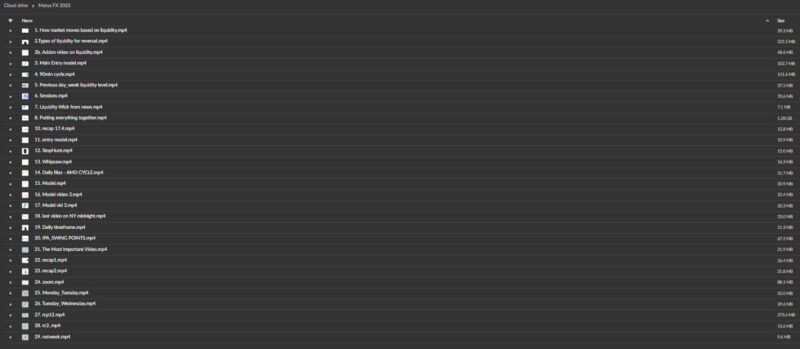

Marus FX 2023

Original price was: $997.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Marus FX 2023

Unlock Your Trading Potential with Marus FX 2023: The Essential Course for Navigating Market Liquidity

Are you ready to transform your trading skills and gain a deep understanding of market dynamics? The Marus FX 2023 course is meticulously crafted to empower both novice and experienced traders with the knowledge and strategies needed to navigate the complexities of financial markets. By focusing on liquidity—an essential driver of market movements—this groundbreaking course equips you with the tools to anticipate market reversals and make informed trading decisions. Join us and elevate your trading game today!

What Makes the Marus FX 2023 Course Essential for Traders?

In the world of trading, understanding the various forms of liquidity is crucial. The Marus FX 2023 course delves into the intricacies of market liquidity and its profound impact on price movements. This course is not just about theory; it emphasizes practical application, allowing you to put your learning into action right away. With insights on order book liquidity, volume-based liquidity, and institutional liquidity, you will gain a comprehensive understanding of how these elements influence market reversals.

Moreover, the course is structured to cater to traders at all levels. Whether you are just starting your journey or looking to refine your skills, Marus FX 2023 offers a wealth of knowledge that can help you enhance your trading performance. The emphasis on strategic analysis and practical application ensures that you walk away with actionable insights, making this course a valuable investment in your trading education.

How Does the Marus FX 2023 Course Break Down Liquidity Types for Market Reversals?

Understanding liquidity is the cornerstone of successful trading, and the Marus FX 2023 course meticulously explores the different types of liquidity that play a pivotal role in market reversals. From order book liquidity, which reflects the supply and demand dynamics at any given moment, to volume-based liquidity, which highlights the importance of trading volumes, this course covers it all.

The course guides you through how these liquidity types can signal potential market reversals. By learning to recognize these signals, you will be better equipped to anticipate and respond to shifts in market dynamics. For instance, knowing when to expect increased liquidity during specific market hours or in response to major news events can significantly enhance your trading strategy. This comprehensive understanding of liquidity not only improves your ability to make informed trading decisions but also positions you to capitalize on market opportunities as they arise.

What is the Main Entry Model in Marus FX 2023, and How Can It Benefit You?

One of the critical components of the Marus FX 2023 course is the Main Entry Model. This systematic approach provides traders with a clear framework for making informed entry decisions in the market. Understanding when and how to enter a trade can be the difference between profit and loss, and this model serves as your roadmap.

The Main Entry Model emphasizes a structured approach to trading, helping you identify optimal entry points based on market conditions and liquidity analysis. By applying this model, you can minimize impulsive decisions driven by emotions, allowing for a more disciplined trading strategy. Additionally, the course illustrates how to combine the Main Entry Model with liquidity insights to enhance your chances of success. This alignment of strategy and market understanding sets you on a path toward more consistent trading results.

Why is Timing Critical in Trading, and How Does the 90-minute Cycle Fit In?

In trading, timing is everything. The Marus FX 2023 course highlights the significance of the 90-minute cycle, which helps traders identify essential price movements and trading opportunities within the trading day. This cycle not only provides insights into short-term market behaviour but also allows you to position yourself strategically for potential market shifts.

By understanding the 90-minute cycle, you can anticipate key price movements that may arise from changes in liquidity or market sentiment. This aspect of the course empowers you to make timely decisions, enhancing your ability to seize opportunities as they present themselves. Additionally, the course teaches you how to analyze price action within this cycle, providing you with a competitive edge in your trading endeavors.

