Retail Capital – My Trading Framework

Original price was: $299.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Retail Capital – My Trading Framework

Retail Capital – My Trading Framework: Master Market Dynamics with Proven Strategies

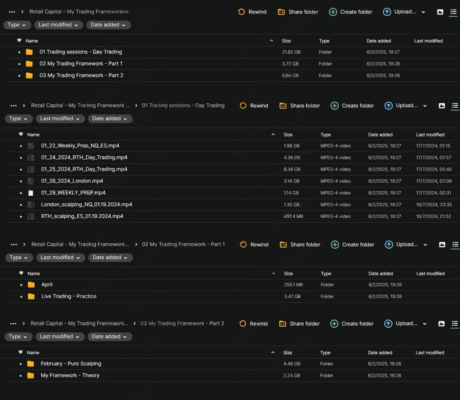

Retail Capital—My Trading Framework is an all-encompassing course crafted for traders eager to master market dynamics and refine their trading strategies. Developed by seasoned trader and educator Retail Capital, it distils over 13 years of trading experience into a structured framework that emphasises technical analysis, market psychology, and the practical application of successful strategies.

Designed for traders committed to hard work and personal development, this course covers everything from the fundamentals of market rotation to advanced techniques such as Volume Profile analysis and Backtesting. It is packed with actionable insights, real-world examples, and live trading sessions that equip traders with the tools and knowledge they need to enhance their market proficiency. Whether you’re just starting or looking to refine your skills, My Trading Framework offers a clear path to becoming a more disciplined and successful trader.

What Can You Expect from Retail Capital – My Trading Framework?

Retail Capital’s My Trading Framework offers a comprehensive approach to trading that goes beyond theoretical knowledge. This course integrates practical strategies honed through years of real-world experience, enabling traders to apply proven methodologies in live market conditions.

How Does the Course Help You Understand Market Rotation?

Market rotation is a fundamental concept at the heart of trend identification. Retail Capital—My Trading Framework provides an in-depth exploration of how market rotation works, helping traders identify key trends and make more informed trading decisions. Understanding market rotation allows traders to determine the direction and timing of price movements, which is essential for predicting the best moments to enter and exit trades.

The course covers the mechanics of market rotation, explaining how price shifts between various sectors and timeframes. This knowledge is crucial because it allows traders to recognize when specific industries or stocks will likely outperform others. Traders will learn to interpret rotational patterns to spot breakouts, retracements, and the continuation of trends.

Understanding market rotation also helps to minimize risks by avoiding entering trades at the wrong time. By recognizing early signs of rotational shifts, you can make more informed decisions, enhancing the potential for high-probability trades. With this deep understanding, you’ll be able to capitalize on market cycles, improving the consistency and profitability of your trading strategy.

What is the Average Daily Range (ADR), and How Can It Improve Your Trading?

Average Daily Range (ADR) is a key metric traders use to gauge a market’s volatility and potential movement within a single trading day. In My Trading Framework, Retail Capital provides a deep dive into ADR, explaining how this metric can help you set realistic targets and stop-loss levels based on historical price action. By analyzing ADR, traders can predict the range in which a stock or asset will likely move on a given day, allowing them to make better-informed decisions.

The course teaches you how to calculate ADR, interpret its significance, and apply it to your trades. By understanding how price movements typically unfold during a trading day, you can anticipate price targets, reducing the likelihood of being stopped out prematurely or missing out on profitable moves. With this knowledge, you can create well-structured trading plans, minimizing risk while optimizing reward potential.

ADR can be an indispensable tool for traders focused on short-term trading, day trading, or scalping. By using ADR and other indicators and strategies taught in this course, traders can improve their ability to predict price action and adjust strategies dynamically according to market conditions.

Why is Backtesting a Long-Only Strategy Important?

Backtesting is a powerful method for validating trading strategies before applying them in live markets. In Retail Capital – My Trading Framework, you’ll learn how to backtest a long-only strategy using historical data to ensure that your trading plan is robust and effective. By simulating past market conditions, Backtesting allows you to assess how a strategy would have performed over time and helps identify any weaknesses in your approach.

