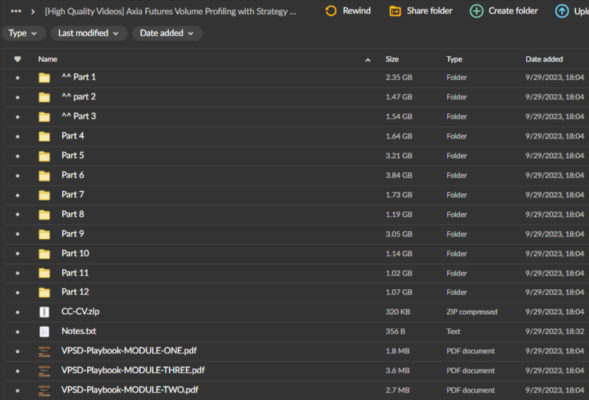

Axia Futures – Volume Profiling with Strategy Development

Original price was: $1,999.00.$19.00Current price is: $19.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Axia Futures – Volume Profiling with Strategy Development

Unlock Your Trading Potential with the Axia Futures – Volume Profiling with Strategy Development Course

Are you ready to improve your trading skills and market analysis capabilities? The Axia Futures – Volume Profiling with Strategy Development course is your gateway to mastering one of the most effective techniques in the trading world. This comprehensive program delves into the intricacies of volume profiling and equips you with the strategic mindset necessary to navigate the dynamic financial markets. Whether a novice eager to establish a solid foundation or an experienced trader looking to refine your strategies, this course is tailored to enhance your performance and decision-making skills.

What is Volume Profiling and Why is it Important?

How Does Volume Profiling Enhance Market Analysis?

Volume profiling is a powerful tool that provides insights into market sentiment, helping traders understand where buying and selling pressure exists. By analyzing volume data relative to price levels, traders can identify key support and resistance zones crucial for effective decision-making. The Axia Futures – Volume Profiling with Strategy Development course introduces you to this methodology, allowing you to visualize where the majority of trading activity occurs.

Understanding the nuances of volume profiling can dramatically improve your trading strategy. It allows you to gauge market sentiment more accurately and helps you make informed decisions based on empirical data rather than mere speculation. In this course, you’ll learn how to interpret volume profiles to identify high-probability trade setups and market reversals.

Why is Volume Profiling Essential for Every Trader?

In an era where markets are influenced by rapid technological advancements and changing participant dynamics, volume profiling stands out as an essential skill for traders. It helps you detect shifts in supply and demand, ensuring you remain ahead of the curve. The Axia Futures – Volume Profiling with Strategy Development course teaches you the fundamentals of this technique and emphasizes its practical application in live market scenarios.

By mastering volume profiling, you will gain an edge over many market participants who rely solely on traditional price action methods. This course empowers you to become a more discerning trader, leveraging volume analysis to inform your trading decisions and strategy development.

Understanding Market Auction Theory: The Backbone of Volume Profiling

What is Market Auction Theory?

At the heart of volume profiling lies market auction theory, which explains how prices are determined in a marketplace through the interactions of buyers and sellers. This concept is pivotal for grasping the mechanics behind volume profiling, as it offers insights into market dynamics and the behaviour of various market participants.

The Axia Futures—Volume Profiling with Strategy Development course delves into this theory, explaining how supply and demand influence price movements. You will learn to identify key market players and their intentions, empowering you to make more strategic trading decisions.

How Can Market Auction Theory Influence Your Trading Strategies?

By understanding market auction theory, you can better interpret the information contained within volume profiles. This understanding will help you recognize when the market is bullish or bearish and how to position your trades accordingly. The course provides practical exercises that encourage you to apply this knowledge in real trading scenarios, enhancing your ability to create robust trading strategies.

Furthermore, the course emphasizes the importance of adaptability in trading. Markets are constantly changing, and a solid understanding of auction theory allows you to adjust your strategies based on the current market environment. This adaptability is crucial for long-term success in trading.

Mastering Volume Profile Tools: Your Key to Effective Analysis

What Tools Will You Learn to Use?

The Axia Futures – Volume Profiling with Strategy Development course introduces you to an array of volume profiling tools and software utilized by industry professionals. Familiarizing yourself with these tools is essential for effective market analysis and strategy development.

Throughout the course, you’ll engage in practical exercises that enable you to analyze market data effectively. By gaining hands-on experience with these tools, you will enhance your ability to draw actionable insights from complex data sets, positioning yourself as a knowledgeable trader in a competitive environment.

How Do Volume Profile Tools Enhance Your Trading?

Using the right tools can dramatically elevate your trading game. The Axia Futures – Volume Profiling with Strategy Development course teaches you how to leverage these tools to identify high-probability trade setups and manage risk effectively. You’ll learn how to visualize volume at specific price levels, which can help you anticipate potential reversals or continuations.

Moreover, understanding how to use volume profiling tools allows you to execute trades with precision. This course equips you with the technical skills necessary to analyze and interpret volume data, ensuring that your trading strategies are not only informed by intuition but also backed by solid analysis.

Building Volume Profile Trading Strategies: A Comprehensive Approach

How Do You Construct Robust Trading Strategies?

The core of the Axia Futures – Volume Profiling with Strategy Development course focuses on teaching you how to develop robust trading strategies based on volume profiling techniques. You will learn to identify high-probability setups and create strategies tailored to various market conditions.

Building effective trading strategies involves understanding both market context and risk management. The course emphasizes the importance of adapting your strategies to different timeframes and market environments, ensuring you are always in tune with current conditions.

What Makes a Trading Strategy Successful?

