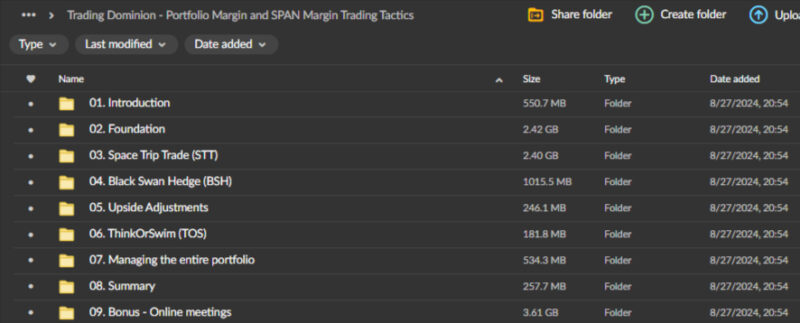

Trading Dominion – Portfolio Margin and SPAN Margin Trading Tactics

Original price was: $497.00.$38.00Current price is: $38.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Trading Dominion – Portfolio Margin and SPAN Margin Trading Tactics Course

Master Advanced Margin Strategies with Trading Dominion’s Portfolio Margin and SPAN Margin Trading Tactics Course

The Portfolio Margin and SPAN Margin Trading Tactics Course by Trading Dominion is a powerful training program designed for experienced traders seeking to elevate their trading performance. This in-depth course explores how to leverage portfolio and SPAN margin accounts to maximize returns, optimize capital usage, and manage risk effectively. With a focus on advanced trading techniques and a sophisticated approach to margin, this course is essential for those wanting to understand and implement higher-level strategies in their trading portfolio.

Why Choose Trading Dominion’s Portfolio Margin and SPAN Margin Trading Tactics Course?

As markets become more volatile and competitive, the ability to use advanced tools like portfolio and SPAN margin effectively has become crucial for any serious trader. Trading Dominion offers a structured and strategic approach that equips traders to capitalize on these tools, providing them with in-depth insights into margin dynamics and how these techniques can be applied to maximize leverage, minimize risk, and generate higher returns.

What Are Portfolio Margin and SPAN Margin?

Understanding Portfolio Margin and Its Benefits

The Portfolio Margin and SPAN Margin Trading Tactics Course begins with a comprehensive introduction to portfolio margin accounts, examining how they differ from traditional margin accounts. Portfolio margin is designed to allow traders to maximize their account leverage based on the overall risk of their portfolio, rather than calculating margin requirements for individual positions. This offers increased flexibility and enables traders to open larger positions while effectively managing risk. For traders interested in pursuing opportunities that require higher leverage, understanding portfolio margin is critical.

What is SPAN Margin and How Is It Different?

The course then transitions to SPAN margin, short for Standard Portfolio Analysis of Risk. Commonly used in futures and options trading, SPAN margin calculates margin requirements by simulating potential market moves to gauge possible losses across a portfolio. This system of margining provides a dynamic way to adjust requirements based on changing market conditions. The Trading Dominion course covers everything you need to know about SPAN margin and how it applies to different types of trades, particularly in the futures and options markets.

How Does the Course Address Margin Requirements and Risk Management?

Demystifying Margin Requirements for Portfolio and SPAN Margin Accounts

Trading Dominion’s course provides essential insights into how margin requirements are calculated within portfolio and SPAN margin accounts. This is especially valuable for traders aiming to optimize their capital usage by understanding how different market conditions affect margin requirements. Knowing these specifics helps traders strategically plan for different scenarios, allowing them to adjust their positions proactively.

Mitigating Risk Through Advanced Margin Strategies

With increased leverage comes increased risk, so effective risk management is a fundamental component of this course. Trading Dominion’s instructors explain how to implement risk-based margining strategies, such as setting appropriate stop-loss orders, hedging positions, and ensuring that portfolios are diversified enough to cushion against unforeseen losses. This focus on disciplined risk management ensures that traders can confidently use portfolio and SPAN margin accounts to their fullest potential while safeguarding their investments.

What Trading Strategies Are Covered for Portfolio Margin?

How Can You Leverage Positions Using Portfolio Margin?

One of the core benefits of portfolio margin accounts is the ability to leverage positions without drastically increasing risk. In the Trading Dominion course, traders learn how to increase their position sizes strategically and capitalize on opportunities that would otherwise be limited in traditional margin accounts. Portfolio margin allows traders to enhance capital efficiency, and the course explains how to do this without overextending exposure, leading to a more sustainable trading approach.

Advanced Spread and Arbitrage Strategies

The Portfolio Margin and SPAN Margin Trading Tactics Course includes specialized strategies like spread and arbitrage tactics, which become far more accessible with portfolio margin accounts. By effectively utilizing spreads, traders can capitalize on the difference between two positions, while arbitrage techniques allow them to exploit price discrepancies across markets. These strategies not only diversify a trader’s approach but also provide avenues for safer, calculated trades that minimize risk while still capitalizing on market opportunities.

