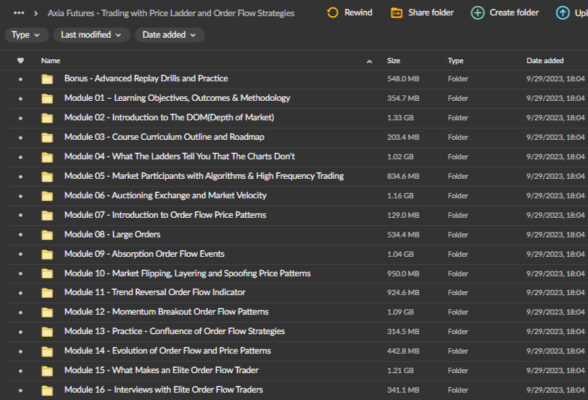

Axia Futures – Trading with Price Ladder and Order Flow Strategies

Original price was: $799.00.$19.00Current price is: $19.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Axia Futures – Trading with Price Ladder and Order Flow Strategies

Axia Futures – Trading with Price Ladder and Order Flow Strategies: Mastering Market Depth for Optimal Trades

In today’s fast-paced trading environment, success is largely determined by a trader’s ability to understand and respond to market dynamics in real-time. The Axia Futures – Trading with Price Ladder and Order Flow Strategies course offers a comprehensive guide to mastering order flow and price ladder strategies, which are vital for traders seeking deeper insights into market behavior. Led by the expert Alex Haywood, this course focuses on equipping traders with the tools and techniques necessary to navigate complex financial markets and make informed trading decisions.

Whether you’re a beginner aiming to build a solid foundation or a seasoned professional looking to refine your strategies, this course offers invaluable lessons to help you gain a competitive edge in the ever-evolving trading landscape.

Why Choose the Trading with Price Ladder and Order Flow Strategies Course?

The Trading with Price Ladder and Order Flow Strategies course offers an in-depth exploration of key concepts such as market velocity, depth of market, and the impact of high-frequency trading. The strategies taught in this course are rooted in real-world application, ensuring that you can implement them immediately to improve your trading performance.

This course is ideal for traders who want to leverage advanced trading techniques to make more informed and profitable decisions. By mastering the price ladder and order flow strategies, you’ll be able to anticipate market movements better, identify trading opportunities more effectively, and manage risk more effectively.

What Does the Trading with Price Ladder and Order Flow Strategies Course Include?

How is the Course Structured?

The Axia Futures—Trading with Price Ladder and Order Flow Strategies course consists of 17 modules, each designed to provide a comprehensive understanding of order flow trading. From foundational concepts to advanced strategies, this course covers every aspect necessary to master market dynamics through order flow analysis.

The course curriculum begins by explaining the basics of order flow and price ladder concepts. It gradually delves into more advanced topics such as high-frequency trading and trend reversal patterns. The inclusion of market replay sessions and hands-on drills further enriches the learning experience, helping students practice their skills in simulated environments.

Each module is led by Alex Haywood, a seasoned trading expert whose real-world experience brings the course material to life. With his guidance, you’ll develop a nuanced understanding of interpreting price ladder data, anticipating market trends, and executing trades with precision.

What are the Key Benefits of the Course?

One of the most significant benefits of this course is its focus on practical, actionable strategies. The Axia Futures – Trading with Price Ladder and Order Flow Strategies course teaches theoretical concepts and provides students with the tools they need to apply those concepts in real-time trading environments.

1. Comprehensive Curriculum:

The course covers a broad range of topics, ensuring that students walk away with a well-rounded understanding of order flow trading. Every critical aspect of price ladder and order flow analysis is addressed, from market structure to advanced indicators.

2. Hands-on Learning:

The course offers market replay sessions, which allow students to practice their skills in real trading scenarios. This interactive approach ensures that students learn and apply what they’ve learned, which is essential for building confidence and proficiency in trading.

3. Community Support:

Another significant advantage of this course is the support system it provides. Students can connect with fellow traders, share insights, and collaborate to enhance their learning experience. This community-driven approach ensures that you are always trading with others, as you can always rely on the expertise and support of peers and instructors.

Who Should Take This Course?

