Price Action Volume Trader Course – Trading with Market & Volume Profile

$197.00 Original price was: $197.00.$32.00Current price is: $32.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Price Action Volume Trader Course – Trading with Market & Volume Profile

Price Action Volume Trader Course: Master Trading with Market & Volume Profile

The Price Action Volume Trader Course—Trading with Market & Volume Profile is a cutting-edge program designed for traders who aim to refine their skills and achieve precision in market analysis. This course integrates Auction Market Theory (AMT) with advanced tools like Market Profile (TPO Charts) and Volume Profile, providing a powerful framework for making informed trading decisions. Whether you’re a day trader, swing trader, or long-term investor, this comprehensive training equips you with the tools to navigate various markets confidently and consistently.

Why Choose the Price Action Volume Trader Course?

How Can Market and Volume Profiles Transform Your Trading?

Market Profile and Volume Profile are essential tools for understanding price movements and volume dynamics, offering unparalleled insights into market behaviour. These methodologies empower traders to identify key interest levels, interpret market structure, and accurately anticipate future price movements.

- Precision and Clarity: By mastering Market and Volume Profiles, traders can pinpoint areas of value and inefficiency for optimal trade execution.

- Universal Application: These concepts apply to all markets, including futures, forex, stocks, and cryptocurrencies, making them versatile for any trading strategy.

- Data-Driven Decision-Making: Gain an edge using data-backed insights to align trades with broader market trends.

The Price Action Volume Trader Course bridges the gap between theory and practice, delivering actionable strategies for real-world success.

What Will You Learn in the Price Action Volume Trader Course?

How Does Auction Market Theory Lay the Foundation for Market Analysis?

At the heart of this course is Auction Market Theory (AMT), which explains how markets operate as dynamic auctions. By mastering AMT, traders gain a deeper understanding of the buyer-seller dynamics driving price action.

- Core Concepts of AMT: Learn how time, price, and volume interact to shape market behaviour.

- Market Balance and Imbalance: Understand periods of equilibrium and transition to identify trading opportunities.

- Analyzing Transitions: Develop the ability to spot market shifts and prepare for price movements before they happen.

This foundational knowledge equips traders with the insights needed to analyze market structure effectively and stay ahead of the curve.

What Are Market Profile (TPO) Charts and How Do They Add Value?

Market Profile charts, also known as Time Price Opportunity (TPO) charts, provide a unique perspective on market structure, helping traders identify areas of balance and inefficiency.

- Interpreting TPO Charts: Learn how to use TPO charts to assess developing market structures and locate areas of value.

- Identifying Key Levels: Master techniques to find high-probability trade zones based on market participation and activity.

- Strategic Applications: Use Market Profile to refine trade entries, exits, and risk management strategies.

TPO charts are a game-changer for traders seeking to understand market intent and capitalize on high-probability setups.

How Does Volume Profile Enhance Trade Precision?

Volume Profile analyzes trading activity at specific price levels, offering a granular view of where market participants are most active.

- Volume Clusters: Identify zones of high and low trading activity to gauge market sentiment and potential turning points.

- Key Areas of Interest: Use volume distribution to pinpoint areas of support, resistance, and price acceptance.

- Strategic Trade Placement: Leverage Volume Profile insights to plan trades with optimal entry and exit points.

By combining Volume Profile with Market Profile, traders can build a comprehensive market view that informs both short-term and long-term strategies.

How Does the Course Apply Across Markets and Strategies?

Can Market Profile and Volume Profile Be Used in All Markets?

The techniques taught in this course are universally applicable, enabling traders to succeed in a variety of financial instruments and market conditions.

- Futures Trading: Use high-volatility environments to your advantage with precise volume and market analysis.

- Cryptocurrency Trading: Apply Auction Market Theory to volatile crypto assets for better risk management.

- Forex and CFDs: Gain deeper insights into global currency pairs and derivative instruments.

