Wyckoff Analytics – Anticipating Market Action Using Market Profile And Volume Analytics Strategies

Original price was: $780.00.$14.00Current price is: $14.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Wyckoff Analytics – Anticipating Market Action Using Market Profile And Volume Analytics Strategies

Anticipating Market Action Using Market Profile and Volume Analytics Strategies Course: A Deep Dive into Wyckoff Analytics

The Anticipating Market Action Using Market Profile and Volume Analytics Strategies course by Wyckoff Analytics provides traders with powerful tools to navigate complex market dynamics. Combining Market Profile and Volume Analytics with the principles of the Wyckoff Method, this course helps traders understand market sentiment, identify accumulation and distribution phases, and anticipate price movements with precision. If you want to elevate your trading skills and learn to identify high-probability trade setups, this course is an invaluable resource.

In this detailed course, you’ll discover how Wyckoff Analytics can help you decode the intricacies of market action, including how to leverage Market Profile to understand where the market is spending time, and how Volume Analytics can help you assess the strength behind price moves. Applying these tools in tandem can enhance your decision-making and increase your chances of success in the markets.

Why Should You Choose the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies Course?

What is Wyckoff Analytics, and Why Is It Essential for Traders?

Wyckoff Analytics is a comprehensive trading methodology that blends time-tested market principles with modern analytics tools to enhance market understanding and improve decision-making. Developed by Richard D. Wyckoff, the Wyckoff Method is based on a deep understanding of market psychology, the relationship between supply and demand, and the phases of accumulation and distribution. This method has stood the test of time and remains highly relevant to traders today.

In the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course, traders learn how to apply Market Profile and Volume Analytics in combination with Wyckoff’s principles to understand market structure, sentiment, and momentum. Whether you’re a novice or an experienced trader, this course provides the tools necessary to identify optimal entry and exit points and to trade with greater confidence.

How Does Market Profile Enhance Market Analysis?

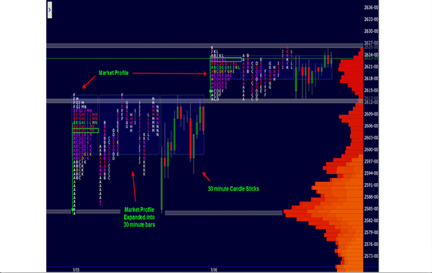

Market Profile is a unique charting technique that allows traders to visualize market activity over a given period. Unlike traditional price charts, Market Profile plots price on a horizontal axis and volume on a vertical axis, creating a more comprehensive view of market behaviour. This visual representation helps traders see where most of the trading volume has occurred, highlighting market balance and imbalance areas.

The Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course teaches you how to read and interpret these Market Profile structures. You’ll learn to identify key levels such as the Point of Control (POC), Value Area (VA), and areas of excess. These elements give traders crucial insights into where the market is in balance, where it is likely to break out, and where strong support or resistance levels form. Understanding these concepts is essential for developing effective trading strategies and making informed decisions.

How Can Volume Analytics Improve Your Trading Strategy?

What Role Does Volume Play in Price Action?

Volume is often referred to as the “fuel” of price action. The Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course delves into the vital relationship between price and volume, providing traders with a clearer understanding of market participation and strength. Volume analysis reveals how much buying or selling pressure is behind price movements, making it easier to gauge the validity of a price trend.

This course combines Volume Analytics with Market Profile to teach you how to identify areas of high volume, which can indicate critical support and resistance levels. Volume spikes often signal significant changes in market sentiment, such as the beginning of a new trend or the exhaustion of an existing trend. By monitoring volume patterns, traders can spot these turning points early and position themselves for successful trades.

How Does Volume Analytics Help Identify Market Sentiment?

In the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course, you’ll also learn how to interpret volume patterns alongside price movements to assess market sentiment. For example, when prices rise but volume declines, this could indicate weakening momentum, signaling that a reversal may be imminent. On the other hand, when prices rise in conjunction with strong volume, it suggests that the trend is supported by substantial market participation.

Volume-based indicators, such as Volume-at-Price charts, play a pivotal role in revealing hidden market dynamics. These indicators help you see where significant price levels coincide with heavy trading volume, marking areas where market participants have shown a willingness to buy or sell at those levels. Understanding these key relationships is crucial for confirming trend strength and anticipating potential reversals.