The Axia Futures – Trading with Price Ladder and Order Flow Strategies course suits a wide range of traders. Whether you are new to trading or have years of experience, this course offers valuable insights that can help elevate your trading game.

1. Beginners:

If you’re starting, this course provides a strong foundation in order flow and price ladder strategies, which are essential for developing a profitable trading approach. The step-by-step instruction makes complex topics accessible, ensuring you have the knowledge and tools needed to start trading confidently.

2. Intermediate Traders:

For those who already have some trading experience, this course will take your skills to the next level. You’ll learn advanced strategies for interpreting market data and executing trades with greater precision, allowing you to refine your existing trading techniques.

3. Experienced Traders and Professionals:

Even seasoned traders can benefit from this course. Including high-frequency trading analysis and trend reversal patterns offers valuable insights for traders looking to stay ahead of market shifts. Additionally, professionals in the algorithmic trading space can gain a deeper understanding of how their strategies impact market dynamics.

Understanding Key Concepts in the Course

What is the Price Ladder in Trading?

The price ladder is a visual representation of the order book, showing the bid and ask prices for a particular asset at any given time. This vertical interface provides traders with a detailed view of market depth, allowing them to see how many buy and sell orders are stacked at different price levels.

By analyzing the price ladder, traders can gain insights into the market’s supply and demand dynamics. This data is crucial for day traders and scalpers, who rely on real-time information to make quick decisions. The Trading with Price Ladder and Order Flow Strategies course teaches you how to read the price ladder effectively, interpret order flow, and use this data to inform your trading decisions.

How Does Order Flow Trading Work?

Order flow trading involves analyzing the flow of buy and sell orders in the market to predict future price movements. By understanding where large orders are placed and how quickly they are being filled, traders can anticipate shifts in market sentiment and act accordingly.

In this course, you’ll learn how to leverage order flow data to identify trading opportunities, manage risk, and optimize your entry and exit points. You’ll also explore advanced order flow indicators that provide deeper insights into market activity, such as delta, cumulative volume, and market imbalance.

How Can These Strategies Improve Your Trading?

1. Improved Market Understanding:

The insights gained from analyzing the price ladder and order flow data can give traders a better understanding of the market’s inner workings. This allows you to anticipate price movements more accurately, improving your timing and trade execution.

2. Enhanced Risk Management:

By using order flow strategies, you can identify areas of high liquidity, which can act as support or resistance levels. This information is invaluable for setting stop-loss orders and managing risk effectively.

3. Greater Confidence in Trade Execution:

The detailed information provided by the price ladder allows traders to execute trades with greater confidence. Instead of relying solely on technical analysis or chart patterns, you can make decisions based on real-time market data, leading to more informed and profitable trades.

The Instructor: Who is Alex Haywood?

Alex Haywood is a renowned expert in the field of order flow trading, and his expertise is the backbone of the Axia Futures – Trading with Price Ladder and Order Flow Strategies course. With years of experience in trading and education, Alex’s teaching methodology focuses on making complex topics accessible and ensuring that students can apply the lessons learned to their trading strategies immediately.

Throughout the course, Alex provides real-world examples and case studies that bring the concepts to life. His approach is highly practical, ensuring that students not only understand the theory behind order flow trading but also know how to implement it effectively in live market conditions.

Student Feedback: What Do Participants Say About the Course?

Students of the Axia Futures – Trading with Price Ladder and Order Flow Strategies course consistently praise its comprehensive curriculum and practical application. Many traders have reported a significant improvement in their understanding of market dynamics and their ability to execute trades with confidence.

Testimonials highlight the course’s ability to break down complex topics into easily digestible lessons, as well as the hands-on learning opportunities provided through market replay sessions. Students also appreciate the supportive community and the ongoing access to resources that help reinforce their learning long after the course is completed.

Conclusion: Is This Course Right for You?

The Axia Futures – Trading with Price Ladder and Order Flow Strategies course offers a complete education for traders looking to master the intricacies of order flow and price ladder trading. With a focus on practical application, expert instruction, and a supportive community, this course provides everything you need to take your trading to the next level.

If you’re serious about improving your trading performance and gaining a deeper understanding of market dynamics, this course is a must-have. Enroll today and start leveraging the power of order flow strategies to enhance your trading success.