- Stock Trading: Recognize institutional activity and trade with confidence based on volume clusters.

These tools are adaptable, making them valuable for traders in any market.

What Strategies Are Covered for Short-Term and Swing Trading?

Whether you’re an intraday trader or focused on longer-term positions, this course offers tailored strategies to suit your style:

- Day Trading: Analyze real-time data with TPO and Volume Profiles to execute precise intraday trades.

- Swing Trading: Develop a macro perspective on market structure to identify long-term trends and opportunities.

By combining actionable insights with flexible strategies, this course ensures success for both short-term and swing traders.

What Exclusive Features Does the Course Offer?

How Does the Compass Software Simplify Trading Setup?

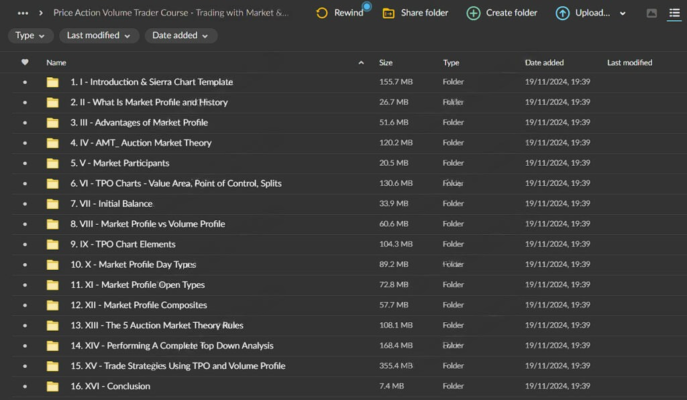

Participants gain access to a downloadable Sierra Chart file, which contains all the charts used in course recordings.

- Customizable Templates: Use the preloaded Sierra Chart setup as a foundation or adapt it to fit your unique trading style.

- Platform-Agnostic Strategies: While designed for Sierra Chart, the methodologies taught are compatible with any trading software.

This feature streamlines the learning process, allowing you to focus on strategy rather than setup.

What Makes This Course Stand Out?

- Comprehensive Learning: The course covers everything from foundational Auction Market Theory to advanced Market and Volume Profile strategies.

- Actionable Knowledge: Emphasis on practical, real-world applications ensures you can implement what you learn immediately.

- Expert Guidance: Benefit from instructor-led support and a community of traders to enhance your learning experience.

Who Should Enroll in the Price Action Volume Trader Course?

Is This Course Right for You?

The Price Action Volume Trader Course is designed for traders at all levels:

- Beginners: Build a strong foundation in market analysis with Auction Market Theory and Volume Profile.

- Intermediate Traders: Refine your strategies with advanced tools like Market Profile and multi-timeframe analysis.

- Experienced Traders: Gain insights into institutional activity and develop a macro view of market trends.

Whether you’re starting out or seeking to optimize your performance, this course offers invaluable insights.

Conclusion: Master the Market with Price Action and Volume Profile

The Price Action Volume Trader Course – Trading with Market & Volume Profile is the ultimate resource for traders seeking precision, consistency, and profitability. By mastering the principles of Auction Market Theory, Market Profile, and Volume Profile, participants gain a competitive edge in any market.

With its focus on practical application, actionable strategies, and universal relevance, this course equips you with the tools and knowledge to succeed. Whether you’re trading futures, forex, stocks, or cryptocurrencies, the methodologies taught in this course will transform your approach and deliver long-term results.

Take control of your trading journey—enroll in the Price Action Volume Trader Course today

Product For Sale

Product For Sale

Product For Sale Related Products

$1,497.00 Original price was: $1,497.00.$28.00Current price is: $28.00.

$799.00 Original price was: $799.00.$14.00Current price is: $14.00.

$997.00 Original price was: $997.00.$14.00Current price is: $14.00.

$497.00 Original price was: $497.00.$16.00Current price is: $16.00.