Maximizing Capital Efficiency and Allocation

Trading Dominion’s course places a strong emphasis on capital allocation. By employing portfolio margin, traders can free up capital that can be allocated to other trades or investment opportunities, optimizing their portfolio as a whole. This section of the course teaches how to maximize capital efficiency, helping traders build a versatile portfolio that can withstand market fluctuations and stay agile in the face of new opportunities.

What Trading Strategies Does the Course Cover for SPAN Margin?

Applying SPAN Margin Techniques to Futures and Options Trading

SPAN margin is a critical tool in futures and options trading, and Trading Dominion’s course is designed to help traders understand the unique margin dynamics of these financial instruments. By simulating a range of market conditions, SPAN margin adapts margin requirements to reflect market volatility and potential risk. In the course, traders learn how to apply these adjustments to their advantage, building strategies that accommodate these variations while maintaining profitable positions.

How to Utilize Dynamic Margin Adjustments to Your Advantage

The SPAN margin system’s dynamic adjustments allow traders to capitalize on market changes in real time. Trading Dominion teaches how to use these adjustments to optimize trading positions as market conditions shift, empowering traders to keep their portfolios resilient and adaptable. Through practical examples, traders can see how dynamic margin adjustments work in action, enhancing their ability to make timely and informed decisions.

Scenario Analysis and Stress Testing within SPAN Margin

Risk is inherent in trading, but the Trading Dominion course provides tools for anticipation and preparation. Scenario analysis and stress testing are essential for traders using SPAN margin. By practicing scenario analysis, traders can simulate potential losses or gains based on hypothetical situations, equipping them to handle actual market conditions more confidently. Stress testing adds another layer of security, enabling traders to understand how their portfolios would fare in extreme market shifts.

How Does This Course Support Practical Application?

Real-World Case Studies and Examples

Trading Dominion incorporates real-world case studies, allowing participants to see how advanced margin strategies perform in practice. Each example breaks down the key decisions, rationale, and risk management techniques, providing valuable insights bridging the gap between theory and real-world trading. This hands-on approach helps reinforce the material, giving traders the confidence they need to implement these tactics on their own.

Immersive Live Trading Sessions

One of the standout features of the Portfolio Margin and SPAN Margin Trading Tactics Course is the inclusion of live trading sessions. These sessions allow students to observe the application of portfolio and SPAN margin strategies in real time, providing an interactive learning experience. Participants can ask questions, gain real-time feedback, and witness the nuances of advanced trading techniques as they happen.

Why Is This Course Essential for Experienced Traders?

Elevate Your Trading Approach with Advanced Margin Techniques

For traders ready to advance their skills, Trading Dominion’s Portfolio Margin and SPAN Margin Trading Tactics Course is invaluable. By mastering portfolio and SPAN margin accounts, traders can approach the markets with a level of sophistication that goes beyond traditional margin accounts. The course encourages a deeper understanding of the margin’s role in trading, preparing traders to use leverage strategically and responsibly.

Gain Insights from Industry Experts

Trading Dominion’s instructors bring years of experience in portfolio and SPAN margin trading. This expertise provides course participants with insider knowledge that is crucial for navigating the complexities of margin-based strategies. The instructors are dedicated to explaining concepts and sharing practical tips and techniques that have been tested and proven in real-world markets.

Build a Resilient and Adaptive Trading Portfolio

The primary goal of this course is to help traders build a portfolio that is resilient to market changes and adaptable to evolving trading environments. By applying the strategies learned in the course, participants can create a well-rounded portfolio structured to withstand market volatility while providing opportunities for high returns. This adaptability is key to achieving consistent success, and Trading Dominion’s teachings ensure traders are well-equipped for any market condition.

Conclusion: Elevate Your Trading with Trading Dominion’s Portfolio Margin and SPAN Margin Trading Tactics Course

Trading Dominion’s Portfolio Margin and SPAN Margin Trading Tactics Course is a must-have for experienced traders looking to maximize leverage while managing risk effectively. This course provides comprehensive coverage of portfolio and SPAN margin dynamics, offering valuable strategies that make full use of advanced margin accounts.

With a focus on both theoretical knowledge and practical application, Trading Dominion empowers traders to build sophisticated, resilient portfolios.

For any trader seeking to elevate their approach and enhance their returns, the Portfolio Margin and SPAN Margin Trading Tactics Course by Trading Dominion offers the ideal blend of insights, strategies, and tools needed for a successful margin-based trading strategy.

Enrol today to take full control of your trading potential and position yourself as a knowledgeable, adaptive, and disciplined trader.