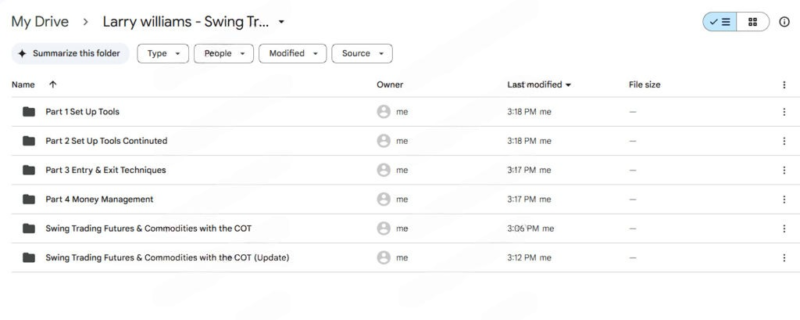

Larry williams – Swing Trading Futures & Commodities with the COT

Original price was: $1,695.00.$32.00Current price is: $32.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Larry williams – Swing Trading Futures & Commodities with the COT

Master Swing Trading Futures & Commodities with the COT Course: Your Path to Trading Success

Unlock the full potential of swing trading with Larry Williams’ Swing Trading Futures & Commodities with the COT Course. Designed for traders looking to deepen their understanding of market dynamics and refine their strategies, this course leverages the Commitment of Traders (COT) report to provide actionable insights into the futures and commodities markets. Whether you’re a beginner or an experienced trader, Larry Williams’ methods can help you profit from short- to medium-term price movements with precision.

By the end of the course, you’ll clearly understand how to interpret the COT report alongside technical analysis to make informed and confident trading decisions. With Larry’s expert guidance, you’ll learn how to incorporate fundamental sentiment and technical indicators to develop a complete trading strategy that works in all market conditions.

What Will You Learn in the Swing Trading Futures & Commodities with the COT Course?

Why is the Commitment of Traders (COT) Report Essential for Successful Trading?

How Can You Use the COT Report to Your Advantage?

The COT report is a key tool for traders looking to understand the underlying market sentiment in the futures and commodities markets. Published weekly by the Commodity Futures Trading Commission (CFTC), it provides insights into how different market participants—commercial hedgers, large speculators, and small traders—are positioned in the market.

- Commercial Hedgers are often considered the “smart money.” They use futures contracts to hedge their risks in the physical market. Commercial hedgers deeply understand the underlying assets, making their positions crucial in predicting long-term market moves.

- Large Speculators: These are institutional investors, hedge funds, and traders who are speculating on the market’s direction. Understanding their positioning is vital, as their decisions can drive short-term trends.

- Small Traders: Often retail investors, these traders are less influential but can provide clues about market extremes. Large concentrations of small traders in a particular direction can indicate potential reversals.

By analyzing the positions of these groups, you can get a sense of market sentiment and potential turning points. This course teaches you how to interpret these signals, giving you a clear edge when trading in the futures and commodities markets.

How Can You Integrate the COT Report with Swing Trading Strategies?

What Are the Key Concepts of Swing Trading?

Swing trading aims to profit from short- to medium-term price movements, typically from a few days to several weeks. In the Swing Trading Futures & Commodities with the COT course, Larry Williams dives deep into effective entry and exit strategies that combine COT insights with technical analysis.

- Identifying the Right Entry and Exit Points: Larry breaks down his method for timing entries and exits with precision. By using the COT report, you can gauge the market sentiment and enter trades when the momentum is in your favor. Similarly, understanding COT positioning helps you avoid entering at a market extreme, which could lead to a premature exit.

- Risk Management: The course emphasizes capital preservation and position sizing to help you manage risk effectively. Larry explains how to use stop-loss orders, risk-reward ratios, and position sizing to minimize potential losses while maximizing profits.

- Market Reversals: Swing trading often revolves around capitalizing on market reversals. With the right timing and market understanding, you can trade market turns using both COT data and technical chart patterns, ensuring that you enter on price dips and exits near price peaks.