A successful trading strategy is built on a foundation of sound analysis and disciplined risk management. In this course, you’ll not only learn how to develop strategies but also how to optimize trade execution and manage risk effectively. You’ll explore the nuances of position sizing, stop-loss placement, and trade management—key elements that can make or break a trader’s performance.

Additionally, the course provides you with tools to assess the effectiveness of your strategies over time, allowing for continuous improvement. This iterative process is essential for adapting to changing market conditions and enhancing your overall trading performance.

Advanced Market Analysis Techniques: Staying Ahead of the Curve

What Advanced Techniques Will You Learn?

Beyond the basics, the Axia Futures – Volume Profiling with Strategy Development course delves into advanced market analysis techniques that can further sharpen your trading acumen. You will learn how to adapt your strategies to various market conditions, ensuring you can thrive in both trending and ranging environments.

Advanced analysis techniques include understanding market correlations, sentiment analysis, and multi-timeframe analysis. By integrating these techniques with volume profiling, you will develop a more holistic approach to market analysis that can lead to more informed trading decisions.

How Do Advanced Techniques Benefit Your Trading?

Utilizing advanced market analysis techniques allows you to see beyond surface-level price movements. This deeper insight can help you identify potential market shifts before they happen, providing you with a significant advantage. The Axia Futures – Volume Profiling with Strategy Development course encourages you to think critically about market conditions and how they affect your trading strategies.

Moreover, this comprehensive approach ensures that you are not reliant on a single method of analysis. By integrating various techniques, you can create a more adaptable trading strategy that can withstand the volatility of the financial markets.

The Importance of Risk Management and Trading Psychology

How Does Risk Management Influence Your Trading Success?

Risk management is a critical aspect of trading that cannot be overlooked. The Axia Futures – Volume Profiling with Strategy Development course emphasizes the necessity of disciplined risk management practices to safeguard your trading capital. You will learn to assess risk-reward ratios, determine optimal position sizes, and implement stop-loss strategies effectively.

By understanding the principles of risk management, you can protect your trading account from significant drawdowns. This knowledge will instill confidence in your trading decisions, allowing you to focus on executing your strategies without the fear of catastrophic losses.

What Role Does Trading Psychology Play in Your Success?

Trading psychology is often the differentiator between successful and unsuccessful traders. The Axia Futures – Volume Profiling with Strategy Development course addresses the psychological aspects of trading, providing you with tools to maintain a calm and focused mindset under pressure.

You will learn techniques to manage emotions, stay disciplined, and develop a resilient trading mentality. By mastering your psychology, you can improve your decision-making process and avoid common pitfalls that lead to poor trading outcomes.

Engage in Live Trading Sessions: Experience Real-Time Learning

What Can You Expect from Live Trading Sessions?

One of the standout features of the Axia Futures – Volume Profiling with Strategy Development course is the inclusion of live trading sessions. These sessions offer a unique opportunity to observe experienced traders as they apply volume profiling techniques in real-time market conditions.

Participating in live trading allows you to see the practical application of the concepts learned in the course. You will gain insights into decision-making processes and the thought patterns of successful traders, enriching your learning experience.

How Do Live Sessions Enhance Your Learning Experience?

Live trading sessions create an interactive learning environment where you can ask questions and receive immediate feedback. This real-time engagement fosters a deeper understanding of the material, ensuring you can apply what you’ve learned effectively. Additionally, witnessing the application of volume profiling in live markets reinforces the concepts, solidifying your knowledge and skills.

Join a Community of Like-Minded Traders

Why is Community Important in Trading?

Enrolling in the Axia Futures – Volume Profiling with Strategy Development course connects you with a vibrant community of like-minded traders. This network provides an invaluable platform for collaboration, idea sharing, and peer support.

Being part of a trading community fosters continuous learning and personal growth. Engaging with others who share similar goals and challenges can enhance your trading journey and motivate you to stay committed to your development.

How Can Community Support Improve Your Trading Skills?

A supportive trading community can be a game-changer for your trading career. By exchanging ideas and strategies with fellow traders, you can gain fresh perspectives and insights that you may not have considered on your own.

Moreover, the camaraderie within a community can help alleviate the isolation that many traders experience. This sense of belonging can boost your confidence and provide encouragement during challenging trading periods.

Conclusion: Elevate Your Trading with Axia Futures

The Axia Futures – Volume Profiling with Strategy Development course represents a comprehensive learning experience designed to equip you with the skills and knowledge needed to thrive in the financial markets. With a focus on volume profiling and strategic development, this course is not just about theory—it’s about practical application that can lead to real-world success.

Why Should You Enroll in This Course?

Whether you’re starting your trading journey or looking to refine your existing skills, this course offers a wealth of resources and insights tailored to meet your needs. You will walk away with a thorough understanding of market dynamics, the tools to analyze volume data, and the confidence to implement effective trading strategies.

The structured approach of the Axia Futures – Volume Profiling with Strategy Development course ensures that you develop a solid foundation while also exploring advanced concepts. You’ll have the opportunity to learn from industry experts, engage in hands-on exercises, and participate in live trading sessions, providing a well-rounded educational experience.

Take the Next Step in Your Trading Journey

Investing in your trading education is one of the best decisions you can make to secure your financial future. The insights and skills you gain from the Axia Futures – Volume Profiling with Strategy Development course can empower you to make informed trading decisions, adapt to changing market conditions, and ultimately achieve your trading goals.

Don’t miss this opportunity to unlock your full potential as a trader. Enroll in the Axia Futures – Volume Profiling with Strategy Development course today and take your first step towards mastering the art of market analysis. Join a community of dedicated traders, enhance your trading strategies, and position yourself for long-term success in the financial markets.

Embrace the journey of continuous learning and discover how volume profiling can revolutionize your trading experience. With Axia Futures by your side, you are not just learning to trade—you are learning to thrive.