How Can Previous Day and Week Liquidity Levels Influence Your Trading Strategy?

Understanding historical liquidity patterns can significantly inform your trading strategy. The Marus FX 2023 course explores the concept of Previous Day Week Liquidity Levels, teaching you how to analyze past liquidity data to anticipate potential market reversals. This analysis offers valuable insights into likely market behaviour, allowing you to make more informed trading decisions.

By examining previous liquidity levels, you can identify support and resistance areas that may influence future price movements. The course provides practical examples and case studies, enabling you to see how historical patterns can serve as predictive tools for today’s market conditions. This knowledge not only enhances your analytical skills but also equips you with a framework for making strategic decisions based on past performance.

How Do Market Sessions Affect Liquidity and Trading Opportunities?

Financial markets operate within various sessions, each with its unique characteristics and liquidity dynamics. The Marus FX 2023 course covers the impact of session-based liquidity, helping you understand how different market hours can affect trading conditions. By recognizing these differences, you can tailor your trading strategies to maximize opportunities.

For example, liquidity tends to increase during certain sessions, such as the overlap of major market hours. Understanding when these overlaps occur allows you to position yourself advantageously, enhancing your potential for profitable trades. The course delves into session-based analysis, providing you with tools to identify optimal trading times based on historical data and liquidity patterns.

What Role Does News Play in Creating Liquidity Spikes?

In the fast-paced world of trading, news events can lead to significant liquidity spikes that create both risks and opportunities. The Marus FX 2023 course teaches you how to analyze the effects of news on market dynamics, particularly focusing on liquidity wicks that appear on price charts during major announcements.

By understanding how news events impact liquidity, you can better navigate the volatility that often follows. The course provides strategies for capitalizing on these spikes while mitigating potential risks associated with sudden price movements. This knowledge is invaluable for traders looking to harness the power of news to inform their trading decisions effectively.

How Can You Recognize and Mitigate Risks from Stop Hunts and Whipsaws?

Stop hunts and whipsaws are common occurrences in the trading landscape, often resulting from market manipulation tactics. The Marus FX 2023 course equips you with the skills to recognize these patterns and implement strategies to mitigate their impact on your trading. Understanding these market conditions is essential for protecting your capital and maintaining a sustainable trading strategy.

The course offers practical insights into identifying stop hunts and whipsaws, providing you with the tools to make informed decisions in the face of potential market manipulation. By learning to anticipate these movements, you can adjust your trading strategies accordingly, enhancing your ability to minimize losses and maximize gains.

How Does the Daily Bias – AMD Cycle Help Shape Your Trading Decisions?

The Marus FX 2023 course introduces the AMD (Amplitude, Momentum, Direction) cycle, a critical tool for assessing daily market bias. This cycle provides a framework for understanding the prevailing sentiment and potential direction of the market throughout the trading day. By incorporating this analysis into your trading strategy, you can make more informed decisions aligned with current market conditions.

The AMD cycle helps you gauge market momentum and identify key trading opportunities based on shifts in sentiment. By mastering this tool, you can enhance your ability to predict price movements and adjust your trading strategies accordingly. The course emphasizes practical application, ensuring that you leave with the knowledge and skills to implement the AMD cycle effectively in your trading.

What Are IPA and Swing Points, and How Can They Elevate Your Technical Analysis?

Initial Price Action (IPA) and swing points are fundamental components of technical analysis that every trader should master. The Marus FX 2023 course teaches you how to effectively use IPA and swing points to identify potential areas of support and resistance in the market. These tools are crucial for developing a robust trading strategy and enhancing your overall market analysis.

By learning to identify swing points, you gain insights into potential reversal zones, enabling you to make informed decisions about entry and exit points. The course emphasizes practical exercises and real-world applications of these concepts, ensuring that you can apply your knowledge in live trading scenarios. This expertise will empower you to refine your trading strategies and improve your overall performance.

Why Should You Enroll in Marus FX 2023 Today?

The Marus FX 2023 course is not just a trading course; it’s a comprehensive guide designed to transform your understanding of financial markets. By focusing on the critical role of liquidity and providing actionable insights, this course equips you with the knowledge and skills to navigate market complexities effectively.

Whether you are a novice trader eager to learn the ropes or an experienced trader looking to refine your skills, Marus FX 2023 offers invaluable resources that can elevate your trading performance. Don’t miss this opportunity to invest in your trading education.

Enrol now and embark on your journey to becoming a proficient trader with a profound understanding of market dynamics!