What Role Does Technical Analysis Play in Swing Trading?

How Can You Combine COT Data with Chart Patterns and Indicators?

While the COT report provides a crucial view into market sentiment, technical analysis helps identify specific price points for entry and exit. In the Swing Trading Futures & Commodities with the COT course, Larry Williams teaches you how to combine both approaches for a more robust trading strategy.

- Chart Patterns and Indicators: Learn how to recognize key chart patterns (such as head and shoulders, double tops, and bottoms) and how to use technical indicators like moving averages, RSI, and MACD to confirm trades. Larry demonstrates how to use these tools in conjunction with COT analysis to maximize the probability of a successful trade.

- COT and Technical Divergence: One powerful method Larry teaches is identifying divergences between price action and trader positioning. For example, if the price of a commodity is making new highs, but large speculators are reducing their positions, this divergence can signal a potential market reversal. Larry explains how to spot these divergences, providing additional confidence in your trade setups.

By combining COT data and technical indicators, you’ll have a well-rounded approach to trading futures and commodities, allowing you to make more informed decisions based on both market sentiment and price action.

How Do You Master the Psychological Aspects of Trading?

How Can You Develop a Winning Mindset for Swing Trading?

Trading is as much about mental discipline as it is about analysis. In Swing Trading Futures & Commodities with the COT, Larry emphasizes the importance of trading psychology, teaching you how to develop a mindset that supports long-term success.

- Managing Emotions: Emotional decisions can ruin even the best technical setups. Larry explains how to stay disciplined and avoid impulsive trades by sticking to your strategy and risk management rules. He also provides techniques for managing the stress that comes with trading, helping you maintain mental clarity during volatile market conditions.

- Building Confidence: Confidence is critical in trading. Larry’s course provides you with clear, actionable steps to build confidence in your analysis and trade execution. When you understand how to interpret COT data and combine it with technical analysis, you will gain the confidence to act on your insights.

- Developing Patience: Trading is not about making quick profits; it’s about making consistent gains. Larry teaches you how to wait for the right setups, how to exercise patience during market corrections, and how to stay committed to your strategy.

By developing the right mindset, you’ll be able to execute trades with greater consistency, and better control over your emotions, ultimately leading to improved profitability in the long run.

Why Should You Choose Larry Williams’ Swing Trading Course?

What Makes Larry Williams an Expert in Futures and Commodities Trading?

Larry Williams is a renowned and highly respected trader with decades of experience in the futures and commodities markets. He has successfully traded futures for a significant part of his career, and his methods have been proven to generate consistent profits over the years.

Larry has a unique ability to simplify complex concepts, making them accessible to traders of all experience levels. Whether you’re new to swing trading or have years of trading experience, Larry’s clear, practical approach will help you optimize your trading strategy. His proven track record in futures and commodities trading, combined with his commitment to teaching, makes this course a must for any trader looking to enhance their trading skills.

Who Is This Course Ideal For?

- Beginner Traders: If you are new to futures or commodities trading, this course offers an excellent foundation. With Larry’s clear guidance, you’ll learn how to interpret the COT report and apply it alongside technical analysis.

- Intermediate Traders: If you already have some experience, this course will take your skills to the next level by teaching you how to combine COT analysis with technical indicators and price action.

- Commodity Investors: If you’re interested in trading or investing in commodities like gold, oil, or agricultural products, this course offers the tools to understand the market sentiment and make more informed decisions.

Conclusion: Unlock Your Trading Potential with Larry Williams’ Proven Methods

Swing Trading Futures & Commodities with the COT by Larry Williams is a game-changing course for anyone looking to profit from the futures and commodities markets. With his proven strategies and deep understanding of the COT report, Larry Williams provides you with a complete framework for trading success.

By enrolling in this course, you’ll learn how to effectively interpret market sentiment, develop a robust swing trading strategy, and refine your mental discipline for long-term profitability. Whether you’re new to trading or a seasoned pro, Larry’s course will help you navigate the complexities of the futures and commodities markets and unlock your full trading potential.

Start mastering COT-based trading today and take your trading career to new heights!