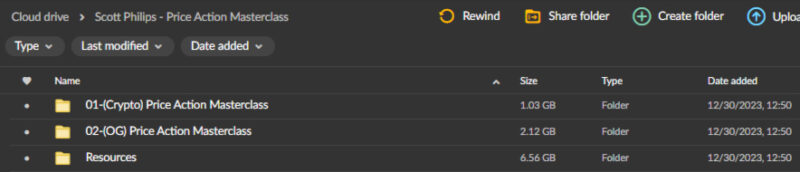

Scott Philips – Price Action Masterclass

Original price was: $99.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Scott Philips – Price Action Masterclass

Price Action Masterclass with Scott Philips – Master the Art of Trading

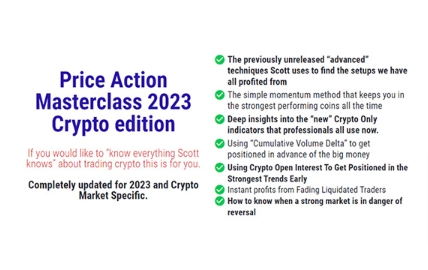

Join Scott Philips in the Price Action Masterclass, an immersive course tailored for traders who want to refine their skills and make informed trading decisions without relying on indicators. This course is designed for both beginners and experienced traders, focusing on the fundamental principles of price action trading. You’ll gain valuable insights into market dynamics, develop your intuition, and learn how to interpret raw price movements effectively.

Why Focus on Price Action Trading?

Understanding Market Behavior

The course kicks off by emphasizing the importance of reading price action as a direct reflection of market sentiment. By analyzing price movements without indicators, you’ll gain a clearer understanding of buyer-seller dynamics and learn to identify critical levels, trends, and reversal points. This foundational skill fosters a deeper comprehension of market behavior, allowing you to adapt your strategies across various trading conditions.

Building Intuition and Flexibility

Mastering price action analysis enhances your intuition and adaptability in the fast-paced trading environment. This course equips you with an independent toolkit that empowers you to trust your judgment, an essential asset in navigating volatile markets.

Adapting to Market Conditions: Trends and Ranges

Recognizing Market States

Scott Philips teaches you how to identify whether the market is trending or ranging. Understanding these conditions is crucial for determining the best trading approach. You’ll learn when to follow the trend and when to capitalize on price oscillations within ranges, enhancing your trading effectiveness.

Implementing Effective Strategies

Once you’ve recognized the market state, Philips provides tailored strategies for trending and range-bound markets. These include selecting optimal entry and exit points, setting stop-loss orders, and managing trades with precision, all backed by actionable insights and clear examples.

The Role of Indicators in Price Action Trading

Using Indicators Wisely

While price action is central to this course, Philips acknowledges the usefulness of specific indicators. You’ll learn to integrate tools like moving averages and RSI without overly relying on them. This balanced approach enables you to reinforce your price action analysis while maintaining clarity in your decision-making.

Simplifying Your Toolkit

With a multitude of indicators available, it can be overwhelming. Philips guides you through selecting the most relevant tools, helping you create a streamlined and practical trading toolkit.

Mastering Range Trading Techniques

Profiting in Range-Bound Markets

Philips breaks down the intricacies of trading within ranges, teaching you to identify support and resistance zones. You’ll learn strategies for maximizing profits while understanding where buyers and sellers are likely to place their trades.

The Vacuuming Technique

A standout technique covered in the course is “vacuuming,” which involves exploiting gaps in price action. Recognizing these gaps allows you to anticipate breakouts or reversals, gaining a significant edge in choppy market conditions.

Psychological Factors in Trading

Understanding Market Psychology

Philips dedicates a section to the psychological aspects that drive price movements. By grasping the mindset of market participants, you’ll enhance your ability to interpret trends and avoid common pitfalls, such as entering trades too late or overstaying in a position.

Building Confidence in Trend Identification

You’ll also explore technical indicators and patterns that signal strong trends, equipping you with the knowledge to distinguish genuine trends from temporary fluctuations.

Identifying Counter-Trend Opportunities

Spotting Reversal Signals

Learn how to recognize patterns that indicate potential trend reversals. This skill enables you to seize counter-trend opportunities, diversifying your trading strategies and maximizing profit potential.

Managing Counter-Trend Risks

Philips offers practical strategies for mitigating risk when trading counter-trends, ensuring you can navigate these opportunities with confidence.

Technical Patterns and Decision-Making

Recognizing Exhaustion Signals

Discover technical patterns, such as blow-off tops that signals the end of trends. By mastering these signals, you’ll enhance your timing and secure profits effectively.

Timing Market Highs and Lows

The course provides insights into identifying potential market tops and bottoms, improving your precision in trading volatile conditions.

Volume and Gaps in Price Action

Interpreting Volume Spikes

Understand the significance of volume in price action analysis. Philips covers how to analyze short-term volume spikes to inform your trading decisions.

Utilizing Microgaps and Opening Gaps

Learn to interpret microgaps and opening gaps, essential elements that can greatly impact your short-term trading strategies.

Real-World Application and Case Studies

Practical Examples

Philips integrates real-world case studies, including live examples of tape reading, to demonstrate how price action principles apply across various assets.

Crafting Your Unique Trading Style

The course concludes with guidance on developing a personalized trading approach that aligns with your goals and risk tolerance, enabling you to navigate the markets with confidence.

Why Choose the Price Action Masterclass?

Scott Philips’ Price Action Masterclass offers a comprehensive, no-frills approach to trading. The curriculum spans from foundational analysis to advanced techniques, ensuring traders at any level can benefit. With an emphasis on practical applications and a balanced exploration of psychological and technical aspects, this course is a valuable resource for anyone looking to excel in price action trading.

Elevate your trading game and make informed, confident decisions in the financial markets. Join the Price Action Masterclass today!