Wall Street Prep – Real Estate Financial Modeling

Original price was: $997.00.$20.00Current price is: $20.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Wall Street Prep – Real Estate Financial Modeling

Master the Art of Real Estate Valuation with the Wall Street Prep – Real Estate Financial Modeling Course

Are you ready to elevate your financial modelling skills and gain a deep understanding of Real Estate Investment Trusts (REITs)? The Wall Street Prep – Real Estate Financial Modeling course is an essential resource for professionals in investment banking, equity research, real estate, and anyone looking to specialize in the complex yet lucrative world of real estate finance. This course is meticulously designed to provide a practical, hands-on approach to building and valuing financial models for REITs, equipping you with the tools to excel in your career.

What Makes the Real Estate Financial Modeling Course Unique?

Wall Street Prep’s Real Estate Financial Modeling course stands out due to its specialized focus on REITs. This unique sector operates under its own set of financial and operational dynamics. The course goes beyond theory, offering in-depth insights into the distinctive challenges, tax advantages, and structural complexities that characterize the REIT industry. This comprehensive understanding is crucial for anyone looking to navigate and succeed in this specialized field.

How Does the Course Provide Hands-On Learning?

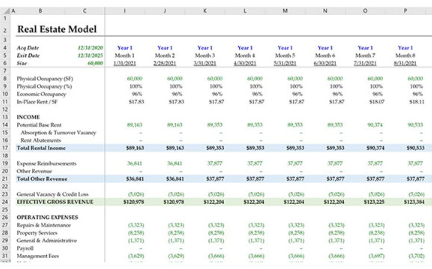

A core component of the Real Estate Financial Modeling course is its emphasis on practical, hands-on learning. Using a real-world case study, BRE Properties, you will learn to build REIT financial and valuation models from scratch. This immersive experience allows you to:

- Develop and Analyze Models: The course guides you through creating models for same-store properties, acquisitions, developments, and dispositions step-by-step. By working directly with these models, you gain a strong grasp of best practices in real estate modelling.

- Simulate Real Scenarios: You will engage in exercises replicating real-world situations, helping you understand how various factors impact a REIT’s financial performance and valuation.

This hands-on approach ensures that you learn and apply the theory effectively, honing your skills to handle real-life challenges in REIT financial modelling.

What Are the Key Profit Metrics Covered in the Course?

Understanding REIT-specific profit metrics is vital for evaluating a REIT’s financial health and operational performance. The Real Estate Financial Modeling course focuses on critical metrics such as:

- Funds from Operations (FFO): Learn how FFO is calculated, why it is used as a performance indicator, and how it differs from net income.

- Adjusted Funds from Operations (AFFO): Understand how AFFO adjusts for maintenance costs and other capital expenditures to provide a clearer picture of a REIT’s cash flow.

- Cash Available for Distribution (CAD): Discover how to analyze CAD to assess a REIT’s ability to pay dividends and sustain growth over time.

By mastering these metrics, you’ll be equipped to perform a nuanced analysis of a REIT’s financial standing, enabling you to make more informed investment decisions.

How Does the Course Approach Valuation Techniques?

The course delves into advanced valuation techniques, focusing on the Net Asset Value (NAV) approach. This method is crucial for evaluating a REIT’s worth and involves:

- Basic Valuation Techniques: Understand how to calculate the NAV by assessing the fair value of a REIT’s underlying properties, liabilities, and other assets.

- Advanced Multi-Year Assessments: Learn how to perform multi-year assessments of acquisitions, developments, and dispositions to understand a REIT’s growth prospects comprehensively.

This focus on valuation ensures you gain a holistic perspective on evaluating a REIT, enhancing your ability to accurately gauge its intrinsic value and potential for future growth.

Why Is Understanding the REIT Landscape Crucial?

The Real Estate Financial Modeling course delves deeply into the REIT landscape, providing a solid foundation for understanding the unique dynamics that drive this sector. Here’s what you’ll explore:

- Tax Advantages and Structures: Gain insights into the tax benefits that REITs enjoy, including how they are required to distribute a significant portion of their taxable income to shareholders. Learn about the different REIT structures, such as UPREITs and DOWNREITs, and understand how they impact financial modelling and valuation.

- Market Drivers and Challenges: Understand the external and internal factors influencing REIT performance, such as interest rates, property market cycles, and regulatory changes. This knowledge is essential for predicting market trends and making strategic investment decisions.

By understanding these unique dynamics, you’ll be better prepared to analyze REITs effectively, identify potential opportunities, and navigate challenges in this specialized industry.

How Does the Course Ensure Comprehensive Mastery?

The Real Estate Financial Modeling course from Wall Street Prep doesn’t just stop at teaching you how to build models—it ensures you achieve a comprehensive mastery of the REIT industry. Here’s how:

- Real-World Application: Upon completing the course, you’ll find that constructing and deconstructing financial models for REITs becomes second nature. You’ll be able to accurately depict operations and performance, whether you’re building models for internal decision-making or client presentations.

- Skill Proficiency: Using advanced valuation techniques and metrics to assess a REIT’s intrinsic value. This knowledge is invaluable whether you’re working in investment banking, equity research, or any field requiring deep real estate finance expertise.

What Are the Career Benefits of Taking This Course?

Completing the Wall Street Prep – Real Estate Financial Modeling course provides numerous career benefits:

- Enhance Your Professional Skillset: Develop expertise in a specialized area highly valued in the finance industry, setting yourself apart from other professionals.

- Boost Your Career Opportunities: Whether you’re looking to advance in your current role or transition to a new one, having specialized knowledge in REIT modelling makes you a more attractive candidate for employers.

- Prepare for Real-World Challenges: The course prepares you to handle real-world scenarios, making you more effective in your role and capable of delivering high-quality financial models that drive decision-making.

How Does Wall Street Prep Support Your Learning Journey?

Wall Street Prep is renowned for its comprehensive and practical approach to financial education. With the Real Estate Financial Modeling course, you’ll benefit from:

- Expert Instruction: Learn from seasoned professionals who bring real-world experience to the classroom, offering insights and guidance beyond textbooks.

- Flexible Learning Options: Access course materials at your own pace, allowing you to balance your professional responsibilities with your educational goals.

- Ongoing Support: Receive support from instructors and fellow students through forums and webinars, ensuring you have the necessary resources to succeed.

Why Should You Enroll in the Real Estate Financial Modeling Course?

The Real Estate Financial Modeling course by Wall Street Prep is a must-have for anyone looking to specialize in REITs or enhance their skills in real estate finance. By enrolling in this course, you’ll gain:

- A Competitive Edge: Develop specialized skills that set you apart in the competitive field of finance.

- Practical Experience: Learn through hands-on exercises and real-world case studies, preparing you to tackle complex modelling challenges with confidence.

- Comprehensive Knowledge: Master the intricacies of REITs, from understanding the unique drivers of the industry to mastering advanced valuation techniques.

Conclusion: Your Path to Real Estate Finance Mastery

The Wall Street Prep – Real Estate Financial Modeling course is more than just a training program; it’s a transformative experience that equips you with the knowledge, skills, and confidence to excel in real estate finance. Whether you’re a seasoned professional or just starting your career, this course offers a unique opportunity to build expertise in a dynamic and lucrative field.

Enrol today and take the first step towards mastering the art of REIT financial modelling.

By understanding the critical aspects of REIT modelling and valuation, you’ll position yourself as a valuable asset in any organization and pave the way for future career growth and success.