TradeWithKene Course

Original price was: $100.00.$10.00Current price is: $10.00.

- 24/7 Contact Support & Fast Chat

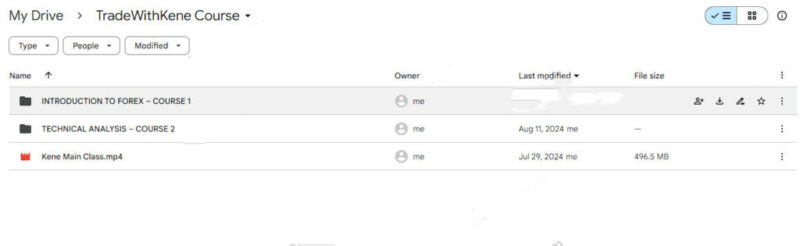

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

TradeWithKene Course

Master Forex Trading with the TradeWithKene Course: Your Ultimate Guide to the Forex Market

The TradeWithKene Course is your gateway to mastering the art and science of Forex trading. Designed to provide a comprehensive understanding of the world’s largest and most liquid financial market, this course equips you with the knowledge, skills, and strategies necessary to navigate Forex markets confidently and profitably. Whether you’re a beginner looking to build a solid foundation or an experienced trader aiming to refine your skills, the TradeWithKene Course offers an in-depth, structured approach to learning Forex trading from the ground up.

Why Choose the TradeWithKene Course?

What Makes This Course a Must-Have for Aspiring Forex Traders?

The TradeWithKene Course offers a detailed exploration of Forex trading, covering everything from the basics to advanced market analysis techniques. This course is meticulously designed to provide you with a thorough understanding of key concepts such as currency pairs, exchange rates, leverage, and market structure. Through interactive lessons, practical exercises, and real-world examples, you’ll gain the confidence to trade effectively and make informed decisions that align with your trading goals.

Introduction to Forex Trading: What is Forex and How Does It Work?

Understanding the Fundamentals of Forex Trading

What is Forex Trading and Why Should You Learn It?

Forex trading, or foreign exchange trading, involves exchanging one currency for another with the goal of profiting from fluctuations in exchange rates. The Forex market is the largest and most liquid financial market globally, boasting a daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, and offers numerous opportunities for traders to profit from the constant shifts in currency values.

Key Concepts in Forex Trading: What You Need to Know

- Currency Pairs: In Forex trading, currencies such as EUR/USD (Euro vs. US Dollar) are always traded in pairs. Understanding how these pairs work is essential for grasping the mechanics of Forex trading.

- Exchange Rates: The exchange rate is the value at which one currency can be exchanged for another. Knowing how to interpret and analyze exchange rates is crucial for predicting market movements and making profitable trades.

- Leverage: Leverage allows traders to control larger positions with less capital, amplifying potential gains and risks. Learning to use leverage wisely is key to managing your risk exposure in Forex trading.

- Pips: A pip is the smallest unit of measurement in the Forex market, typically representing a change of 0.0001 in the exchange rate. Understanding pips is fundamental to calculating profit and loss in Forex trading.

Exploring Forex Market Characteristics: What Makes Forex Unique?

What Are the Defining Features of the Forex Market?

- High Liquidity: The Forex market is highly liquid, with a vast number of participants — including banks, financial institutions, corporations, and individual traders — providing continuous liquidity. This high liquidity ensures smooth transaction execution and tight bid-ask spreads, making it easier for traders to enter and exit positions.

- Global Reach: As a global market, Forex trading takes place around the clock across different time zones. This means you can trade currencies at any time, making it a flexible option for traders with varying schedules.

- Role of Market Makers: Market makers are financial institutions that provide liquidity by quoting both bids and asking prices for currencies. Understanding their role is crucial for recognizing how prices are set and how to navigate the market efficiently.

Lesson 1: The Basics of Forex Trading — Building a Strong Foundation

What Will You Learn in the First Lesson of the TradeWithKene Course?

The introductory lesson of the TradeWithKene Course focuses on building a solid foundation in Forex trading. You will learn:

- Understanding Forex Trading and Its Terminology: Grasp the essential terms and concepts, such as currency pairs, exchange rates, leverage, and pips.