Through practical examples and step-by-step guidance, Retail Capital demonstrates the backtesting process, showing you how to evaluate and refine your strategy. The course emphasizes the importance of using historical data to verify your trading approach, ensuring it holds up in different market environments. Backtesting is particularly useful when developing new strategies or adapting to changing market conditions, as it provides a data-driven approach to strategy development.

Backtesting also allows traders to better understand their risk tolerance and profitability potential. By simulating trades in various market conditions, you can determine whether your strategy will perform consistently or adjustments are necessary. This increases your confidence in executing your strategy in live markets, ultimately contributing to a more disciplined and systematic approach to trading.

How Can Footprint and Volume Profile Analysis Boost Your Market Understanding?

Footprint charts and Volume Profile analysis are essential for understanding market depth and order flow. These techniques help traders identify key support and resistance levels, gauge market sentiment, and predict price movements more accurately. By studying footprint charts and volume profiles, traders can visualize the market’s inner workings and gain insights into the buying and selling pressures that influence price action.

Retail Capital’s course includes detailed lessons on footprint charting and volume profiling, offering practical examples and actionable insights on how to use these techniques to enhance your trading decisions. Footprint charts provide a clear view of price action at a granular level, showing the precise amount of volume traded at each price level. This allows traders to identify price levels where major buying or selling activity occurs, offering clues about potential reversals or breakouts.

On the other hand, volume Profile analysis provides a horizontal view of volume at different price levels, helping traders identify high-volume areas where price is likely to encounter resistance or support. By combining these two tools, traders can gain a more complete picture of the market, improving their ability to spot trend reversals, consolidation zones, and breakout opportunities.

What Role Does VIX Statistics Play in Your Trading Strategy?

The VIX (Volatility Index) is often called the “fear gauge” because it measures market volatility and investor sentiment. A high VIX typically signals heightened fear and uncertainty in the market, while a low VIX suggests a more stable, risk-averse environment. Understanding VIX statistics is a critical component of My Trading Framework and helps traders gauge overall market sentiment, which can influence their trading decisions.

Retail Capital’s course dives deep into the statistical implications of the VIX, helping traders understand how changes in volatility can impact market behaviour and price movement. By analyzing VIX trends, traders can better assess the risk environment and adjust their positions accordingly. For example, during periods of high volatility, traders might choose to tighten their stop losses or take more cautious positions, while lower volatility periods may present opportunities for more aggressive trading.

Knowing how to interpret VIX data in real time can help traders anticipate market swings and adjust their strategies to changing risk conditions. By incorporating the VIX into your trading toolkit, you can stay ahead of market shifts and improve your trades’ overall accuracy and profitability.

What Makes Retail Capital – My Trading Framework Stand Out?

Retail Capital – My Trading Framework provides a holistic and actionable trading education perfect for novice and seasoned traders. The course focuses on practical skills you can implement immediately, emphasizing discipline and dedication—two of the most important factors for trading success.

Live Trading Sessions and Real-World Insights

One of the course’s standout features is its inclusion of live trading sessions. Retail Capital demonstrates how the strategies covered in the course can be applied in real time, showcasing both winning and losing trades. This approach helps demystify the challenges of trading and provides invaluable insights into dealing with market volatility and emotional discipline during live market conditions.

Comprehensive and Accessible Learning

Retail Capital—My Trading Framework offers lifetime access to the course materials for just $299, making it a highly affordable resource for traders looking to improve their technical skills and trading strategies. The course accommodates traders of all skill levels, providing a comprehensive foundation while offering advanced techniques to refine your approach.

Conclusion: Why Should You Buy Retail Capital – My Trading Framework?

Retail Capital: My Trading Framework is an indispensable resource for traders committed to improving their market proficiency and achieving long-term success.

With its emphasis on technical analysis, risk management, and real-world applications, this course equips traders with the tools and strategies they need to excel in a competitive market. Whether you’re looking to master market rotation, backtest strategies, or refine your use of Volume Profile analysis, Retail Capital – My Trading Framework offers comprehensive guidance and practical advice to help you become a more disciplined, profitable trader.