, traders can anticipate turning points, recognize trend changes, and position themselves to capitalize on emerging opportunities.

What Can You Expect from the First Day of the Live Markets Seminar?

Day One: Laying the Foundation with Market Analysis and Preparation

Day one of the Live Markets Seminar is all about building a solid foundation in Market Profile analysis. Jim Dalton starts by taking participants through the basics of his trading process, focusing on how to use Market Profile as a tool for market analysis and preparation.

- Introduction to Auction Theory and Market Behavior: The day kicks off with an overview of auction theory and its role in understanding market behavior. Participants learn about the fundamental concepts that underpin Dalton’s trading approach, including value areas, market rotation, and price acceptance levels.

- Developing a Pre-Market Routine: Jim emphasizes the importance of a consistent pre-market routine. He teaches traders how to analyze overnight activity, interpret developing market profiles, and identify key levels of support and resistance before the market opens.

- Identifying Market Opportunities: The focus shifts to using Market Profile to spot high-probability trading opportunities. By analyzing the day’s developing profile, traders learn how to anticipate where major players are likely to enter the market, setting the stage for potential trade setups.

This structured approach to pre-market analysis helps traders enter the day with a clear plan and a set of actionable scenarios, boosting their confidence and readiness.

What Happens During the Live Market Sessions?

Day Two & Three: Real-Time Market Analysis and Live Trading

Days two and three are dedicated to live market narration, where Jim Dalton guides participants through real-time market analysis. This segment is one of the most valuable aspects of the course, as it demonstrates how to apply Market Profile concepts in a live trading environment.

- Understanding Market Context: Jim narrates the unfolding auction process, explaining how to interpret market shifts, trend development, and changes in momentum. He focuses on how to read the profile structure and what it reveals about the intentions of major market participants.

- Live Trading Strategies: Participants witness Jim’s real-time approach to identifying and executing trades. He demonstrates how to use Market Profile to set entry and exit points, manage risk, and adjust strategies based on the day’s evolving conditions.

- Navigating Fast-Moving Markets: One of the key skills developed during this segment is the ability to stay focused and disciplined in high-volatility environments. Jim shares his techniques for maintaining composure, avoiding emotional trading, and adhering to a predefined plan even when markets are moving quickly.

These live market sessions provide an inside look at how a professional trader interprets market activity minute-by-minute, offering educational and inspiring lessons.

How Can Traders Implement What They Learn in Their Own Trading?

Building a Structured Trading Process

The Live Markets Seminar course is not just about learning new techniques—it’s about integrating those techniques into a cohesive trading process. Jim Dalton emphasizes the importance of having a structured approach to trading, one that encompasses preparation, analysis, execution, and post-trade review.

- Daily Market Preparation: Participants learn how to develop a consistent routine for market preparation. This involves reviewing overnight data, setting key levels, and planning for different scenarios based on the developing profile.

- Execution and Risk Management: Jim provides practical tips on how to execute trades with precision. He explains how to set realistic profit targets, manage stop-loss levels, and adjust position sizes according to the day’s risk profile.

- Review and Continuous Improvement: The final component of the process is the post-trade review. Jim highlights the importance of evaluating each trading day, identifying what went well and what needs improvement. This disciplined approach to continuous learning is a hallmark of successful traders.

By incorporating these elements into their daily routine, traders can build a robust trading process that improves consistency and profitability over time.

Who Should Take the Jim Dalton – Live Markets Seminar Course?

This course is ideal for:

- Day Traders and Scalpers: Looking to refine their understanding of market structure and auction theory.

- Swing Traders: Who want to improve their ability to read market context and anticipate price movements.

- Aspiring Professionals: Interested in gaining an insider’s perspective on how an experienced trader analyzes and executes trades in real time.

- Experienced Traders: Seeking to add Market Profile and auction theory to their trading toolkit.

What Are the Key Takeaways from the Live Markets Seminar?

Gain a Deeper Understanding of Market Dynamics

Participants walk away with a comprehensive understanding of Market Profile analysis and auction theory and how these concepts apply to real-world trading. This knowledge empowers traders to go beyond surface-level price action and delve into the deeper forces driving market behavior.

- Improve Market Preparation: Learn how to structure your pre-market routine to identify critical opportunities before the trading day begins.

- Master Real-Time Market Narration: Develop the ability to narrate market activity in real-time, recognizing shifts in sentiment and adjusting strategies accordingly.

- Enhance Risk Management: Gain insights into managing risk in high-volatility markets, ensuring that every trade is executed with a clear plan and defined risk parameters.

Final Thoughts: Is the Live Markets Seminar Worth It?

The Jim Dalton – Live Markets Seminar is a must-have resource for any trader serious about improving their market analysis skills. With its unique combination of theory, live trading, and real-time market narration, this seminar offers a complete framework for understanding and navigating the markets with confidence. For those looking to master Market Profile and gain the edge in fast-moving markets, this course is an invaluable addition to their trading education.

Enroll today to start transforming your trading approach and take your skills to the next level!