Simpler Trading – Options Flow Secrets (Elite)

Original price was: $1,997.00.$21.00Current price is: $21.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Simpler Trading – Options Flow Secrets (Elite)

More straightforward Trading – Options Flow Secrets (Elite) Course: Mastering Options Flow Analysis

The Simpler Trading Options Flow Secrets (Elite) Course is an advanced program designed to equip traders with the skills to analyze and interpret options flow data. Options flow data refers to the influx of orders for options contracts entering the market and provides traders with invaluable insights into potential market movements.

Covering a wide array of topics, including identifying unusual options activity, tracking institutional trades, and using options flow data for informed trading decisions, this course is essential for beginner and experienced traders aiming to enhance their trading prowess and gain a competitive market edge.

Critical Components of the Course

Identifying Unusual Options Activity

Unusual options activity signifies significant deviations in options trading volume or open interest compared to standard trading patterns. The Options Flow Secrets (Elite) Course teaches traders to identify and interpret unusual activity, such as large block trades or high volume spikes, and discern whether this activity indicates informed trades or speculative bets. Recognizing unusual options activity allows traders to anticipate potential market movements and identify lucrative trading opportunities.

Tracking Institutional Trades

Institutional traders and market makers often leave discernible footprints in the options market through extensive and sophisticated trades. The course provides techniques for tracking institutional trades via options flow data and analyzing block trades, sweeps, and order flow patterns. Monitoring institutional activity helps traders understand market dynamics better and make informed trading decisions.

Interpreting Options Flow Data

Flow data offers valuable information about market sentiment, trends, and potential price movements. The course covers advanced techniques for interpreting this data, including analyzing call-to-put ratios, identifying option skew, and tracking the flow of options contracts across different strike prices and expiration dates. Mastering options flow analysis gives traders a deeper understanding of market dynamics and enables them to make accurate predictions about future price movements.

Developing Trading Strategies

Beyond fundamental options flow analysis, the course delves into advanced trading strategies leveraging options flow data. Traders learn to use this data to identify trade setups, confirm trading signals, and optimize risk-reward ratios. Whether you are a day trader, swing trader, or options trader, the Options Flow Secrets (Elite) Course provides valuable insights and techniques to enhance your trading strategies and market performance.

Risk Management and Trade Execution

Successful trading hinges on effective risk management. The course emphasizes managing risk when using options flow data to inform trading decisions. Traders learn risk management techniques, including position sizing, setting stop-loss orders, and managing trades based on risk-reward ratios. Additionally, the course covers trade execution strategies to help traders effectively enter and exit trades based on options flow signals.

Interactive Learning Experience

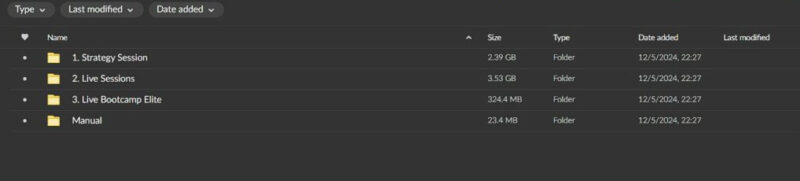

The Simpler Trading Options Flow Secrets (Elite) Course offers an interactive learning experience. The course includes video lessons, live trading sessions, and interactive assignments to reinforce key concepts and provide hands-on experience with options flow analysis. Students also have access to a community of traders and instructors for support, networking, and discussion of real-time market opportunities.

Course Modules

- Introduction to Options Flow Analysis

- Overview of options flow data

- Importance and benefits of options flow analysis

- Identifying Unusual Options Activity

- Recognizing significant deviations in trading volume and open interest

- Interpreting large block trades and high-volume spikes

- Tracking Institutional Trades

- Techniques for monitoring block trades, sweeps, and order flow patterns

- Understanding the impact of institutional activity on market dynamics

- Interpreting Options Flow Data

- Analyzing call-to-put ratios and option skew

- Tracking options flow across different strike prices and expiration dates

- Developing Advanced Trading Strategies

- Using options flow data to identify trade setups

- Confirming trading signals and optimizing risk-reward ratios

- Risk Management and Trade Execution

- Position sizing and setting stop-loss orders

- Effective trade entry and exit strategies based on options flow signals

- Interactive Learning and Practical Application

- Video lessons and live trading sessions

- Interactive assignments and community engagement

Conclusion

The Options Flow Secrets (Elite) Course by Simpler Trading is a comprehensive resource for traders looking to master options flow analysis and improve their trading performance. By learning to identify unusual options activity, track institutional trades, interpret options flow data, develop advanced trading strategies, and manage risk effectively, traders can gain a competitive edge and make more informed trading decisions. Whether you are a seasoned trader or just starting, this course offers a complete guide to mastering options flow analysis and elevating your trading skills.

Enrol in the Simpler Trading Options Flow Secrets (Elite) Course today and start transforming your trading strategies with expert insights and practical techniques.