How Does Wyckoff Analytics Combine Market Profile and Volume Analytics for Market Action?

What Is the Wyckoff Method, and How Does It Enhance Market Analysis?

The Wyckoff Method is a market analysis approach developed by Richard D. Wyckoff that focuses on the study of market structure, price movements, and the behavior of large institutional players, often referred to as the Composite Operator. This method incorporates the concepts of accumulation and distribution, which represent periods when institutional traders are buying or selling a particular asset.

In the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course, Wyckoff principles are applied alongside Market Profile and Volume Analytics to identify key phases of the market. For instance, during an accumulation phase, prices tend to move sideways within a defined range, accompanied by increased volume on upswings and decreasing volume on downswings. Conversely, in a distribution phase, prices tend to consolidate at higher levels with shrinking volume, suggesting that large players are selling their positions.

By incorporating Wyckoff’s Law of Supply and Demand and the concept of Composite Operators, this course teaches traders how to use Market Profile and Volume Analytics to confirm the presence of accumulation or distribution phases. The insights gained from this combination of techniques help traders anticipate potential price moves and make better trading decisions.

How Do You Identify Accumulation and Distribution Phases Using Wyckoff Analytics?

One of the main advantages of using Wyckoff Analytics in combination with Market Profile and Volume Analytics is the ability to identify the subtle signs of accumulation and distribution phases, which are key to anticipating future price action. In the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course, you’ll learn how to identify these phases through both price and volume patterns.

For example, during an accumulation phase, the market may experience periods of price consolidation, where buyers and sellers are in a tug-of-war. As this occurs, the Market Profile will often show a Value Area forming around the Point of Control (POC), indicating that the market is finding balance. Volume patterns during this phase will often show increased activity during upward price movements and lower volume during downward price movements, confirming that large institutional players are absorbing supply and preparing to move prices higher.

Similarly, in a distribution phase, you will notice narrowing price ranges and diminishing volume. The Market Profile may show a distribution of volume at higher price levels, and Volume Analytics will reveal a lack of enthusiasm from buyers as prices move up, signaling that large market players are beginning to distribute their holdings.

By understanding these patterns, traders can confidently anticipate whether the market is preparing for a breakout or a breakdown, positioning themselves for profitable trades.

How Can You Use Wyckoff Analytics for Effective Trade Setups?

How Do You Identify High-Probability Trade Setups Using Wyckoff Analytics?

One of the key takeaways from the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course is learning how to identify high-probability trade setups. The combination of Market Profile, Volume Analytics, and Wyckoff Method enables traders to recognize the most favorable conditions for entering and exiting trades.

Traders can use Wyckoff Analytics to identify areas of support and resistance, recognize trend shifts, and confirm the strength or weakness of market trends. The Market Profile helps identify the Value Area where most of the market activity is taking place, while Volume Analytics highlights the level of market participation behind these price movements. By aligning these tools with Wyckoff’s principles of supply and demand and the behavior of the Composite Operator, traders can gain an edge in predicting market moves and timing their entries and exits effectively.

What Are the Benefits of Using Wyckoff Analytics for Anticipating Market Action?

By leveraging Wyckoff Analytics, traders can anticipate market action with a higher degree of accuracy. This course shows how to integrate multiple methods into one cohesive strategy, providing traders with a robust toolkit to analyze the market from different angles. Understanding Market Profile, Volume Analytics, and Wyckoff principles gives traders a clearer picture of market dynamics, helping them make well-informed decisions based on solid data.

The benefits of using this approach are clear: increased confidence in market analysis, better timing of trades, and a higher probability of success in the markets. With Wyckoff Analytics, traders are equipped to navigate complex market conditions and spot opportunities that others might miss.

Conclusion: Why You Should Enroll in the Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies Course

The Wyckoff Analytics – Anticipating Market Action Using Market Profile and Volume Analytics Strategies course offers traders a powerful framework for anticipating market action with precision. By combining Market Profile and Volume Analytics with the timeless principles of the Wyckoff Method, this course equips traders with the tools they need to identify key market phases and high-probability trade setups.

Whether you’re looking to refine your trading skills, understand market sentiment, or enhance your ability to predict price movements, this course provides the insights and strategies you need to succeed in today’s dynamic markets.

Don’t miss the opportunity to learn from the experts at Wyckoff Analytics and take your trading to the next level.