Trading EQuilibrium – Reality Based Course

Original price was: $595.00.$13.00Current price is: $13.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

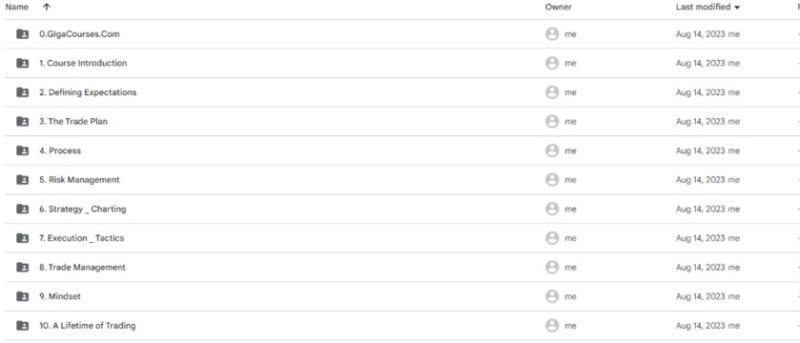

Trading EQuilibrium – Reality Based Course

Master Trading with the Trading EQuilibrium – Reality-Based Course

Are you ready to dive into trading with confidence and skill? The Trading Equilibrium—Reality Based Course is your comprehensive guide to achieving long-term success in swing and position trading. This program is designed for traders who seek realistic, sustainable strategies rather than fleeting achievements. Whether you’re a novice or an experienced trader, this course will equip you with the knowledge and tools necessary to build a lasting trading career.

Why Choose the Reality-Based Course?

The Reality-Based course stands out by focusing on practical, real-world trading strategies that prioritize risk management and consistency. It is perfect for those who are serious about treating trading as a business and are ready to invest in their financial future.

Course Overview

Module 1: Building a Repeatable Process

How Can You Establish a Disciplined Trading Routine?

- Structured Trading Process: Learn the importance of having a disciplined, repeatable trading process. This module emphasizes consistency, which is crucial for long-term success.

- Self-Leadership: Develop the mindset of a successful trader. Understand how self-discipline and leadership play a vital role in your trading journey.

Module 2: Mastering Swing / Position Trading

What Are the Nuances of Swing and Position Trading?

- Risk Management: Delve into strategies that help you manage risk effectively. Learn how to safeguard your capital while maximizing profitability.

- Market Volatility: Gain insights into navigating market volatility, ensuring you stay profitable in different market conditions.

Module 3: Trading as a Business

How Can You Transform Trading into a Sustainable Business?

- Strategic Planning: Treat your trading activities as a serious business. This module highlights the importance of strategic planning and professionalism.

- Business Model: Learn how to transition from amateur trading to a sustainable business model that supports long-term growth.

Module 4: Entry and Stop Dynamics

How Can You Optimize Entry and Stop Orders?

- Market Timing: Discover the secrets to optimal entry and stop order placement. Minimize losses and maximize gains with precise strategies.

- Practical Strategies: Equip yourself with strategies that ensure effective market timing, enhancing your overall trading performance.

Module 5: Top-Down Market Analysis

Why Is Top-Down Market Analysis Crucial?

- Trend-Aligned Decisions: Adopt a top-down approach to market analysis, allowing you to make informed trading decisions aligned with market trends.

- Comprehensive Analysis: Stay ahead in the fast-paced trading environment with comprehensive analysis techniques.

Module 6: Identifying Relative Strength

How Can You Leverage Assets with Relative Strength?

- Market Leaders: Learn to identify and invest in assets displaying relative strength, giving you a strategic edge in trading.

- Strategic Investment: Focus on pinpointing market leaders for strategic investment decisions, enhancing your trading success.

Module 7: Aggression vs. Defense

When Should You Take Aggressive Stances or Adopt Defensive Strategies?

- Risk and Reward: Understand the balance between taking aggressive stances and adopting defensive strategies.

- Market Conditions: Adapt to market conditions for optimal performance, maximising opportunities while minimizing risks.

Module 8: Leveraging Options in Trading

What Are the Benefits of Using Options in Trading?

- Options Strategy: Explore the strategic use of options in swing and position trading. Add depth to your trading arsenal with versatile options strategies.

- Market Navigation: Open new avenues for navigating the market with a comprehensive understanding of options trading.

Module 9: Spotting Key Setups

How Can You Identify and Execute High-Reward Market Setups?

- Analytical Prowess: Enhance your analytical skills to identify essential market setups.

- Execution Skills: Capitalize on favourable market conditions for substantial gains with precise execution skills.

Module 10: Long and Short Entry Patterns

How Can You Prepare for Any Market Scenario?

- Long and Short Patterns: Becoming proficient in long and short entry patterns ensures you are prepared for any market scenario.

- Versatile Skills: Develop a well-rounded skill set to generate profits in both rising and falling markets.

Module 11: Balancing Trading with Full-Time Employment

How Can You Trade Effectively While Managing a Full-Time Job?

- Income Maximization: Discover strategies for balancing trading with a full-time job, allowing you to maximize income without compromising your career.

- Practical Solutions: Implement practical solutions that enable you to trade effectively alongside your professional commitments.

Conclusion: Achieve Long-Term Trading Success

The Trading EQuilibrium – Reality Based Course is more than just a trading program; it’s a blueprint for building a resilient, profitable trading career. By focusing on realistic strategies, risk management, and continuous learning, this course provides everything you need to thrive in the dynamic world of trading.

Whether you’re new to trading or looking to enhance your skills, this course offers the tools, knowledge, and support necessary for long-term success. Enroll now and embark on your journey to becoming a master trader with a sustainable market edge.

Ready to Transform Your Trading Career?

Enroll today in the Trading EQuilibrium – Reality Based Course and start your path to sustainable trading success. Equip yourself with the skills and strategies to navigate the markets confidently and achieve your financial goals.