- Identifying Key Characteristics of the Forex Market: Learn about market liquidity, the role of market makers, and the significance of a global trading environment.

- Developing a Foundation for Further Learning: Gain the necessary background knowledge to advance to more complex topics and strategies in later lessons.

By the end of this lesson, you will have a clear understanding of the Forex market’s fundamental characteristics and be prepared to explore more advanced concepts.

Lesson 2: Understanding Market Structure — Analyzing Trends and Patterns

How Can Market Structure Analysis Improve Your Trading Decisions?

The second lesson in the TradeWithKene Course explores the concept of market structure, which is essential for identifying market trends and patterns. Market structure analysis involves understanding how prices move and the forces that drive these movements, helping traders make more informed decisions.

- Trend Lines: Learn how to draw and interpret trend lines, which connect a series of highs or lows in the market to indicate the direction of a trend. Recognizing trends early can provide valuable opportunities for profit.

- Support and Resistance Levels: Discover how to identify support and resistance levels — key areas where prices tend to stop or reverse direction. These levels offer insights into market psychology and can help you effectively plan your entry and exit points.

- Channels: Understand how to use channels to identify price movements within a bounded area. Channels clearly indicate the trend’s direction and strength, enabling traders to anticipate potential breakouts or reversals.

Practical Application: How to Identify Market Structure?

What Techniques Can You Use to Analyze Market Structure?

- Visual Analysis: Use charts to visually identify patterns and trends in the market. Understanding how to read and interpret various chart types, such as candlestick and bar charts, is crucial for recognizing trading opportunities.

- Technical Indicators: Learn to utilize technical indicators like moving averages, the Relative Strength Index (RSI), and Bollinger Bands to confirm trends and identify potential entry and exit points.

- Fundamental Analysis: Incorporate fundamental analysis by evaluating economic data, news events, and geopolitical developments that can impact currency prices. Combining technical and fundamental analysis provides a comprehensive approach to market analysis.

Lesson Objectives: Enhancing Your Trading Skills

What Are the Key Takeaways from This Lesson?

By the end of this lesson, you will:

- Understand the concept of market structure and its importance in Forex trading.

- Learn how to identify trend lines, support and resistance levels, and channels using charts and technical indicators.

- Develop skills to analyze market structure and make informed trading decisions, increasing your potential for success.

Lesson Summary: A Pathway to Mastery in Forex Trading

How Does This Lesson Prepare You for Advanced Trading Strategies?

This lesson serves as a stepping stone to more advanced topics, such as trend lines, Fibonacci retracements, candlestick analysis, and more. By mastering market structure analysis, you’ll be better equipped to identify profitable trading opportunities and make strategic decisions.

Beyond the Basics: Advanced Topics in the TradeWithKene Course

What Will You Learn in the Advanced Modules of the Course?

As you progress through the TradeWithKene Course, you will delve into advanced topics that build on your foundational knowledge:

- Technical Analysis Techniques: Explore advanced chart patterns, such as head and shoulders, triangles, and flags, and learn how to use them to predict future price movements.

- Fibonacci Retracements and Extensions: Understand how to apply Fibonacci tools to identify potential reversal points and set profit targets.

- Candlestick Analysis: Learn to read candlestick patterns, such as doji, engulfing patterns, and hammers, to gain insights into market sentiment and make more precise predictions.

Who Should Enroll in the TradeWithKene Course?

Is This Course Right for You?

The TradeWithKene Course is ideal for:

- Beginner Traders: Individuals new to Forex trading who want to build a solid foundation and gain confidence in their trading abilities.

- Intermediate Traders: Those with some trading experience looking to deepen their knowledge and enhance their strategies.

- Experienced Traders: Traders seeking to refine their techniques, learn advanced analysis methods, and stay ahead in the competitive Forex market.

Conclusion: Why You Should Join the TradeWithKene Course

Take the Next Step Toward Forex Trading Mastery

The TradeWithKene Course offers a comprehensive and structured approach to mastering Forex trading. With a blend of foundational knowledge, advanced techniques, and practical applications, this course equips you with the tools needed to succeed in the dynamic world of Forex trading. Whether you’re just starting or looking to sharpen your skills, this course provides the guidance and expertise to elevate your trading journey. Join today and start your path to becoming a confident and successful Forex trader!